Admirals (Admiral Markets) Recensione

Leggete la nostra recensione concisa e completa sui pro e i contro di Admirals (Admiral Markets)

Non disponibile in Stati Uniti

Spread Live

| Broker | Mercato valutario | Materie prime | |||||

|---|---|---|---|---|---|---|---|

| EURUSD | GBPJPY | AUDNZD | Nella media | XAUUSD | XAGUSD | Nella media | |

| Broker | Mercato valutario | Materie prime | |||||

|---|---|---|---|---|---|---|---|

| EURUSD | GBPJPY | AUDNZD | Nella media | XAUUSD | XAGUSD | Nella media | |

Analizziamo il costo combinato di spread e commissioni mediato nel tempo. La tabella sopra visualizza i costi combinati di spread e commissioni campionati da conti live utilizzando il nostro strumento di analisi degli spread. Per confrontare Admirals (Admiral Markets) con altri broker o simboli diversi da quelli mostrati, clicca sul pulsante arancione di modifica e seleziona nuovi broker o simboli.

Lo spread è la differenza tra il prezzo di acquisto (sell) e il prezzo di vendita (buy) di un bene. Su alcuni tipi di conto, viene addebitata anche una commissione oltre allo spread, che costituisce un costo di transazione aggiuntivo.

Recensioni degli utenti di Admirals (Admiral Markets)

Classificato 11 su 1736 (Broker di mercati valutari)

Questa valutazione si basa su 7 recensioni di utenti che hanno dimostrato di essere clienti reali di questa società e 1 che non l'hanno fatto.Tutte le recensioni sono sottoposte a una significativa moderazione umana e tecnica.Le società che ottengono oltre 30 recensioni da parte di utenti verificati vengono valutate solo in base alle loro valutazioni e ottengono un segno di spunta verde accanto alla loro valutazione.

28 marzo 2025

Posizione: Namibia

28 marzo 2025

Xm is the best marketing service provided with best spreads

Traduzione:

Xm è il miglior servizio di marketing fornito con i migliori spread

0

Lascia un commento

Invia un commento

26 marzo 2025

Posizione: Kenia

Tipi di conto: Standard

26 marzo 2025

One of the best brokers it has bonuses that helps opening many positions , margin is low

Traduzione:

Uno dei migliori broker ha bonus che aiutano ad aprire molte posizioni, il margine è basso

20 marzo 2025

Posizione: Italia

20 marzo 2025

I would say the best part of being here for me has been the customer service and it’s worked really well for me and it’s funny how when I always reach out to them Everything just seems to work out lol. I started out here with the demo account and it was wonderful. It showed me how trading here fully would be, the trading conditions and also the way I navigated the platform and the fast withdrawals was all the signals I need to make that choice.

Traduzione:

Direi che la parte migliore dell'essere qui per me è stato il servizio clienti e ha funzionato davvero bene per me ed è divertente come quando mi rivolgo sempre a loro tutto sembra funzionare lol. Ho iniziato qui con l'account demo ed è stato meraviglioso. Mi ha mostrato come sarebbe stato fare trading qui in modo completo, le condizioni di trading e anche il modo in cui ho navigato sulla piattaforma e i prelievi rapidi erano tutti i segnali di cui avevo bisogno per fare quella scelta.

13 marzo 2025

Posizione: Brasile

13 marzo 2025

I have been trading with xm for more than a year. so far my observation is that it’s a quite credible forex broker with rich history.

I think for newbies who could potentially read this review it’s the most important aspects that they should pay attention to.

Also check the copy trading feature. there are a lot of traders with interesting trading strategies. it’s in case you don't want to trade yourself or you are not capable

Traduzione:

Faccio trading con xm da più di un anno. Finora la mia osservazione è che è un broker forex piuttosto credibile con una storia ricca. Penso che per i principianti che potrebbero potenzialmente leggere questa recensione, sia l'aspetto più importante a cui dovrebbero prestare attenzione. Controlla anche la funzione di copy trading. Ci sono molti trader con strategie di trading interessanti. È nel caso in cui non volessi fare trading da solo o non fossi in grado

10 marzo 2025

Posizione: Indonesia

10 marzo 2025

Banyak kompetisinya dan penarikan sangat mudah mantab

Traduzione:

Ci sono molte competizioni e i prelievi sono molto facili, ottimo

Admirals (Admiral Markets) Valutazione complessiva

Classificato 10 su 1736 (Broker di mercati valutari)

Il rating complessivo deriva da un aggregato di giudizi in più categorie.

| Classificazione | Peso | |

| Valutazione degli utenti | 4,5 (8 Recensioni) | 3 |

| Popolarità | 4,0 | 3 |

| Regolamento | 5,0 | 2 |

| Valutazione dei prezzi | 5,0 | 1 |

| Caratteristiche | Non classificato | 1 |

| Assistenza clienti | Non classificato | 1 |

Normativa

| Società | Licenze e Regolamenti | Denaro dei Clienti Segregato | Fondo di Compensazione del Deposito | Protezione del Saldo Negativo | Rimborsi | Leva massima per i clienti retail |

|---|---|---|---|---|---|---|

| Admiral Markets Pty Ltd |

|

|

|

|

30 : 1 | |

| Admiral Markets Cyprus Ltd |

|

|

|

|

30 : 1 | |

| Admiral Markets UK Ltd |

|

|

|

|

30 : 1 | |

| Admirals SC Ltd |

|

|

|

|

1000 : 1 | |

| Admiral Markets AS Jordan Ltd |

|

|

|

|

500 : 1 |

Asset Disponibili: Cerca tutti gli strumenti negoziabili

| Simbolo | Descrizione | piattaforma di trading | Dimensione del contratto | Tasso swap lungo | Swap Tasso Short | Tipo di swap | Giorni di scambio |

|---|---|---|---|---|---|---|---|

| [AEX25] | Netherlands 25 Index CFD, cash (EUR) | MT4, MT5 | 1 units per 1 Lot | -5.09 | 0.55 | Annual % | 5 days (3x Wednesday) |

| [AEX25]-Z | Netherlands 25 Index CFD, cash (EUR) | MT4 | 1 units per 1 Lot | -7.58 | 1.00 | Annual % | 5 days (3x Friday) |

| [ASX200] | ASX200 Index CFD, cash (AUD) | MT4, MT5 | 1 units per 1 Lot | -7.55 | 1.68 | Annual % | 5 days (3x Wednesday) |

| [CAC40] | CAC40 Index CFD, cash (EUR) | MT4, MT5 | 1 units per 1 Lot | -6.09 | 0.55 | Annual % | 5 days (3x Wednesday) |

| [CAC40]-Z | CAC40 Index CFD, cash (EUR) | MT4 | 1 units per 1 Lot | -7.58 | 1.00 | Annual % | 5 days (3x Friday) |

| [DJI30] | Dow Jones Index CFD, cash (USD) | MT4, MT5 | 1 units per 1 Lot | -7.59 | 1.20 | Annual % | 5 days (3x Wednesday) |

| [DJI30]-Z | Dow Jones Index CFD, cash (USD) | MT4 | 1 units per 1 Lot | -7.59 | 1.20 | Annual % | 5 days (3x Friday) |

| [FTSE100] | FTSE100 Index CFD, cash (GBP) | MT4, MT5 | 1 units per 1 Lot | -7.74 | 1.77 | Annual % | 5 days (3x Wednesday) |

| [HSI50] | Hang Seng Index CFD, cash (HKD) | MT4, MT5 | 1 units per 1 Lot | -7.07 | 1.46 | Annual % | 5 days (3x Wednesday) |

| [HSI50]-Z | Hang Seng Index CFD, cash (HKD) | MT4 | 1 units per 1 Lot | -7.07 | 1.46 | Annual % | 5 days (3x Friday) |

| [IBEX35] | IBEX 35 Index CFD, Cash (EUR) | MT4, MT5 | 1 units per 1 Lot | -6.07 | -1.48 | Annual % | 5 days (3x Wednesday) |

| [JP225] | Nikkei 225 Index CFD, cash (JPY) | MT4, MT5 | 10 units per 1 Lot | -2.57 | -1.33 | Annual % | 5 days (3x Wednesday) |

| [JP225]-Z | Nikkei 225 Index CFD, cash (JPY) | MT4, MT5 | 10 units per 1 Lot | -2.57 | -1.33 | Annual % | 5 days (3x Wednesday) |

| [NQ100] | NASDAQ100 Index CFD, cash (USD) | MT4, MT5 | 1 units per 1 Lot | -7.59 | 1.70 | Annual % | 5 days (3x Wednesday) |

| [NQ100]-Z | NASDAQ100 Index CFD, cash (USD) | MT4 | 1 units per 1 Lot | -7.59 | 1.70 | Annual % | 5 days (3x Friday) |

| [OBX25] | Norway Top 25 Index CFD, cash (NOK) | MT4, MT5 | 1 units per 1 Lot | -7.89 | 1.84 | Annual % | 5 days (3x Wednesday) |

| [OBX25]-Z | Norway Top 25 Index CFD, cash (NOK) | MT4 | 1 units per 1 Lot | -7.89 | 1.84 | Annual % | 5 days (3x Friday) |

| [SMI20] | SMI20 Index CFD, cash (CHF) | MT4, MT5 | 1 units per 1 Lot | -3.18 | -6.90 | Annual % | 5 days (3x Wednesday) |

| [SMI20]-Z | SMI20 Index CFD, cash (CHF) | MT4 | 1 units per 1 Lot | -3.18 | -6.90 | Annual % | 5 days (3x Friday) |

| [SP500] | Standard and Poor's Index CFD, cash (USD) | MT4, MT5 | 1 units per 1 Lot | -7.59 | 1.70 | Annual % | 5 days (3x Wednesday) |

| [SP500]-Z | Standard and Poor's Index CFD, cash (USD) | MT4 | 1 units per 1 Lot | -7.59 | 1.70 | Annual % | 5 days (3x Friday) |

| #1COV | Covestro AG CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #AA | Alcoa Inc. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #AAL | Anglo American PLC CFD | MT4, MT5 | 1 units per 1 Lot | -5.99 | -1.61 | Annual % | 5 days (3x Wednesday) |

| #AALB | Aalberts Industries NV CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #AAPL | Apple Inc. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #ABBV | AbbVie Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #ABI | Anheuser-Busch InBev SA/NV CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #ABN | ABN AMRO Group NV CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #ABNB.US | Airbnb Inc (Class A) CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #ABT | Abbott Laboratories CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #AD | Koninklijke Ahold Delhaize NV CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #ADBE | Adobe Systems Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #ADS | Adidas AG CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #ADYEN | ADYEN NV CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #AIR | Airbus Group SE CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #AKZA | Akzo Nobel NV CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #ALO | Alstom SA CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #ALV | Allianz SE CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #AMAT | Applied Materials Inc. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #AMD | Advanced Micro Devices Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #AMZN | Amazon.com, Inc. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #APA.US | APA Corp CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #AR | Antero Resources Corp. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #ASML | ASML Holding NV CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #ASRNL | ASR Nederland NV CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #AXP | American Express Co. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #AZN | AstraZeneca PLC ADR CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #BA | Boeing Co. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #BABA | ALIBABA.COM LTD. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #BAC | Bank of America Corp. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #BAS | BASF SE CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #BAYN | Bayer AG CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #BBVA | Banco Bilbao Vizcaya Argentaria SA CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #BE | Bloom Energy Corp (Class A) CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #BHP.US | BHP Group Ltd ADR CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #BIDU | Baidu Inc ADR CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #BIIB | Biogen Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #BILI | Bilibili Inc ADR CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #BLDP | Ballard Power Systems Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #BMW | Bayerische Motoren Werke AG CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #BN | Danone SA CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #BNP | BNP Paribas SA CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #BNTX | BioNTech SE ADR CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #BOSS | HUGO BOSS AG CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #BP | BP PLC CFD | MT4, MT5 | 1 units per 1 Lot | -5.99 | -1.61 | Annual % | 5 days (3x Wednesday) |

| #BRKB | Berkshire Hathaway Inc (Class B) CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #BYND | Beyond Meat Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #C | Citigroup Inc. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #CAT | Caterpillar Inc. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #CBK | Commerzbank AG CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #CCL | Carnival PLC CFD | MT4, MT5 | 1 units per 1 Lot | -5.99 | -1.61 | Annual % | 5 days (3x Wednesday) |

| #CGC | Canopy Growth Corp CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #COIN.US | Coinbase Global Inc (Class A) CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #CON | Continental AG CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #COTY | Coty Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #CRM | salesforce.com Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #CRON | Cronos Group Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #CRWD | Crowdstrike Holdings Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #CSCO | Cisco Systems, Inc. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #CVX | Chevron Corp. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #DAI | Mercedes-Benz Group AG CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #DBK | Deutsche Bank AG CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #DBX | Dropbox Inc (Class A) CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #DDD | 3D Systems Corp CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #DELL | Dell Technologies Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #DHER | Delivery Hero AG CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #DHL.DE | DHL Group CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #DIS | The Walt Disney Co. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #DOCU | DocuSign Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #DOW | Dow Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #DTE | Deutsche Telekom AG CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #EA | Electronic Arts Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #EBAY | eBay Inc. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #EOAN | E.ON SE CFD | MT4, MT5 | 1 units per 1 Lot | -4.46 | -3.14 | Annual % | 5 days (3x Wednesday) |

| #ETSY | Etsy Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #EXPE | Expedia Inc CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #EZJ | easyJet PLC CFD | MT4, MT5 | 1 units per 1 Lot | -5.99 | -1.61 | Annual % | 5 days (3x Wednesday) |

| #F | Ford Motor Co. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

| #FCX | Freeport-McMoRan Inc. CFD | MT4, MT5 | 1 units per 1 Lot | -7.49 | 0.00 | Annual % | 5 days (3x Wednesday) |

La ricerca dei simboli live sopra riportata è presa da conti live sincronizzati al nostro sistema.

I CFD (Contratti per Differenza) consentono ai trader di speculare sul movimento dei prezzi di vari asset senza possedere l'asset sottostante. Ciò può fornire leva e flessibilità, ma può anche aumentare il rischio.

Tassi Swap Live

Tasso swap: posizione lunga

Tasso swap: posizione corta

Metodo di calcolo del tasso swap

| Broker | Mercato valutario | Materie prime | |||||

|---|---|---|---|---|---|---|---|

| EURUSD | GBPJPY | AUDNZD | Nella media | XAUUSD | XAGUSD | Nella media | |

Admirals | Pips | Pips | Pips | Points | Points | ||

IC Markets | Pips | Pips | Pips | Points | Points | ||

HFM | Pips | Pips | Pips | Points | Points | ||

Pepperstone | Pips | Pips | Pips | Points | Points | ||

| Broker | Mercato valutario | Materie prime | |||||

|---|---|---|---|---|---|---|---|

| EURUSD | GBPJPY | AUDNZD | Nella media | XAUUSD | XAGUSD | Nella media | |

Admirals | Pips | Pips | Pips | Points | Points | ||

IC Markets | Pips | Pips | Pips | Points | Points | ||

Pepperstone | Pips | Pips | Pips | Points | Points | ||

HFM | Pips | Pips | Pips | Points | Points | ||

| Broker | Mercato valutario | Materie prime | |||||

|---|---|---|---|---|---|---|---|

| EURUSD | GBPJPY | AUDNZD | Nella media | XAUUSD | XAGUSD | Nella media | |

Admirals | Pips | Pips | Pips | Points | Points | ||

IC Markets | Pips | Pips | Pips | Points | Points | ||

HFM | Pips | Pips | Pips | Points | Points | ||

Pepperstone | Pips | Pips | Pips | Points | Points | ||

I dati della tabella sopra sono presi da conti live utilizzando il nostro strumento di analisi dei tassi swap. Per confrontare i tassi swap di diversi broker o simboli diversi da quelli mostrati, clicca sul pulsante arancione di modifica.

I tassi swap, noti anche come spese di finanziamento, sono addebitati dai broker per mantenere le posizioni aperte durante la notte. Queste tasse possono essere sia positive che negative. I tassi swap positivi pagano al trader, mentre i tassi swap negativi comportano un costo.

Admirals (Admiral Markets) Profilo

| Nome società | Admiral Markets Pty Ltd |

| Categorie | Broker di mercati valutari, Forex Rebates |

| Categoria primaria | Broker di mercati valutari |

| Anno di istituzione | 2001 |

| Sede centrale | Estonia |

| Sedi degli uffici | Bielorussia, Cipro, Germania, Estonia, Regno Unito |

| Valuta conto | AUD, CHF, EUR, GBP, HUF, PLN, SGD, USD, BGN, RON, CZK, MXN, BRL, CLP |

| Lingue per assistenza | Arabo, bulgaro, Cinese, Inglese, olandese, francese, Tedesco, hindi, ungherese, indonesiano, italiano, coreano, polacco, portoghese, rumeno, russo, spagnolo, bengalese, ceco, estone, lettone, sloveno, croato, Khmer |

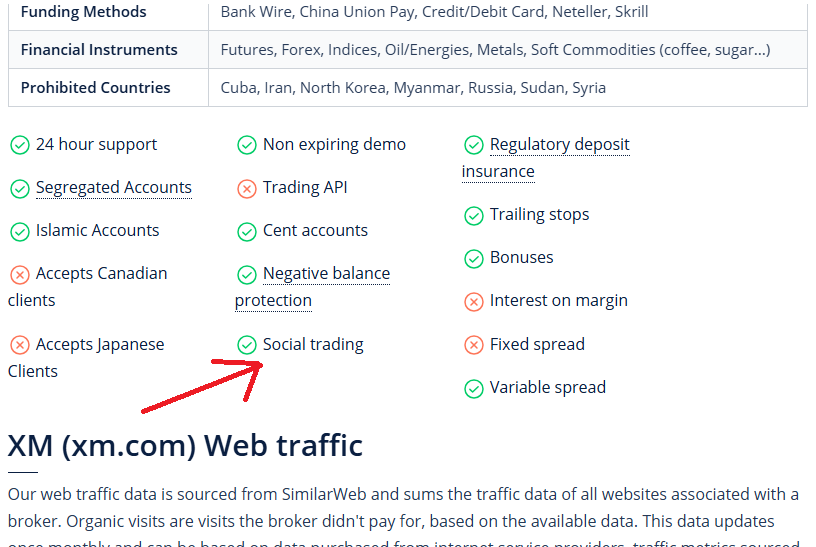

| Metodi di finanziamento | AstroPay, Bank Wire, Bitcoin, Credit/Debit Card, iDeal, Neteller, PayPal, POLi, Przelewy24, Skrill, Boleto Bancario, Trustly, Rapid Transfer, Klarna, MBWay |

| Strumenti finanziari | Future, Mercato valutario, Azioni / Equities, Indici, Obbligazioni, Petrolio / Fonti di energia, Criptovalute, Metalli preziosi, ETFs, Materie prime non metallifere (caffè, zucchero...) |

| Paesi proibiti | Mi sono imbattuto, Stati Uniti |