Retail Traders Remain Confident, With 60% Bullish on Stocks

Retail investors are embracing a paradox: They remain heavily invested in tech stocks and cryptocurrency while simultaneously acknowledging potential market bubbles.

A recent survey by tastytrade and Nasdaq reveals that today's retail trader is confident in market growth but wary of overvaluation. This mix of optimism and caution defines a generation of investors navigating an uncertain financial landscape.

Retail Investors Show Resilience

The survey, conducted in late January 2025 with 1,036 active U.S. retail traders, highlights a high level of optimism. Nearly 60% of respondents expressed bullish sentiment for the next 12 months, with 10% being "very bullish."

Only 26% identified as bearish, showing that despite market uncertainties, most traders expect continued growth. Confidence levels, however, varied by gender. Male traders, who comprised 76% of respondents, were significantly more bullish (63%) than their female counterparts (48%).

The age distribution also provides insight into retail investor trends. While 43% of respondents were aged 35-54 and 36% were over 55, younger traders (ages 18-34) made up 21% of participants. This younger demographic is shaping new market trends, particularly in the adoption of cryptocurrency and speculative assets.

Retail traders continue to favor technology stocks, with 75% expressing confidence in the sector. Communication services (68%) and energy (67%) follow closely, while real estate lags behind, with only 46% showing optimism.

A key focus remains on the "Magnificent Seven" tech giants: Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla. These stocks reportedly accounted for 23% of retail traders' holdings over the past year, with younger investors allocating an even larger share (32%) of their portfolios to these companies.

The Crypto Divide

According to the report, 75% of traders aged 18-34 actively trade crypto, with 93% having engaged in the market at some point. In contrast, only 22% of traders over 55 actively trade crypto, and just 38% have ever participated.

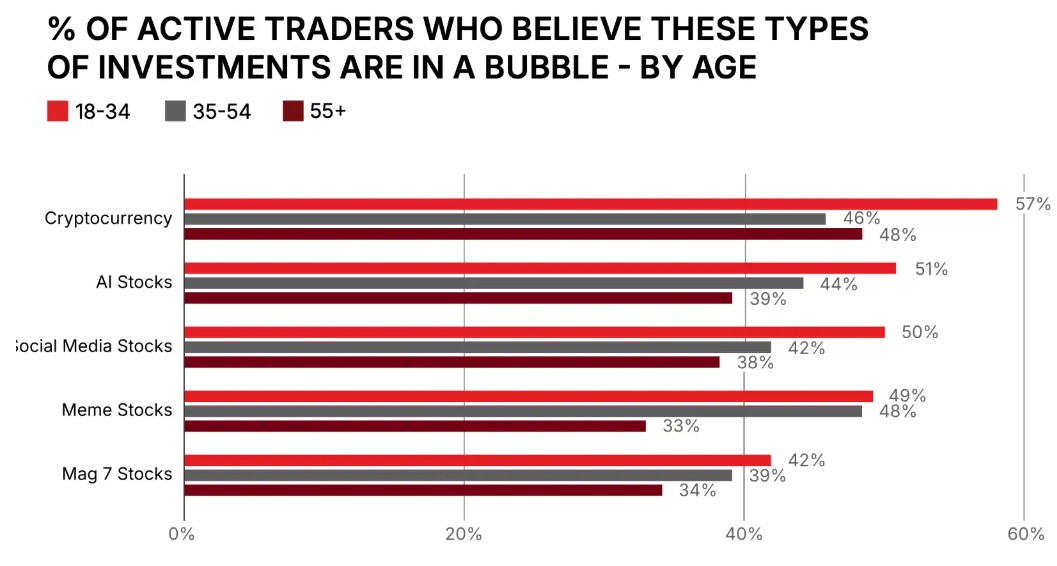

More than half of traders aged 18-34 consider cryptocurrencies, AI stocks, and social media stocks overvalued, a significantly higher percentage than their older counterparts.

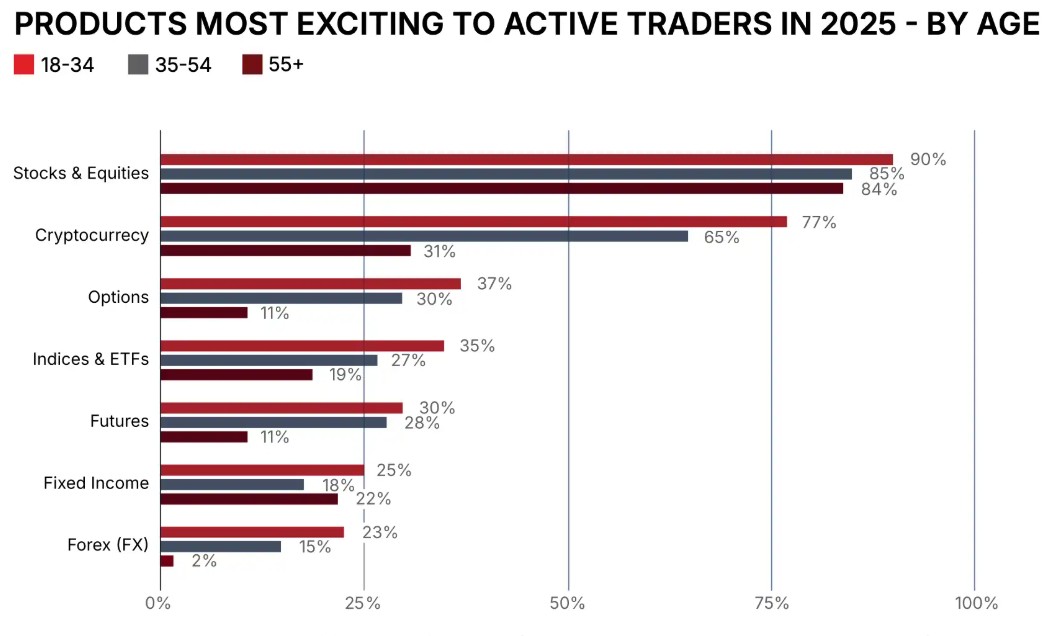

Stocks remain the most popular asset class among all traders (86%), but enthusiasm for other investment vehicles varies by age. Cryptocurrency ranks as the second-most exciting product for investors under 55, whereas older traders show limited interest.

Younger investors also display greater enthusiasm for options, indices, futures, and Forex trading. Fixed-income products, traditionally considered a safe haven, maintain relatively consistent appeal across all age groups at around 21%.