How Low Can Bitcoin Go? Arthur Hayes' BTC Price Prediction Suggests That Crypto May Go Down And Hit $100K

Bitcoin (BTC) price faces mounting pressure as BitMEX co-founder Arthur Hayes warns of a potential drop to $100,000, citing macroeconomic headwinds that could trigger significant corrections in the cryptocurrency market. The prediction comes after Hayes liquidated over $13 million in crypto assets, signaling his bearish stance on short-term market conditions.

The forecast came as Bitcoin had been falling for six consecutive sessions, dropping to $112,000. However, BTC is continuing its rebound from Sunday and is climbing to nearly $115,000.

How Low Can Bitcoin Go? Arthur Hayes' $100K Bitcoin Price Warning

Hayes' bearish outlook stems from deteriorating economic fundamentals. The former BitMEX CEO points to the disappointing July Non-Farm Payrolls report, which showed only 73,000 new jobs added versus expectations of 110,000. This economic weakness, combined with sluggish credit growth across major economies, has prompted Hayes to take defensive action.

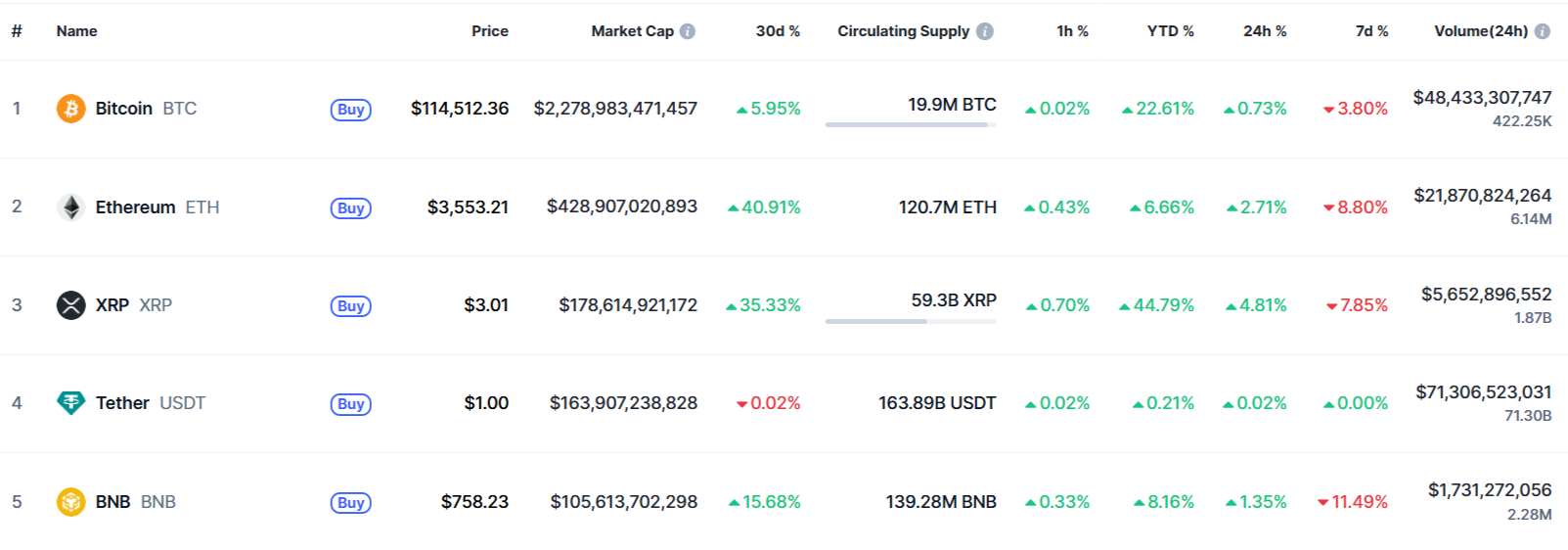

"No major econ is creating enough credit fast enough to boost nominal GDP," Hayes explained on X. "So BTC tests $100k, ETH tests $3k." His warning comes as Bitcoin trades around $114,730, having already declined 7.7% from its July high of $123,000.

Y? US Tariff bill coming due in 3q … at least the mrkt believes that after NFP print. No major econ is creating enough credit fast enough to boost nominal gdp. So $BTC tests $100k, $ETH tests $3k. Come see my @WebX_Asia Tokyo keynote Aug 25 for more info. Back to the beach. https://t.co/zuHlwgQKC7

— Arthur Hayes (@CryptoHayes) August 2, 2025

Hayes' portfolio moves speak volumes about his conviction. The Maelstrom Fund chief investment officer sold $8.32 million worth of ETH, $4.62 million of Ethena, and $414,700 of Pepe. His wallet now holds $22.95 million in USDC stablecoin, representing a significant cash position ahead of anticipated volatility.

BTC Technical Analysis Supports Bearish Scenario

From my technical analysis perspective, Bitcoin's six consecutive days of declines brought prices to the $112,000 level and the 50-day exponential moving average. As I view it, this confluence with the 23.6% Fibonacci retracement creates a critical support zone that has been tested multiple times since 2025.

I observe the Sunday recovery showing a 0.5% gain continued into Monday, confirming the importance of this technical level. However, in my analysis, if this support fails, the next major target becomes the 38.2% Fibonacci retracement just above $104,000, coinciding with local support/resistance from the May-June breakout.

My primary downside target remains the psychological $100,000 level, which aligns with late June lows, the 200-day exponential moving average, and an expanding support zone extending to $98,000 where the 50% Fibonacci retracement lies. I believe this area likely contains significant buy orders from institutions and retail investors seeking lower entry points.

In my view, a break below this crucial support zone would shift medium-term sentiment decisively bearish, potentially targeting the April lows around $75,000 where I expect substantial accumulation orders would create natural support.

Current Market Dynamics and Recovery Signs

Despite Hayes' warnings, Bitcoin has shown resilience in recent trading sessions. According to CoinMarketCap data, Bitcoin currently costs $114,730, rising 0.9% in the last 24 hours. Most major cryptocurrencies are posting rebounds alongside Bitcoin, with Ethereum returning above $3,560 and gaining nearly 3%.

The recovery from weekend lows demonstrates the market's ability to find support at critical technical levels. Sunday morning saw major cryptocurrencies test monthly minimums before recovering strongly in the second half of the day and maintaining gains into the weekly close.

Other Analysts Warning of $100K Test

Hayes isn't alone in his cautious outlook. Several prominent analysts have highlighted the possibility of Bitcoin testing $100,000 or lower. Trading analyst Pentoshi, known for calling the 2021 bull run peak, is preparing to "load up" on Bitcoin if it drops below $100,000, specifically targeting the $94,000 area for aggressive accumulation.

Michael Van De Poppe identifies the $110,000-$112,000 zone as a strong accumulation area, expecting Bitcoin to trade higher over the next 6-12 months while warning that failure to hold support could send BTC toward $103,190.

Meanwhile, some analysts see current levels as a buying opportunity. CryptoGoos notes that Bitcoin volatility nears historic lows, suggesting a potential breakout, while veteran trader Peter Brandt believes in a possible cycle top between $125,000 and $150,000 by Q3 2025.

Analyst | Price Target | Rationale | Timeframe |

Arthur Hayes | $100,000 | Macro headwinds, credit tightening, tariff concerns | Q3 2025 |

Pentoshi | $94,000 accumulation zone | Technical correction, buying opportunity | Short-term |

Michael Van De Poppe | $103,190 if support fails | Support break scenario | Near-term |

Peter Brandt | Traditional cycle analysis | Q3 2025 | |

Bloomberg's Mike McGlone | $10,000 worst case | Regulatory/adoption concerns | Long-term bear case |

Institutional vs. Retail Perspectives

The debate over Bitcoin's trajectory reflects broader disagreement between institutional and retail perspectives. Bloomberg ETF analyst Eric Balchunas argues that Bitcoin has experienced "much less volatility and no vomit-inducing drawdowns" since BlackRock's spot Bitcoin ETF filing in June 2023.

This guy gets it. We’ve been saying same thing. Since BlackRock filing Bitcoin is up like 250% with much less volatility and no vomit-inducing drawdowns. This has helped it attract even bigger fish and gives it fighting chance to be adopted as currency. Downside is prob no more… https://t.co/0ECd5XevcO

— Eric Balchunas (@EricBalchunas) July 26, 2025

Mitchell Askew from Blockware Solutions adds: "The days of parabolic bull markets and devastating bear markets are over". This institutional view suggests that ETF inflows and corporate treasury adoption have fundamentally changed Bitcoin's volatility profile.

BTC/USD looks like two entirely different assets before and after the ETF

— Mitchell Askew ✝️🇺🇸🌞 (@MitchellHODL) July 25, 2025

The days of parabolic bull markets and devastating bear markets are over

BTC is going to $1,000,000 over the next 10 years through a consistent oscillation between “pump” and “consolidate"

It will bore… pic.twitter.com/JlyKpLei65

However, Hayes' macro-focused analysis challenges this narrative, emphasizing that traditional economic cycles still influence cryptocurrency markets. His focus on credit creation, tariff policies, and employment data suggests that Bitcoin remains vulnerable to broader economic pressures.

Bitcoin Price Predictions: Expert Forecasts for 2025-2026

Source | 2025 Prediction | 2026 Prediction | Notes |

Standard Chartered | $500,000 by 2028 | Geoff Kendrick's institutional adoption thesis | |

Changelly | $109,046 average | $163,582 average | Conservative range: $105,781-$110,310 |

Digital Coin Price | $223,028 average | N/A | Bullish range: $96,511-$236,486 |

Binance | $114,229 | $119,941 | Platform's algorithmic prediction |

CoinCodex | $129,090 average | N/A | Range: $109,848-$179,948 |

Cathie Wood (ARK) | N/A | Bull case: $1.5M by 2030 |

The wide range of predictions reflects fundamental disagreement about Bitcoin's trajectory. Bulls point to institutional adoption, ETF inflows, and supply constraints from the recent halving. Bears like Hayes focus on macroeconomic headwinds, credit tightening, and potential policy changes.

You may also like: New Ethereum Price Prediction Targets $17K by 2026. Could ETH Gain as Much as 350%?

Why Is Bitcoin Price Going Down? Macroeconomic Headwinds Driving Bearish Sentiment

Hayes' analysis centers on three key macroeconomic factors. First, the disappointing July jobs report signals potential economic weakness that could reduce risk appetite. Second, sluggish credit growth across major economies limits the monetary expansion that historically drives Bitcoin prices higher.

Third, renewed tariff concerns following President Trump's trade policies create additional uncertainty. The U.S. initiated new tariffs on 69 countries, adding to concerns about global economic disruption. Hayes specifically mentions a "US Tariff bill coming due in 3Q" as a catalyst for market stress.

These factors combine to create what Hayes sees as an unfavorable environment for risk assets. His prediction that "BTC tests $100k, ETH tests $3k" reflects this macro-driven bearish outlook rather than technical analysis alone.

Risk Management and Investment Implications

For investors, Hayes' warning highlights the importance of risk management in volatile markets. His decision to convert over $13 million to stablecoins demonstrates how even crypto bulls adjust positions based on changing conditions.

The $100,000 level represents an 18.7% correction from recent highs, which would be significant but not unprecedented for Bitcoin. Historical analysis shows Bitcoin has experienced corrections of 84% (2017-2018) and 70% (2022), making Hayes' prediction relatively modest by crypto standards.

Investors should consider that multiple support levels exist between current prices and $100,000. The 50-day EMA around $112,000, the $110,000 psychological level, and various Fibonacci retracements provide potential buying opportunities for those sharing Hayes' longer-term bullish outlook.

Bitcoin's current price action reflects the ongoing battle between institutional adoption narratives and traditional economic cycles. While Arthur Hayes' $100,000 prediction may seem bearish, it represents a relatively modest correction in the context of Bitcoin's historical volatility. The confluence of technical support levels around $100,000 suggests this area would likely attract significant buying interest, potentially setting the stage for the next leg higher once macroeconomic uncertainties resolve.

Check also my XRP analysis: XRP Price Will Hit $9 as Analysts Predict 200% Surge by September 2025

Bitcoin News FAQ

How Low Is Bitcoin Going to Drop?

Based on Arthur Hayes' analysis and my technical research, Bitcoin could test the $100,000 psychological support level, representing an 18.7% correction from recent highs. My technical analysis identifies key support zones at $104,000 (38.2% Fibonacci retracement) and the primary target of $100,000 where the 200-day exponential moving average converges with late June lows. If this critical support fails, I expect potential downside to $75,000 (April lows) where substantial accumulation would likely occur.

How Low Can Bitcoin Go in 2025?

In my view, Bitcoin's downside in 2025 is limited by strong institutional support and technical levels. While Hayes warns of a $100,000 test due to macro headwinds, most analysts maintain bullish long-term outlooks. Pentoshi targets the $94,000 area for aggressive accumulation, while Michael Van De Poppe sees $103,190 as a worst-case scenario. Historical context shows Bitcoin's previous corrections of 84% (2017-2018) and 70% (2022), making current predictions relatively modest.

What Is the Reason Bitcoin Is Going Down?

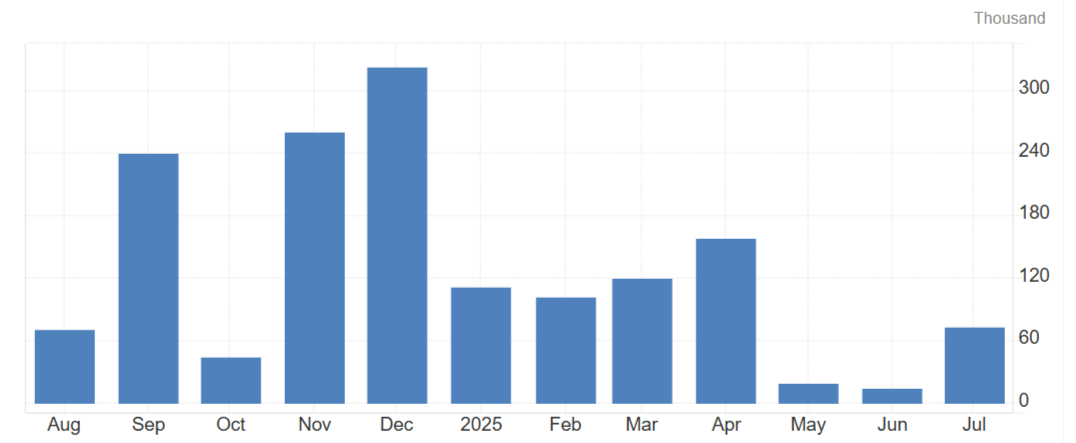

Hayes identifies three primary factors driving Bitcoin's decline: the disappointing July Non-Farm Payrolls report showing only 73,000 new jobs, sluggish credit growth across major economies limiting nominal GDP growth, and renewed tariff concerns with the U.S. tariff bill coming due in Q3. These macroeconomic headwinds reduce appetite for risk assets like Bitcoin. Additionally, my technical analysis shows Bitcoin rose over 60% from April lows to July highs with only 8% correction, suggesting a healthy pullback was overdue.

Will BTC Rise Again?

Multiple factors support Bitcoin's recovery potential. Institutional adoption continues with Bloomberg ETF analyst Eric Balchunas noting "much less volatility" since BlackRock's ETF filing. Standard Chartered maintains a $200,000 target for 2025, while Changelly forecasts $109,046 average. In my technical view, the $100,000-$98,000 support zone contains significant buy orders from institutions and retail investors. Even bearish analysts like Pentoshi plan to "load up" below $100,000, suggesting strong demand at lower levels would fuel the next rally.