Bitcoin Finds Support; Analysts Highlight US Offshore Access Impact on Crypto

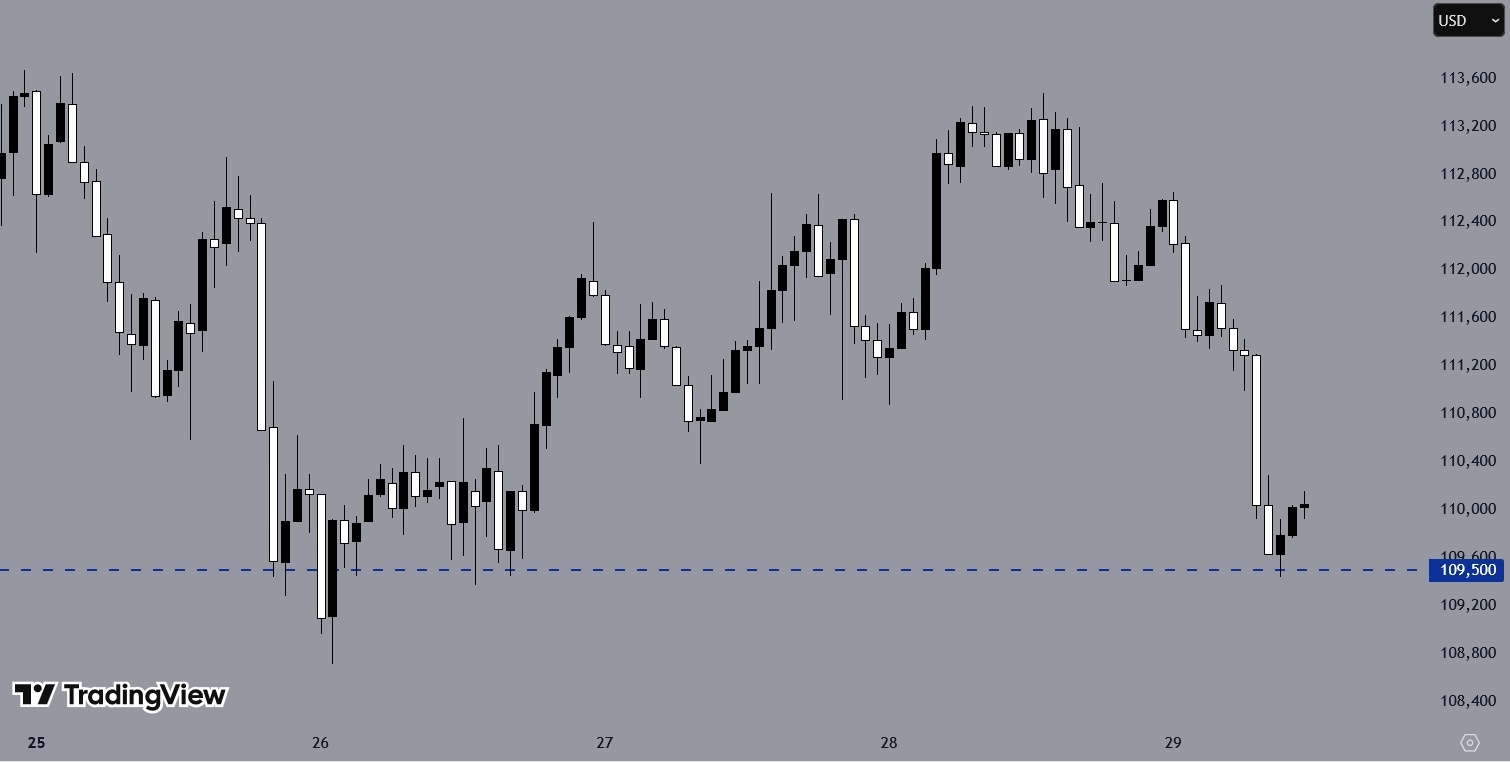

BTCUSD has experienced a strong bearish move on the H1 chart. The price appears to have found support near 1.09K, indicated by two consecutive bullish candles.

Analysts suggest that if the support holds, a short-term rebound could occur, but a break below this level may increase bearish momentum and push the price lower.

CFTC Move May Impact Domestic Platforms

A recent analysis shared on the YouTube channel Crypto World highlighted a recent advisory from the US Commodity Futures Trading Commission, which may allow American traders to access Binance and other offshore cryptocurrency exchanges.

This represents a potential shift from previous restrictions and could increase market activity while intensifying competition for domestic platforms such as Coinbase.

You may find it interesting at FinanceMagnates.com: XRP Consolidates at $3 as Analyst Cautions on Impact of US Economic Data.

Current market conditions show Bitcoin in a short-term recovery, though broader indicators suggest limited upward strength. Resistance is noted near $112K–$117K, with support around $109K–$105K.

NEW #Bitcoin & #Altcoin update! 👇https://t.co/ZtQeuACk3i

— Josh (@CryptoWorldJosh) August 29, 2025

Altcoins Show Mixed Signals, Analysts Warn

Ethereum is trading within a defined range, with support at $3,900–$4,100 and resistance near $4,800–$4,900. Solana has established support at $190–$200 and is targeting $230. XRP shows bearish divergence on the weekly chart, indicating potential weakness. Chainlink is trading near $25, with resistance at $27 and support at $23.