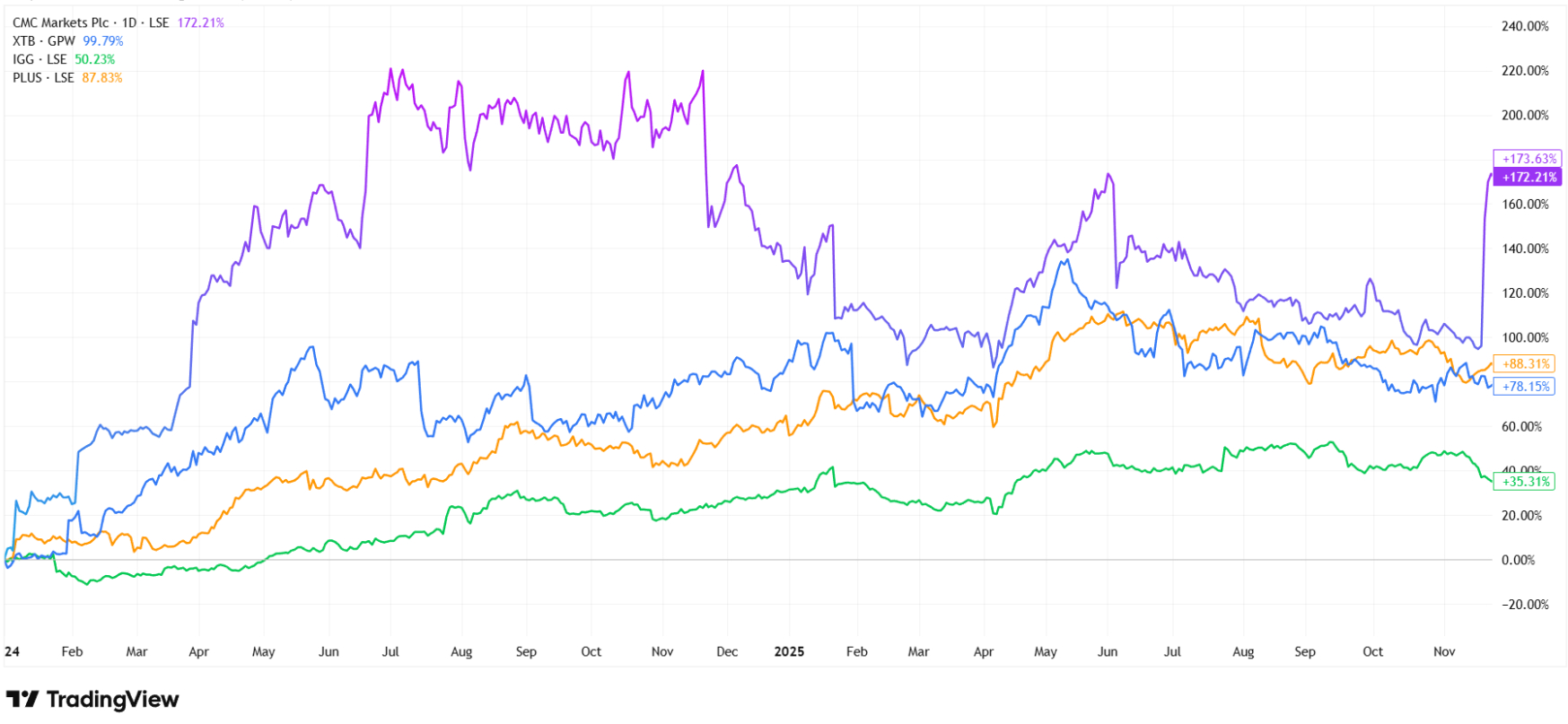

CMC Markets Shares Surge Over 40% After Beating Income Guidance, Outpace CFD Competition

After a turbulent start to the year, shares of CMC Markets (LSE: CMCX) staged a strong comeback, climbing more than 40% in just three trading sessions. The surge followed the release of the company’s half-year financial results and a bullish forecast for the coming year, attracting attention across the trading platform sector.

CMC Markets Shares Bounce Back on Strong Results

CMC Markets’ stock, which spent much of early 2025 drifting near 200 pence, accelerated to retest the 290 pence level last seen at the beginning of the summer. This shift comes after months of steady decline and cautious optimism among market participants.

[#highlighted-links#]

The 40% rally has erased the year’s earlier losses, pushing the broker’s year-to-date performance up to around 17%. In contrast, sector peers like XTB have sunk from all-time highs to a modest loss, while Plus500 and IG Group report more muted single-digit gains.

If the current upside momentum extends past the 290 pence mark, some traders are eyeing the 340 pence resistance that defined last year’s upper bound. Even with the recent pop, CMC shares remain far (almost 85%) from their pre-pandemic peak of 538 pence, leaving plenty of ground to recover.

“It appears that British shareholders are far more enthusiastic about the reports released by their domestic brokers,” says Arkadiusz Jóźwiak, analyst and editor-in-chief of B2C portal Comparic.pl, which focuses on the CFD industry. “When XTB reported similar figures on the Warsaw Stock Exchange, the share-price jumps were not nearly as strong.”

Record Australian Revenues and Westpac Partnership Drive Outlook Higher

CMC’s latest half-year net operating income reached £186.2 million, up 5% from a year ago and surpassing internal forecasts. The Australian stockbroking unit delivered a record performance, boosting net operating income in the region by 34% and lifting assets under administration to A$91 billion. Profit before tax was steady at £49.3 million, with an interim dividend declared at 5.5p per share, up 77% year-on-year.

A key highlight is the extended partnership with Westpac, Australia’s second-largest bank, which is expected to grow CMC’s local customer base by roughly 40% and lift trading volumes 45% once integration is complete. The firm’s leadership signaled this move as “a significant and exciting opportunity” to strengthen CMC’s presence in the Australian market.

While CMC Markets’ growth from 2024 now stands at over 170% from January, Plus500 gained 88%, XTB 78%, and IG Group 35% for the same period. CMC clearly leads the pack when viewed from the start of the last year.

“Super App” Ambitions Put CMC at Industry Forefront

Adding fuel to the rally, CMC confirmed that its three-phase “Super App” modernization is set to launch its first phase, a multi-asset platform combining equities, derivatives, and wealth management, next month in the UK. Later phases will introduce decentralized finance (DeFi) products, tokenized assets, and banking features.

The aim is to compete with the likes of NAGA, Swissquote, and XTB, all of whom are chasing “Super App” status, though none currently match the breadth of China’s Alipay or WeChat financial platforms.

Behind the scenes, CMC showcased operational momentum with its first blockchain-based tokenized share trade and broad growth in European API partnerships, driving hundreds of thousands of new trading accounts through neobank channels.