The Winklevoss Twins Just Launched Gemini Predictions in the US

Gemini started offering prediction markets across the United States this week, capping a five-year effort to secure federal approval and entering a sector that has drawn billions in trading volume this year.

Gemini Launches Prediction Markets Nationwide After Five-Year Regulatory Wait

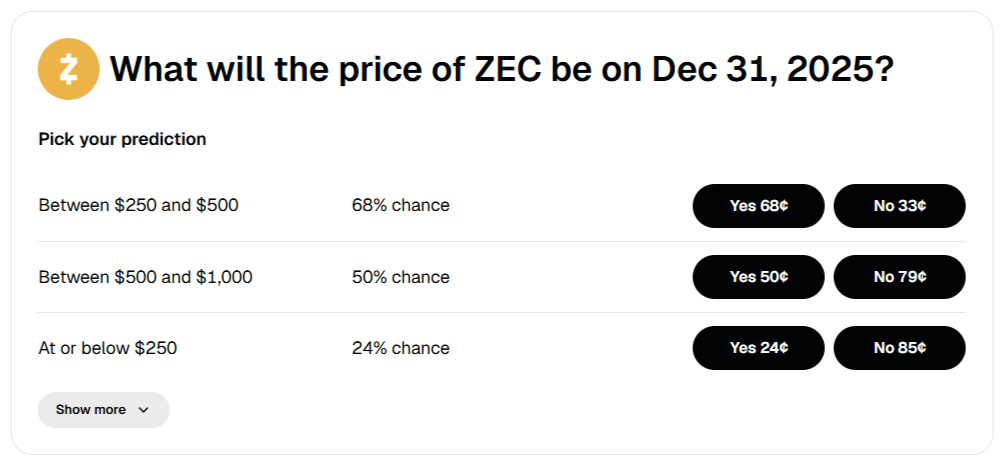

The crypto exchange, founded by billionaire twins Tyler and Cameron Winklevoss, rolled out Gemini Predictions through its subsidiary Gemini Titan after receiving a Designated Contract Market license from the Commodity Futures Trading Commission (CFTC) on December 11. Users can now trade yes-or-no contracts on events ranging from whether Bitcoin will close the year above $200,000 to specific regulatory outcomes.

Introducing Gemini Predictions, now live across all 50 US states 🇺🇲

— Gemini (@Gemini) December 15, 2025

Users can trade on outcomes of real world events with near instant execution and full transparency. pic.twitter.com/1wRhkLCEG5

Gemini first filed for the DCM license in March 2020, making the approval one of the longer regulatory reviews in recent memory.

Cameron Winklevoss credited the Trump administration's approach to crypto regulation for the eventual greenlight, saying it ended what he called the previous administration's hostility toward digital assets.

Three-Way Race for Market Share

The launch puts Gemini directly against Kalshi and Polymarket, which together processed billions in monthly volume during the run-up to the November elections. Polymarket only resumed U.S. operations this month after being banned from American markets in 2022.

Gemini enters with advantages that neither rival has fully matched: a public listing on Nasdaq, a large retail customer base, and regulatory approvals that took years to obtain. The exchange resolved its SEC disputes in September and has since expanded rapidly, adding tokenized stocks and now prediction markets to its platform.

[#highlighted-links#]

The CFTC granted Gemini and three other platforms relief from certain swap reporting requirements on December 12, easing compliance burdens for fully collateralized event contracts. That decision came just one day after Gemini Titan received its DCM license, signaling faster regulatory processing under Acting Chairman Caroline Pham.

Platform Push Beyond Core Trading

Gemini Predictions fits into a wider push across the crypto industry to build what executives call "super apps,” platforms that combine trading, staking, lending, and now event-based betting in a single interface. Coinbase has made similar moves, racing to add prediction markets and tokenized equities before the end of the year.

Smaller platforms followed quickly. PancakeSwap announced Probable, a zero-fee prediction market on BNB Chain, on December 15. The project received backing from YZi Labs, the venture fund started by Binance co-founder Changpeng Zhao. Self-custodial wallets including MetaMask and Trust Wallet have also begun adding prediction features, either through partnerships or direct integrations.

Gemini itself has expanded beyond crypto trading over the past year. The exchange launched tokenized stocks in the European Union in June, starting with MicroStrategy shares and promising to add more equities and ETFs shortly after. That followed an earlier rollout of staking and rewards programs, all aimed at keeping users inside Gemini's ecosystem.

Regulatory Friction Persists in Some States

Federal approval hasn't stopped state-level pushback. Connecticut issued cease-and-desist orders to Kalshi, Robinhood, and Crypto.com in early December, claiming their prediction offerings violated state gambling laws. A judge granted the platforms temporary relief from enforcement while litigation continues.

Those orders marked the tenth state to challenge Kalshi's contracts, illustrating the gap between federal commodity regulation and state gambling statutes. Gemini has not disclosed whether it expects similar challenges or how it plans to navigate conflicting state rules.

Tyler Winklevoss, Gemini's CEO, has called prediction markets a potentially larger opportunity than traditional capital markets, echoing comments he made when the exchange first sought regulatory approval in November. The company also indicated it may pursue broader derivatives offerings, including crypto futures, options, and perpetual contracts, though it gave no timeline for those products.

Gemini Predictions is available on the web and iOS, with no trading fees during an initial promotional period. The platform converts users' existing dollar balances into contract positions with what the exchange describes as near-instant execution.