EUR/USD undervalued with Fed meeting on the horizon - Credit Agricole

It's been a bit of a running theme to start the new month, hasn't it? That being firms expecting further dollar weakness in December. Credit Agricole is the latest to pile in on the greenback in arguing that EUR/USD is "looking undervalued according to our FAST FX model". Adding that the pair has yet to fully reflect the widening rates spread between the euro and the dollar amid growing dovish expectations on the Fed heading into the FOMC meeting this month.

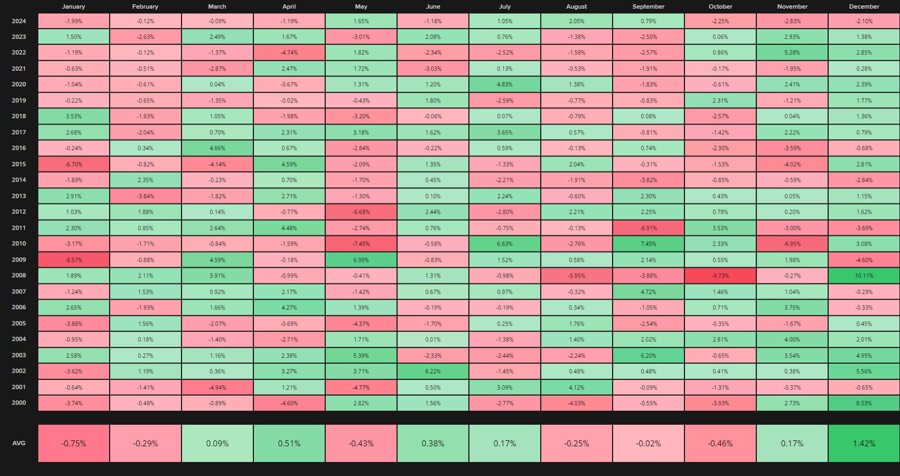

Besides that, they see seasonal patterns as also being a tailwind for EUR/USD to grind higher - noting that the euro has been "one of the most consistent outperformers vs the USD during the month of December in the last 25 years". Well, let's take a look at that seasonal chart then:

Well, they're not wrong in that regard and we're even seeing EUR/USD move higher in the final month of the year in 8 of the last 10 December cycles.

Apart from that, Credit Agricole also sees the euro being more bid as exporters accelerate profit-repatriation flows into year-end. As such, the firm expects EUR/USD to gain further in the week ahead barring any dollar-positive surprises.