FX Trading Rules Tighten as South Korea Targets Retail Investors Risk

South Korea’s Financial Supervisory Service will “review whether the matters related to hedging foreign exchange risks for overseas investments are being fully explained by financial firms,” said FSS Governor Lee Chan-jin today (Monday).

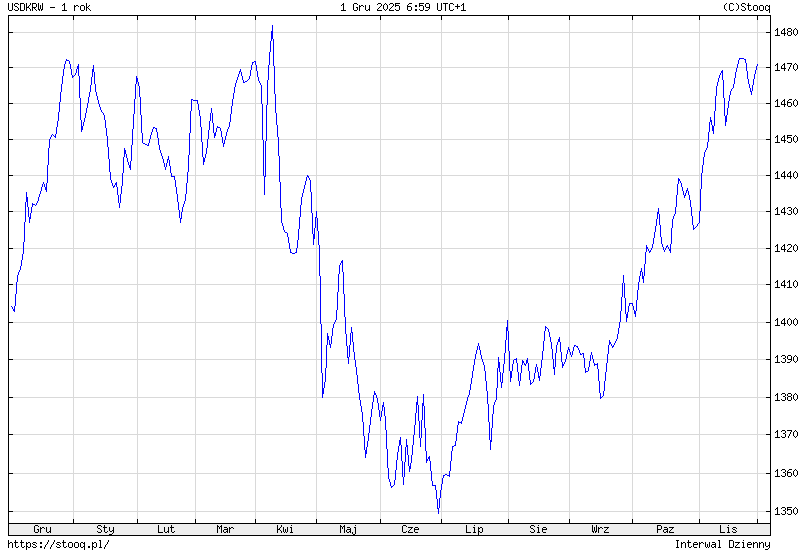

The remarks follow a government notice about new inspections on investor protections around FX risk, prompted by a persistent decline in the Korean won against the U.S. dollar.

This quarter, the won has weakened by over 4%, a trend South Korea’s central bank ties to a surge in residents’ foreign investments and foreign investors’ sale of local stocks.

Yet the watchdog is not planning new regulations on overseas stock buying. According to Lee, there are currently no warning signs for domestic financial institutions in terms of FX exposure: “On the contrary, some insurance firms are making profit.”

Retail Swings Abroad, Regulators Eye Oversight

As Korean retail investors turn more to international equities, questions about their understanding of forex risks have grown. The new review comes amid regulatory efforts elsewhere, such as mandatory pre-training and simulation trading for those seeking to access high-risk overseas derivatives.

These measures arrive as retail flows shift, complicating the market for Korea’s currency and heightening authorities’ concerns over potential retail losses if the won slides further.

[#highlighted-links#]

Bank of Korea officials previously flagged those overseas moves, warning that mass exits could amplify volatility in domestic markets. Still, current changes are focused on reviewing how banks and brokers inform retail clients about currency swings, rather than an outright clampdown. Authorities are also considering compensation approaches as they investigate prior retail derivative sales and potential investor losses.

The consumer protection push comes as Seoul works to liberalize its forex market in other ways. South Korea announced plans in September to extend currency trading to 24 hours a day and establish an offshore won settlement system, moves aimed at winning developed market status from MSCI.

The country's FX market currently operates from 9 a.m. local time until 2 a.m. the next day, a schedule that accommodates European investors but leaves U.S. traders at a disadvantage.

MBK, Coupang, and Data Breaches Add to Market Tension

The regulatory clampdown extends beyond FX. Lee confirmed that probes continue into MBK Partners over its sale of Homeplus, a major retailer, with a decision on potential sanctions expected by the end of the month. MBK said it is acting in line with local law and “has been doing its best to protect investor interests.”

In addition, recent high-profile data breaches at major consumer platforms have prompted renewed calls for tighter security standards. Coupang, South Korea's largest e-commerce platform with annual revenue topping $24 billion and serving nearly half the country's population, recently disclosed that 337 million customer accounts were compromised.

Upbit, the nation's biggest cryptocurrency exchange by trading volume with over 180 crypto assets listed, was also hit by a suspected hack that authorities have linked to North Korea. Lotte Card, a major credit card issuer controlled by MBK Partners, saw personal data of nearly 3 million customers leaked earlier this year.

Lee criticized the companies for being negligent in their data security, warning that stronger regulations may be needed to protect consumers.