MT5 Introduces Usability Fixes While Overtaking MT4 Among Retail Traders

MetaTrader 5, the multi-asset trading platform, has released build 5370 with several updates aimed at improving usability across devices.

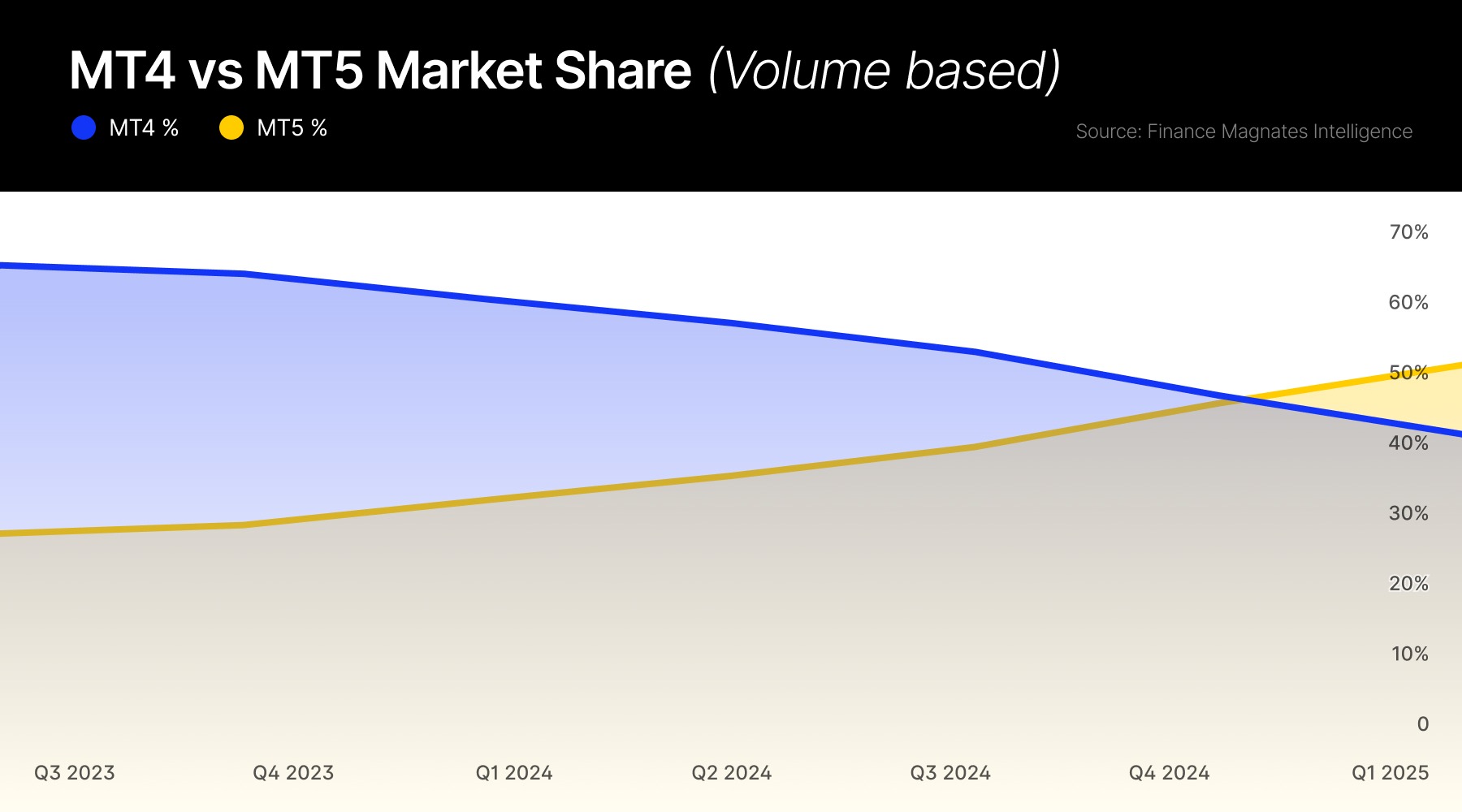

In recent years, MT5 adoption has increased, driven by technological upgrades, regulatory changes, and demand for a wider range of trading instruments. Brokers are increasingly promoting MT5 as MT4 support declines, and MT5 has now officially surpassed MT4 in trading volume, according to Finance Magnates’ Q1 Intelligence Report.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

MT5 Update Fixes Mobile Display and Instrument Issues

The new version introduces the display of contract start and end dates in instrument specifications. It also resolves a price delay indication issue in the “Quotes” section, which previously did not appear on mobile devices in extended view mode.

[#highlighted-links#]

Other improvements include fixes to the timeframe selection menu on mobile horizontal view, the display of available account types when creating a demo account, and localization issues in the account connection window, where some items had previously appeared only in English.

MT5 Surpasses MT4 in Combined Trading Volume

MT5 now accounts for 54.2% of the combined trading volume of MT4 and MT5, while MT4, launched in 2005, retains a 45.8% share. MT4 became widely used for CFD trading because of its user-friendly interface, charting tools, algorithmic trading support, and broad broker compatibility.

FTMO Relaunches in the US with MT5 Access

FTMO, a prop trading firm, has recently resumed services for US-based traders, offering access to the MT5 platform. This makes it the only prop firm currently providing MT5 in the US. The5ers, another returning prop firm, uses cTrader.

Both FTMO and The5ers had suspended US operations in early 2024 and relaunched recently. FTMO’s relaunch is supported through a partnership with OANDA, a US-regulated broker, separating the provision of the evaluation process from the rewards account. The company’s US website uses terms such as “demo trading,” “simulated platform,” and “rewards” to comply with local regulations.

FTMO’s return follows a period of regulatory and platform restrictions in the US, including a crackdown by MetaQuotes on grey-label platform offerings.