Gold weakens as trade-deals take focus, US core PCE data rises and equities rally

- Gold price extends losses after core PCE inflation rises in May, creating a mixed picture on the trajectory of interest rates.

- The Michigan Consumer Sentiment Index rises in June, inflation expectations fall.

- XAU/USD falls toward the May low as trade deal optimism supports demand for equities.

Gold (XAU/USD) is suffering another setback after reports that China and the United States have finalized their trade deal announced earlier in June. The news supports demand for risk assets.

As risk appetite continues to improve, the precious metal has been under pressure this week. With safe-haven flows shifting toward riskier assets, Gold is trading below $3,300 at the time of writing on Friday, with losses nearing 2%.

US inflation data for May rises above analyst estimates

The release of the core Personal Consumption Expenditure (PCE) on Friday has placed additional pressure on the US Dollar but did little to boost Gold.

This important dataset measures the pace at which prices of goods and services are rising and is released on a monthly basis. It is the Federal Reserve’s (Fed)preferred measure of inflation, which plays a significant role in setting expectations for interest rates.

The headline PCE inflation figures for May came in line with expectations. The monthly figure rose by 0.1%, unchanged from April, while the year-over-year rate increased to 2.3%, slightly above April’s 2.2%, and in line with forecasts.

However, the core PCE data—which excludes volatile components such as food and energy—surprised to the upside. Both the monthly and annual figures came in hotter than expected. Core PCE rose 0.2% month-over-month, ahead of the 0.1% estimate, while the annual rate climbed to 2.7%, surpassing expectations for an unchanged reading from April’s 2.6%.

In contrast, broader consumption data disappointed. Personal income fell by 0.4% in May, well below the expected 0.3% increase and a sharp reversal from April’s 0.7% gain. Personal spending also declined by 0.1%, missing the consensus forecast for a 0.1% rise and down from the prior month’s 0.2%.

As the Federal Reserve’s preferred measure of inflation, the rise in core PCE complicates the policy outlook. President Donald Trump continues to pressure the Fed to cut interest rates to support growth, but such action typically fuels inflation—already above the central bank’s 2% target.

Still, with income and spending data showing clear signs of economic fatigue, the Fed may be forced to weigh inflation against the risk of a broader slowdown. For markets, this opens the door to a dovish shift in tone, potentially paving the way for a rate cut as early as July.

Moreover, President Trump is putting immense pressure on the Fed to cut rates to stimulate the economy.

A major concern for the Fed has been the impact of tariffs on inflation. A trade deal with China, which has resulted in a pause of higher reciprocal tariffs on Chinese imports until August 12, could alleviate some of the pressure that potential higher tariffs may have on the US economy. According to the CME FedWatch Tool, the probability of a 25-basis point (bps) rate cut in September has increased to 72%, with markets anticipating rates to fall by at least 50 bps by year-end.

While lower rates bode well for Gold, the increase in demand for equities and riskier assets may continue to weigh on bullion in the short term.

Daily digest market movers: Gold digests the release of key US economic data as safe-haven demand fades

- The latest University of Michigan data painted a mixed picture of consumer sentiment and inflation expectations in the United States. The Consumer Sentiment Index rose slightly to 60.7 in June, up from 60.5 previously, suggesting a modest improvement in overall consumer confidence.

- However, the Consumer Expectations Index slipped to 58.1, indicating that households are feeling slightly less optimistic about future economic conditions.

- On the inflation front, both short- and long-term expectations edged lower, with the one-year outlook falling to 5.0% and the five-year figure easing to 4.0%. While inflation expectations remain elevated, the decline could offer some relief to the Federal Reserve as it navigates conflicting signals—resilient inflation data alongside slowing consumer demand.

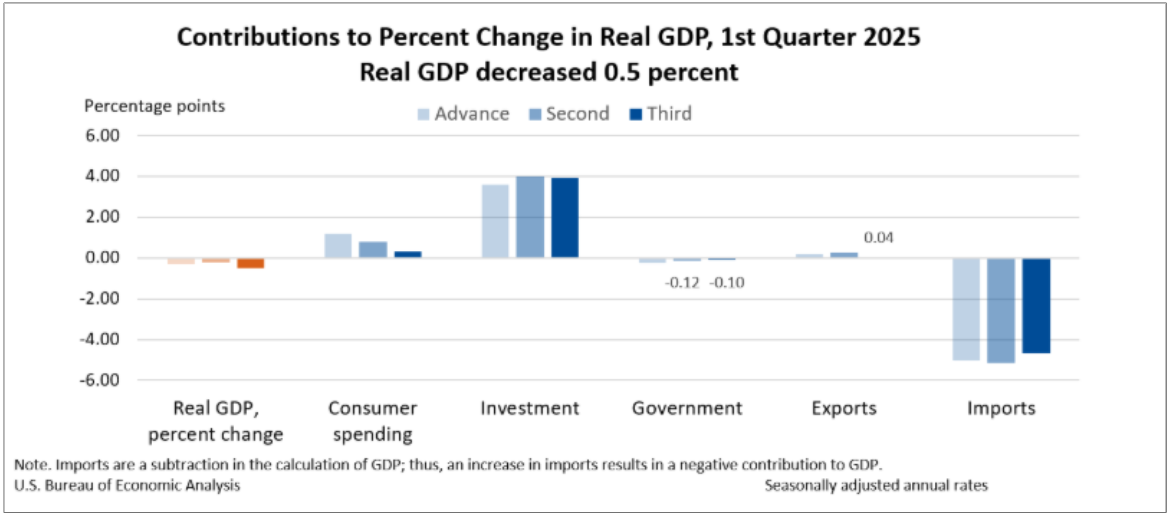

- Thursday’s final Gross Domestic Product (GDP) reading for the first quarter showed that the US economy had contracted by 0.5%, as imports increased before the imposition of the higher tariff rates announced by Trump on “Liberation Day.”

- The table below illustrates the breakdown of the Q1 GDP components released by the US Bureau of Economic Analysis on Thursday.

- The Bank Stress Test, published by the Federal Reserve's Board of Governors, will be released at 20:30 GMT. This report outlines how the largest US banking institutions would perform under various adverse economic scenarios. It is designed to evaluate the resilience of the financial system; the test assesses how these banks would respond to severe financial shocks.

- The results can influence the Federal Reserve’s monetary policy outlook and help gauge potential risks to its long-term goals of price stability and sustainable economic growth.

- For Gold, the culmination of these data releases may play an important role in determining the direction of XAU/USD. Especially once the latest US-China progress on trade talks has been digested by markets, investors focus on the broader macroeconomic environment.

Gold technical analysis: XAU/USD extends losses as bearish momentum pushes the RSI toward oversold terriitory

Gold remains under pressure, with prices trading below the key psychological level of $3,300, which now provides near-term resistance for the yellow metal.

Above that is the 50-day Simple Moving Average at $3,324 and the 20-day SMA near $3,356.

The Relative Strength Index (RSI) is nearing 30, a potential sign of oversold conditions.

In the bearish scenario, a sustained break below the mid-point of the April low-high move, represented by the 50% Fibonacci retracement level, provides support at $3,228. A break of which could open the door toward the $3,200 psychological handle. The 100-day SMA at $3,164 acts as a deeper support level.

Gold daily chart

On the other hand, the bullish scenario would require a decisive recovery above the 20-day SMA, potentially reigniting upside momentum toward the $3,400 and $3,452 resistance levels. Until such a move materializes, Gold may remain vulnerable to deeper retracements within its broader consolidation pattern.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.