Bank of England Proposes Stablecoin Rules, Capping UK Retail at £20K and Business at £10M

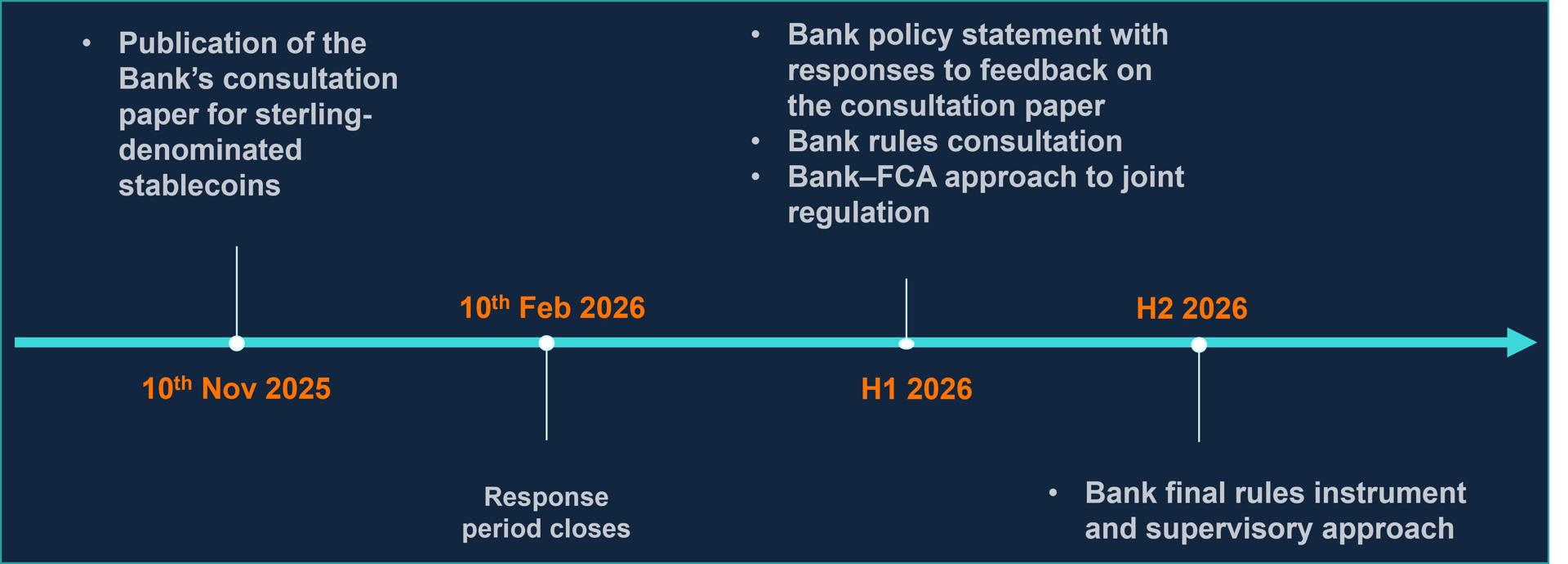

The Bank of England is seeking public feedback on a proposed framework for regulating stablecoins. The consultation paper, released today (Monday), focuses on sterling-denominated “systemic stablecoins.”

Digital assets meet tradfi in London at the fmls25

These are tokens the central bank said are widely used for payments and may pose risks to financial stability. The BoE has said that such stablecoins could undermine public confidence in money and payments.

Stablecoin Issuers Face New BoE Limits

Under the proposal, stablecoin issuers would need to back at least 40% of their liabilities with unremunerated deposits at the BoE. The remaining 60% could be held in short-term UK government debt.

[#highlighted-links#]

Systemically important issuers could initially hold up to 95% in government debt, with the level reduced to 60% as the stablecoin grows.

🇬🇧 JUST IN: The UK’s BOE proposes a £20K cap on individual stablecoin holdings and £10M for businesses. pic.twitter.com/85JXOrs5X5

— Cointelegraph (@Cointelegraph) November 10, 2025

Treasury, BoE Oversee Stablecoin Systemic Importance

The paper also sets limits on holdings. Individual users could be restricted to 20,000 pounds per coin, while businesses could hold up to 10 million pounds. Businesses may qualify for exemptions if higher balances are needed for normal operations.

His Majesty’s Treasury will determine which stablecoin systems and providers are considered systemically important. Once designated, these entities would be subject to the BoE’s rules and ongoing supervision.

The consultation period runs until February 10, 2026. The central bank expects to finalize the regulatory framework in the second half of the year.