Can XRP Price Fall 10% in September 2025? The new price predictions and technical analysis

The urgent question "How low can XRP go in September 2025?" has intensified as the cryptocurrency trades at $2.75, down 4% in the past 24 hours and testing critical support levels that could determine its trajectory through the historically challenging month. Why is XRP going down reflects both seasonal headwinds and technical breakdown from the $2.80-$2.87 resistance zone.

My technical analysis indicates that this may not be the end of the decline. The rejection of a bullish flag pattern suggests that XRP could fall by 10% in September, testing two-month lows.

XRP Price September 2025: Market Dynamics Today

XRP enters September facing significant pressure after breaking below the crucial $2.80 support level during heavy selling, when volume spiked to 76.87M, nearly triple the daily average. The cryptocurrency today, Monday, 1 September 2025, trades at $2.75, having moved across a $0.12 (4%) range in the past 24 hours.

Key XRP metrics for September 1, 2025:

- Current price: $2.75 (down 4% in 24 hours)

- Critical support test: $2.80 level breached

- Institutional liquidations: $1.9 billion since July

- Whale accumulation: 340 million XRP in two weeks

- Total whale holdings: 7.84 billion XRP

The price action reveals a stark divergence between short-term liquidators selling and long-term holders accumulating, creating conflicting signals for September's direction.

Expert Technical Analysis: Limited XRP/USDT Downside Expected

According to my technical analysis of the XRP/USDT chart, the recent declines observed since August 27 have now extended to the sixth consecutive session. The bullish scenario I had previously assumed within a flag formation framework has been invalidated as the price broke below the formation range.

Given that XRP has exited the flag formation to the downside, I now expect that XRP notations during September may correct downward rather than rise dynamically. However, there isn't much room for further declines at this moment. It's worth noting that local support remains in play, defined by levels from July and August in the range of $2.80 to $2.75, which is also being tested today on September 1, 2025.

Although the price briefly fell to $2.70, at the time of writing it has already rebounded by 7 cents to $2.77. On the daily chart, a bullish pin bar candle is forming since morning. If the local support fails to hold, XRP could decline toward a confluence of support levels drawn at the height of peaks from March and May of this year in the $2.60 range. This zone is capped by the $2.50 level where the 200-day exponential moving average (200 EMA) runs.

Answering the question of how low XRP can fall in September 2025, I believe that from current levels it will not be more than 10% or 26 cents maximum. I will continue to maintain the principle that any corrections in this range are opportunities for accumulation, chances to buy XRP at more attractive prices.

While we can forget about the flag formation, in the medium term I would still expect a return to around $3.60, which from current levels means nearly 30% growth potential, and from the vicinity of my designated support zone and 200 EMA almost 45%.

On-Chain Analysis: Critical Support Zones

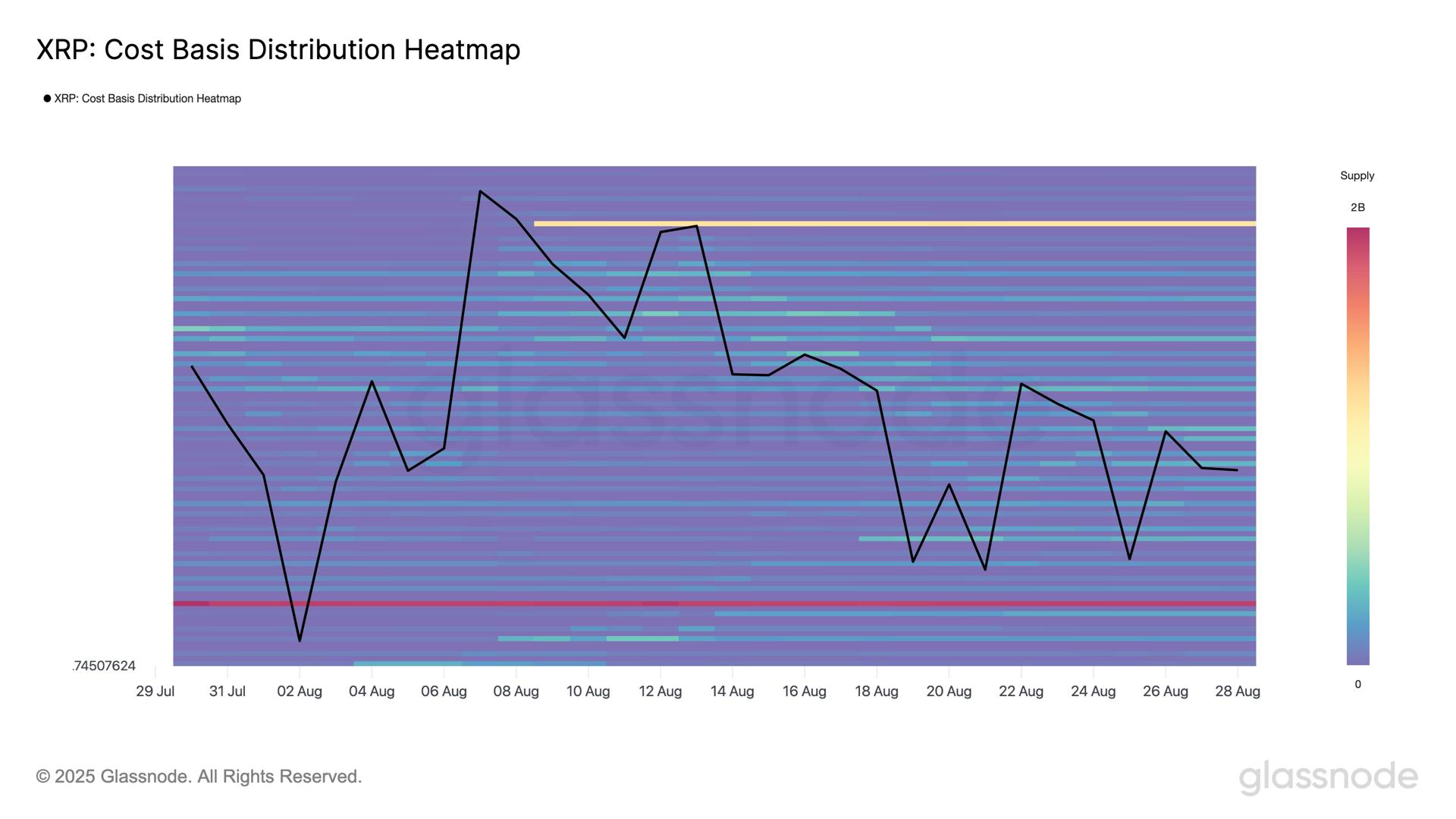

Glassnode Cost Basis Reveals Key Level

Glassnode's cost basis analysis identifies the most critical support zone for XRP. The largest supply cluster sits between $2.81-$2.82, where 1.71 billion XRP were acquired. With XRP trading just below this zone at $2.75, the breakdown has likely triggered profit-taking as holders see their gains vanish.

Whale Accumulation vs. Institutional Selling

Despite the technical breakdown, whale wallets holding 10-100 million XRP accumulated 340 million tokens over the past two weeks, bringing their total holdings to 7.84 billion XRP. This massive accumulation occurred primarily in the $3.20-$3.30 range, suggesting institutional confidence despite short-term weakness.

The divergence is stark: $1.9 billion in institutional liquidations since July contrasts sharply with whale buying, indicating different time horizons and risk appetites among large holders.

XRP Price Predictions September 2025: Expert Consensus

Conservative Forecasts

Changelly's September 2025 predictions show:

- Minimum price: $2.74

- Average price: $2.96

- Maximum price: $3.17

- Potential ROI: 12.8%

Binance's forecast remains more conservative with September ending around $2.80, suggesting limited recovery potential.

Bullish Scenarios

Elon Musk's Grok AI projects XRP could reach $3.50-$4.20 in September 2025, with potential for $5+ if spot ETF approval materializes. The AI bases this on regulatory clarity following the Ripple case and growing institutional adoption.

James Crypto Space, on the other hand, predicts that by the end of this month XRP’s price will rise to $9. Standard Chartered forecasts an increase to $5.50 this year and to $8 dollars next year.

September Headwinds: Multiple Risk Factors for XRP

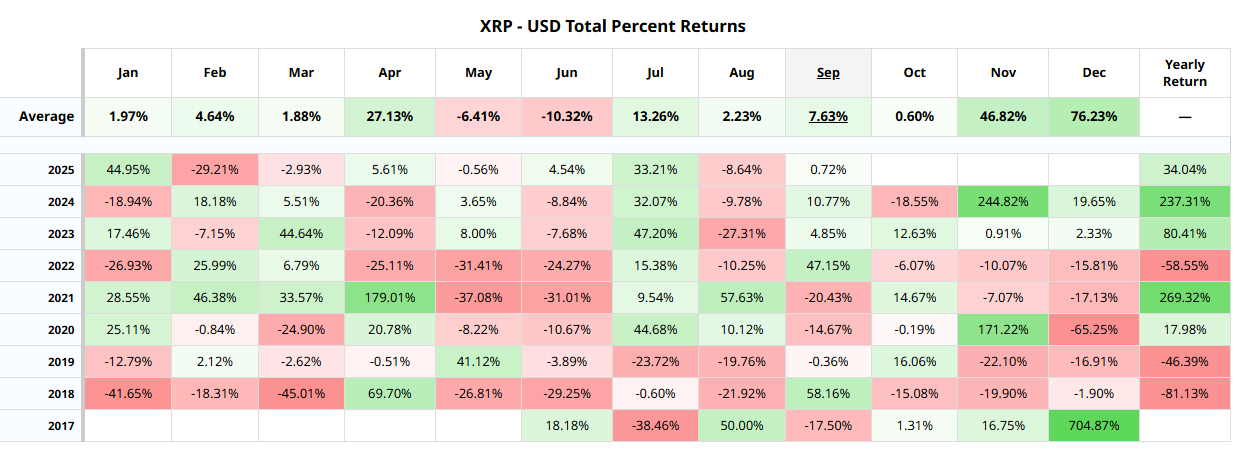

Historical September

Unlike Bitcoin, which I discussed in the context of “Red September” here, XRP has historically performed well in September. The average for this month is a gain of nearly 87 percent, and the last time it declined in September was in 2021.

Regulatory Uncertainty Persists

Despite progress in the Ripple-SEC case, ongoing regulatory pressure in the U.S. keeps institutions cautious. However, 15 XRP ETF applications filed with the SEC provide potential upside catalysts.

Technical Breakdown Signals

Key momentum indicators confirm bearish pressure:

- MACD bearish crossover imminent on weekly charts

- RSI shows oversold conditions in mid-40s

- Volume spike at $2.80 breakdown confirms distribution

Institutional Adoption Provides Floor

ETF Momentum Building - ProShares Ultra XRP ETF attracted $1.2 billion in its first month, while CME XRP futures crossed $1 billion, becoming the fastest-growing product on the platform.

Corporate Treasury Adoption - Japanese gaming firm Gumi allocated $17 million to XRP between September 2025-February 2026, while Hyperscale Data plans to raise $125 million with portions earmarked for XRP.

Liquidity Maps Show Upside Potential - On-chain data reveals liquidity concentrations up to $4.00 that could amplify any recovery move, with technical patterns suggesting $5-$13 upside potential if resistance breaks.

FAQ: XRP September 2025 Outlook

How low can XRP realistically go in September 2025?

Technical analysis suggests maximum 10% decline to $2.50-$2.60 range, with 200-day EMA providing strong support near current levels.

Why is XRP going down despite whale accumulation?

$1.9B institutional liquidations since July outweigh 340M tokens of whale buying, creating short-term selling pressure despite long-term confidence.

What would trigger an XRP recovery in September?

Breaking above $2.87 resistance could flip sentiment toward $3.30, while XRP ETF approval could spark significant upside.

Is the $2.80 level significant for XRP?

Yes. Glassnode shows 1.71B XRP acquired at $2.81-$2.82, making this the largest cost basis cluster and critical support zone.