Tavira Financial Turns to Boost Agency Brokerage after Closure of Its CFD Business

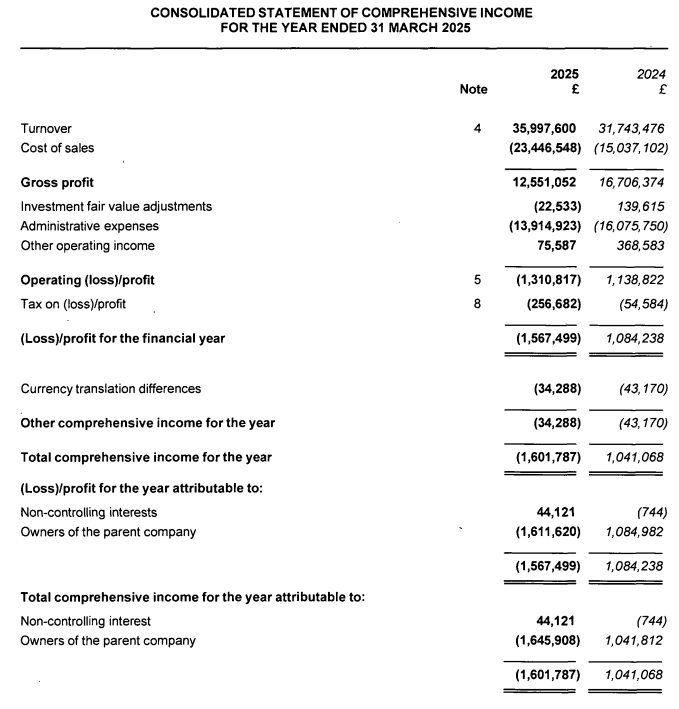

Tavira Financial, which closed its contracts for differences (CFD) business last year, now relies heavily on its agency brokerage division, as its revenue for the fiscal year ended on 31 March 2025 came in at almost £36 million, a jump of 13 per cent.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

Dubai Beats London

Its United Kingdom unit alone generated almost £13.9 million, while its Dubai-based division came out on top with a turnover of £16.1 million. The Monaco-based unit brought in £4.2 million, and the Australian business generated £1.8 million.

Although Tavira’s Australian branch has been operating for only three years, its revenue increased by 155 per cent with a 1,337 per cent jump in profitability. The UK and Dubai entities, however, incurred losses.

In its Companies House filing, the company highlighted that the increase in revenue can be attributed to growth in agency brokerage, as demand for equities jumped 150 per cent and metals increased 71 per cent. Further, there was a 43 per cent increase in corporate brokerage and a 127 per cent jump in asset management.

[#highlighted-links#]

A Cost of Closure

Meanwhile, the closure of its CFD business and the restructuring of its custody unit resulted in a 23 per cent reduction in net assets. Its Dubai branch is also closing the custody unit and winding down the CFD business.

“Agency brokerage continues to provide a stable source of income for the group, becoming increasingly important following the decision to close the CFD business in 2023/24 and the recent decision to restructure the custody business,” the filing noted.

Meanwhile, the FCA-regulated group stressed that its corporate broking business “continues to grow along with the success of our clients,” while its strategy to grow asset management investments pushed the AUM higher.

“Overall, although revenues increased year on year, the additional costs associated with exiting businesses have contributed to the Group reporting a loss for the year,” the filing added. “We are confident this downturn is isolated to the 2024/25 reporting period.”