Up to 14% of Employee Expenses Are Overpaid, Study Shows AI Detects Errors

Even a few small errors in employee expense claims can quietly cost companies millions. Data from Rydoo, an expense management software provider, shows that firms are overpaying on employee reimbursements by 5–14% on average.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

While most expense submissions follow policy, gaps in manual review processes allow costly errors and even deliberate fraud to slip through. Rydoo analyzed over 10 million expense claims through its Smart Audit module, which uses AI to detect non-compliance.

Non-Compliance Drains Money and Time

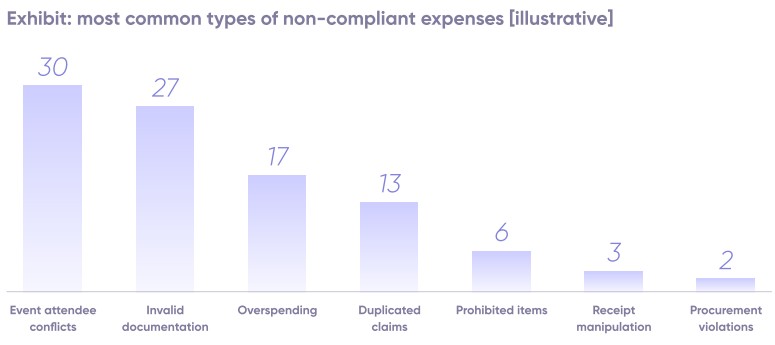

The findings reveal that 86% of expenses comply with company policy, leaving 14% of claims at risk. This 14% includes both errors, such as misclassified or incomplete claims, and intentional actions like duplicates or falsified receipts.

[#highlighted-links#]

Left unchecked, these claims inflate operating costs and reduce potential VAT recovery. Manual expense reviews compound the problem. A mid-sized company of around 650 employees could spend 2,300 hours annually checking claims, yet still miss repeat patterns or anomalies.

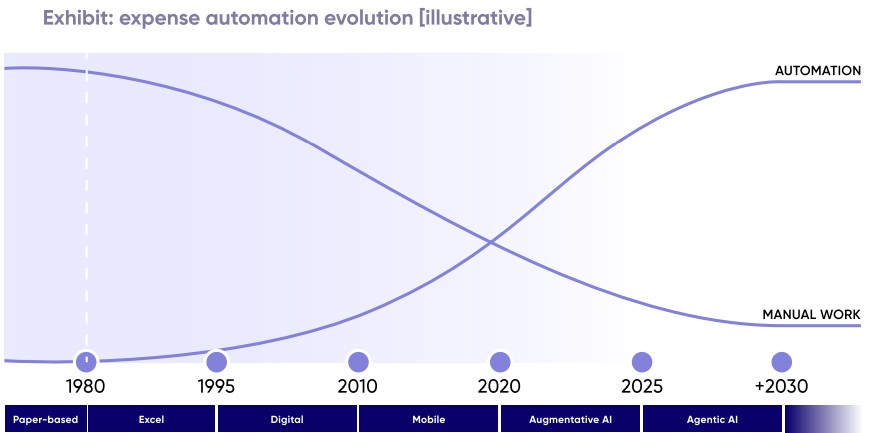

Artificial intelligence is changing the way finance teams approach expense compliance. By analyzing 100% of claims in real time with roughly 97% accuracy, AI flags anomalies automatically.

From Detection to Intelligent Governance

Low-risk, recurring claims—around 70% of submissions—can be processed without human intervention, freeing finance staff to focus on exceptions and higher-risk cases. AI not only improves accuracy but also reduces the hours spent on manual checks, improving operational efficiency across finance teams.

With AI embedded in platforms, finance teams can shift from periodic auditing to continuous assurance, combining real-time monitoring with human-in-the-loop oversight. This approach ensures policy compliance while giving employees faster processing of legitimate claims.

While AI helps control compliance, it also creates new challenges. Fake receipts generated by AI tools and manipulated claims using simple software are becoming more sophisticated, making traditional manual audits increasingly insufficient. Marchon warns that 30% of expense fraud could be AI-generated in the near future, highlighting the need for technology-driven detection systems.

Real Savings and Strategic Value

Automation isn’t just about preventing overpayments. Rydoo’s data shows that around 70% of low-risk claims—like subscriptions, commute allowances, and routine purchases—can be processed end-to-end automatically.

This saves hundreds of hours per year and improves the consistency of reviews. High-value or ambiguous expenses still benefit from human oversight, allowing finance teams to focus on strategic, high-impact work.