INFINOX Capital UK’s Profit Rises 17% as Broker Shifts Focus to Institutional Trading

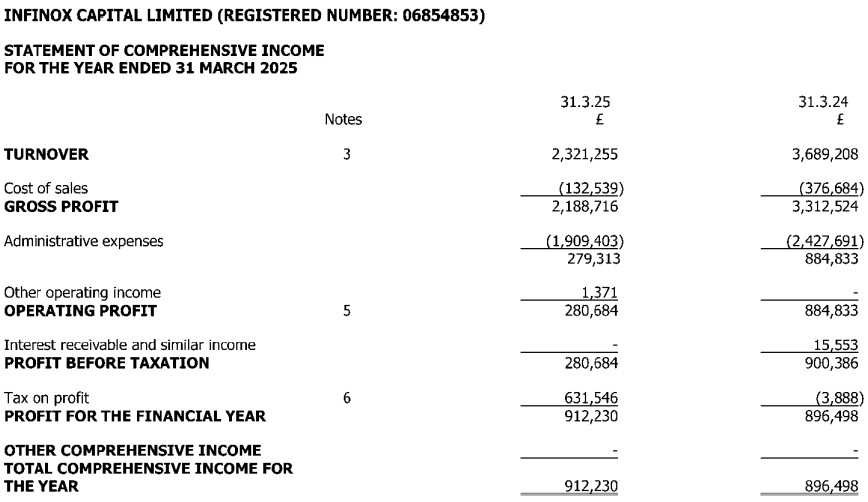

INFINOX Capital Limited closed its 2025 financial year with a profit for the financial year rising 17% to £912,230 despite a drop in revenue following its exit from the retail trading segment.

Profitability Maintained Despite Lower Turnover

According to the company’s latest filings, turnover for the year was £2,321,255, a 37% decline compared to £3,689,208 in 2024. The decline reflects the completion of INFINOX’s strategic move away from retail operations and its focus on the institutional market under the IXO Prime brand.

[#highlighted-links#]

The shift also helped the company sustain high margins. Cost of sales totalled £132,539 (2024: £376,684), resulting in a gross profit of £2,188,716, down from £3,312,524 in the previous year. Administrative expenses fell by 16% to £1,909,403, compared with £2,427,691 in 2024, showing consistent cost discipline.

Operating profit for the year was £280,684, compared with £884,833 a year earlier. Profit before tax also stood at £0.28 million, while the company recognised a deferred tax credit of £631,546 million, which lifted total comprehensive income to £912,230 million, slightly above the previous year’s £896,498.

Directors described the results as satisfactory and said the company remains confident about its long-term position within the institutional trading sector. “The business remains well capitalised to take advantage of future opportunities,” the annual report stated.

IXO Prime Expansion and Outlook

The directors said the company will continue developing the IXO Prime brand, which offers liquidity and institutional services to brokers, money managers, professional clients, and fintech companies. The business will remain focused on strengthening its institutional offerings rather than expanding back into retail.

Key performance indicators also showed client assets under management at £4.99 million, compared with £5.40 million in the previous year.

INFINOX Capital, authorised and regulated by the Financial Conduct Authority (FCA) under registration number 501057, ended the 2025 financial year maintaining profitability and strong capitalisation despite lower turnover.

The company said it expects to build on its institutional presence and operational efficiency through the IXO Prime platform in the coming year.