Week in Brief: Kraken to Acquire NinjaTrader, Trustpilot Targets More “Fake” Reviews

Kraken to Buy NinjaTrader for $1.5B

One of the major stories making headlines this week is the US-based crypto exchange Kraken plans to acquire retail futures trading platform NinjaTrader in a $1.5 billion deal. Founded in 2003, NinjaTrader operates as a Futures Commission Merchant and offers futures trading tools to traders.

According to the announcement, the acquisition is expected to allow Kraken to expand its user base and offer other asset classes besides cryptocurrencies. The report further outlined Kraken's plans to expand NinjaTrader’s reach to the United Kingdom, Europe, and Australia. However, NinjaTrader is expected to continue operating as an independent brand rather than under the Kraken umbrella.

Outside the US, Kraken is also closing notable acquisition deals. The exchange recently revealed its acquisition of a Cyprus firm to obtain the much-needed Markets in Financial Instruments Directive (MiFID) license in the European Union. The crypto exchange acquired contracts for differences (CFDs) provider Greenfields Wealth, formerly Pacific Union Group (rebranded as PU Prime outside Cyprus).

More Business Acquisitions

VP Capital, which owns Capital.com and Currency.com, also announced the sale of the latter (a cryptocurrency platform) to a group of investors represented by CXNEST Ltd. The transaction was completed after an 18-month period, and the new owners also reportedly received full control of Currency.com and its subsidiaries.

The other company anticipating a major transaction is Hidden Road. The crypto prime brokerage is considering selling the company or raising capital at a valuation of more than $1 billion and has already been working with a financial advisor, Bloomberg reported, citing “people with knowledge of the matter.” However, the company has yet to make any official announcements.

The New York-headquartered company also sought to secure $120 million at a valuation of about $1 billion last year. However, it remains unclear whether that round was completed.

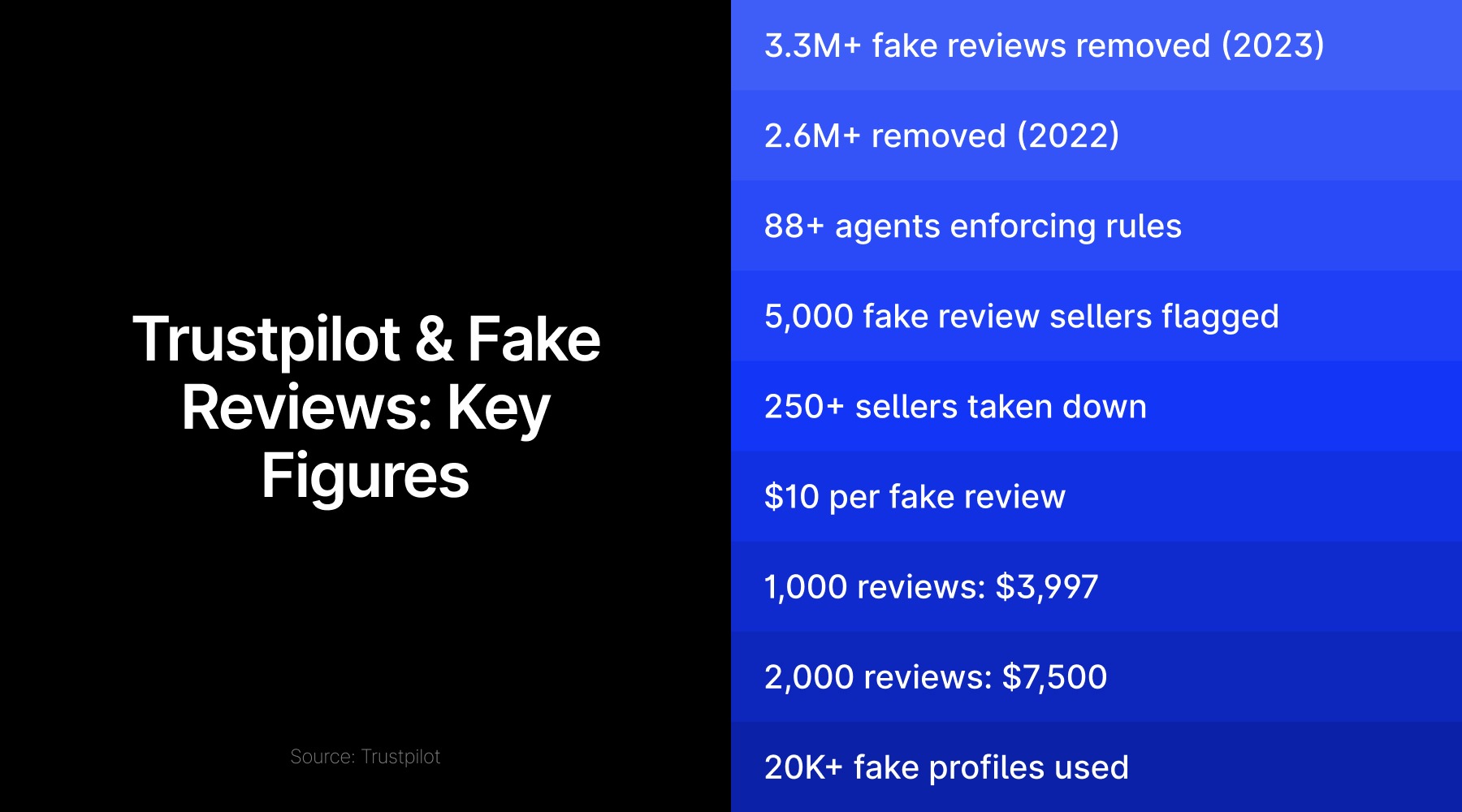

Trustpilot Removes More “Fake” Reviews

Away from business acquisitions and to another big story making waves in the prop trading space, Trustpilot removed fake reviews from the profile of AudaCity Capital, one of the oldest prop trading firms still in operation.

This came about two weeks after the review website took similar action against Hola Prime, which launched around last November but had customers on Trustpilot sharing platform experiences as early as May.

“We’ve detected and removed a number of fake reviews for this company,” a message on AudaCity Capital’s Trustpilot page notes. “If we find additional fake reviews on this profile, we’ll remove those too. If you believe a review is fake, you can flag it.”

Still, with the prop trading space, PipFarm CEO James Glyde uncovered a global network that was manipulating prop trading challenges. “I was actually making my company for the cheaters, not for the traders,” Glyde candidly admitted in his latest interview, detailing how he uncovered an international ring of fraudsters.

Swissquote Targets CHF 500M Profit by 2028

In the financial reports, Swissquote is targeting a pre-tax profit of CHF 500 million in 2028 after closing last year with a record revenue of CHF 661 million and a pre-tax profit of CHF 345.6 million. For 2025, the company has set a revenue guidance of CHF 675 million and a pre-tax profit of CHF 355 million.

As highlighted by the Swiss online trading services provider, “2024 was the best year ever on multiple fronts.” Its yearly revenue grew by 24.4%, while pre-tax profits jumped by 35.3%. However, the guidance shows that growth in 2025 will not be as strong: revenue is projected to grow by only 2.1%, and pre-tax profit by 2.7%.

Troubled CFDs Broker Banxso Exits Cyprus

On the regulatory front, Finance Magnates learned that Banxso, the troubled South African contracts for differences (CFDs) broker, exited its retail business in Cyprus. According to regulatory filings, the Cyprus unit was sold to Nova Securities Limited, a new entrant in the industry.

The exit followed Banxso's decision to stop onboarding retail clients under its Cyprus license months ago. As Finance Magnates reported earlier, the Cyprus unit of Banxso entirely stopped onboarding clients in April 2024. Interestingly, according to archived pages on Wayback Machine, the broker had only onboarded Cyprus residents before the complete suspension of services.

GCC Traders Thrive on Risk, Move with Oil’s Tide

The 2024 edition of financial services research firm Investment Trends’ UAE Leverage. The Trading report highlighted this market's resilience, referring to a notable increase in the number of reactivated and ongoing CFD/FX traders. This is reflected in data from leading brokers such as Capital.com, which recently revealed that UAE traders posted a record $469 billion in volume last year.

No wonder Tarik Chebib, CEO of Capital.com MENA, describes the GCC as being of strategic importance to the business and one of its fastest-growing markets.“Our research shows that GCC-based traders have a higher appetite for risk relative to traders across other markets,” he says. “Their preferred markets include commodities, US indices and cryptocurrencies, reflecting a strong interest in dynamic and high liquidity assets.”

Revolut Expands in Spain

Lastly, fintech giant Revolut reportedly partnered with Spanish authorities to allow users to pay taxes while expanding its payment solutions with Revolut Terminal. The ease of integrating Revolut's digital banking services with tax payments could significantly boost the app's user base in the country.

37% of UAE Retail Investors to Boost Crypto Investments by 2025

— Traders Paradise (@theparadiselive) December 24, 2024

🚀 A recent eToro survey reveals that 37% of retail investors in the UAE aim to increase cryptocurrency investments by 2025.

🔍 Key insights:

54% prioritize financial goals for 2025.

40% plan to invest more in… pic.twitter.com/zWQcoAEeIE

In a move that blends fintech with bureaucracy, Revolut is allegedly partnering with the Spanish government to allow its users to pay taxes directly through the app. According to Murcia Today, the global fintech is enabling customers to pay their state taxes, personal and business, without wading through the usual mountain of paperwork.

Until next week!