Why Is Bitcoin Going Down Despite US Digital Asset Stockpile?

Despite US President Donald Trump signing an executive order to establish a Bitcoin Strategic Reserve for seized government assets, Bitcoin's price action remains choppy. At the time of writing, the price is edging higher on intraday charts, but the anticipated bullish momentum has yet to materialize for many traders.

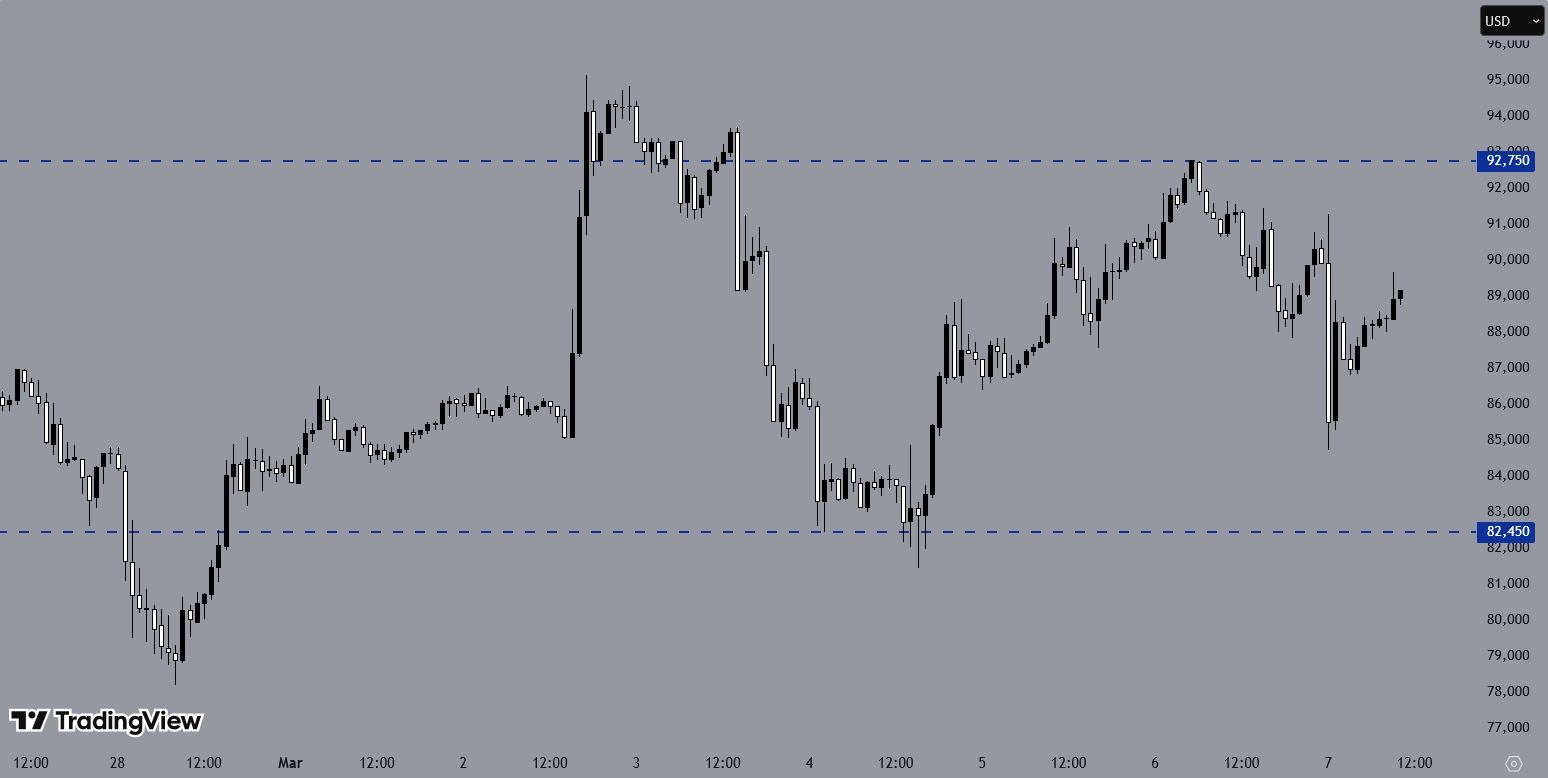

Bitcoin Forms Double Bottom, Faces Rejection

The BTCUSD H1 chart indicates that after a sharp bearish move, the price found support around 82,450, where it formed a double bottom before initiating a bullish correction. The price attempted to extend the upside but faced rejection at 92,750, which has been acting as a resistance and pushing the price lower.

The chart also shows that today's first H1 candle closed as a bearish engulfing candle, hinting at a potential continuation of the bearish trend. However, the following candle formed a bullish inside bar, suggesting buying interest as the price has been gradually moving higher.

BREAKING: 🇺🇸 President Trump signs executive order officially creating a #Bitcoin Strategic Reserve.

— Bitcoin Magazine (@BitcoinMagazine) March 7, 2025

pic.twitter.com/MiyTAbRkE2

DeepSeek AI Predicts Bitcoin’s 2025 Outlook

Bitcoin has been trading below $100,000 for an extended period, with this level serving as a resistance point that may hinder upward momentum. From a wider outlook, DeepSeek AI has outlined three potential scenarios for Bitcoin in 2025. In the base case, Bitcoin is expected to range between $100,000 and $150,000, according to Finance Magnates.

In a more optimistic “hyperbitcoinization” scenario, the price could reach $350,000. A less likely black swan event could push it to $500,000. These forecasts are based on anticipated growth in institutional adoption and broader blockchain integration within global finance. However, DeepSeek AI stresses that these predictions come with significant uncertainty and volatility.