Saxo Bank Grows Client Base to 1.4 Million, Profits Climb 18% in H1 2025

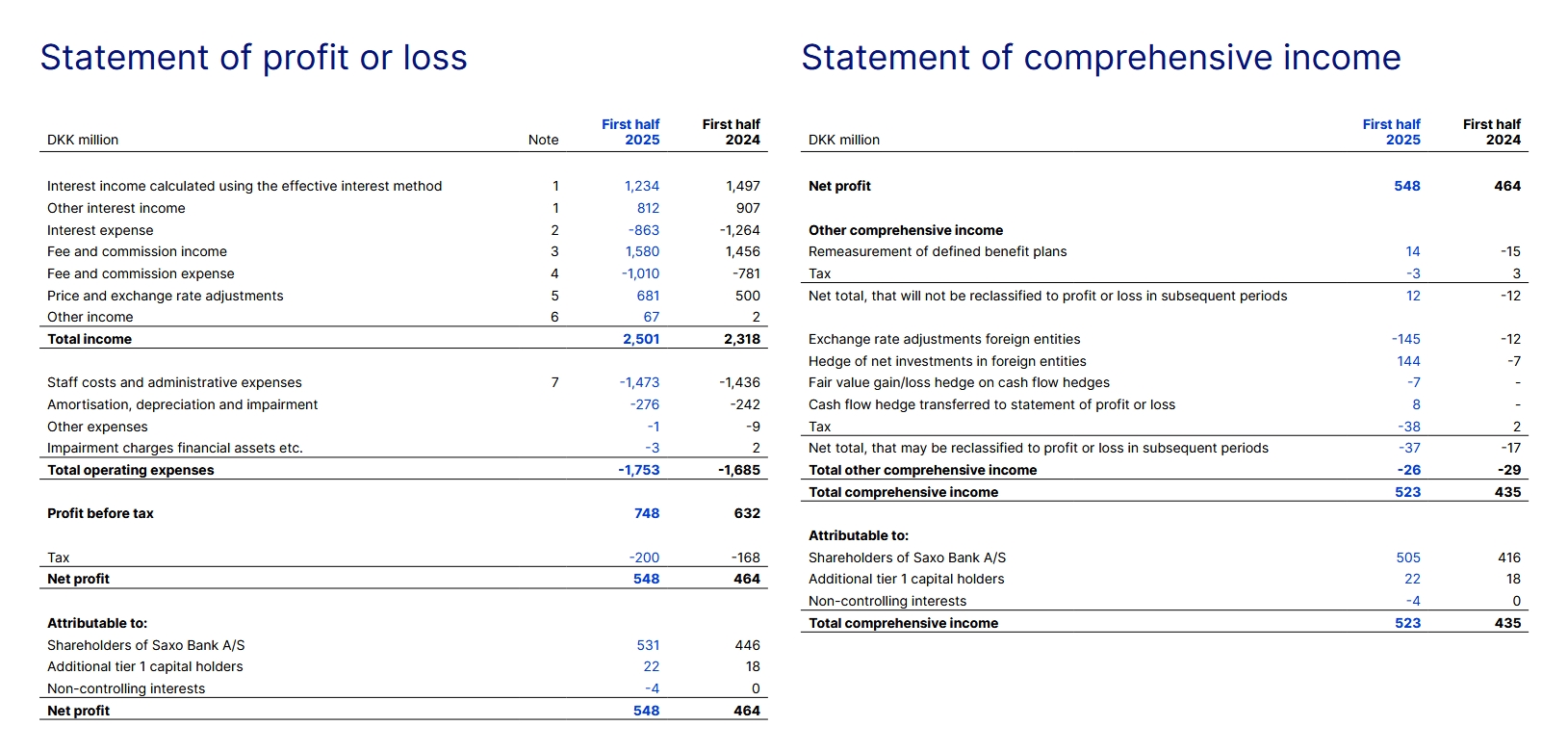

The Saxo Bank Group reported a net profit of EUR 73 million for the first half of 2025, an increase of 18% compared to EUR 62 million in the same period last year. Adjusted net profit stood at EUR 69 million, broadly in line with the EUR 68 million recorded in H1 2024.

Revenue and Asset Growth

“The investment culture worldwide is thriving, and I am pleased that so many new investors are choosing to start and continue their investment journey with Saxo,” Kim Fournais, CEO and Founder of Saxo Bank, said.

Total income rose to EUR 335 million, up from EUR 311 million in the first half of 2024. The bank said client assets reached EUR 118 billion, the highest level in its history, compared to EUR 109 billion a year earlier.

Expansion of Client Base

The number of clients grew to 1.39 million, a 13% increase from 1.23 million in the first half of last year. Saxo noted that this expansion in the client base helped push total assets to the new record.

You may find it interesting at FinanceMagnates.com: Saxo Bank Launches Fractional Shares Trading in Singapore.

Trading activity was also higher. The number of trades executed on Saxo’s platforms rose 28% year-on-year, driven by strong activity in the first four months of 2025. Activity levels returned to more normal conditions during the second quarter.

Impact of Market Conditions

The bank said this was partly linked to higher volatility in global financial markets, which has been influenced by geopolitical tensions since the start of the year.

Saxo’s capital ratio improved slightly, reaching 28.3% compared to 27.5% a year earlier.