What’s Next for Bitcoin, Ethereum, XRP and Dogecoin After $19B Weekend Flash Crash?

A sudden market shock on Friday sent cryptocurrency prices tumbling, exposing which coins truly withstand pressure and which falter under stress.

Triggered by a geopolitical tweet, this intense hour of selling acted like a stress test, giving investors a rare look at crypto resilience during turmoil. The crash wiped out billions, but the market’s reaction tells a deeper story about coin performance and what could come next.

Digital assets meet tradfi in London at the fmls25

Geopolitical Tensions Sparked Broad Market Sell-Off

The cascade began when a tweet from President Donald Trump announced intentions to impose steep tariffs on Chinese imports, reigniting trade tensions.

[#highlighted-links#]

This unexpected news hit after markets closed, reducing liquidity and intensifying volatility. Massive sell orders, stop losses, and leveraged positions triggered liquidations across both stock and crypto markets simultaneously, fueling a rapid price drop within just one hour.

The crypto market collectively suffered its most severe plunge, with over $19 billion in liquidations recorded during this period.

Which Coins Crashed and Which Rebounded?

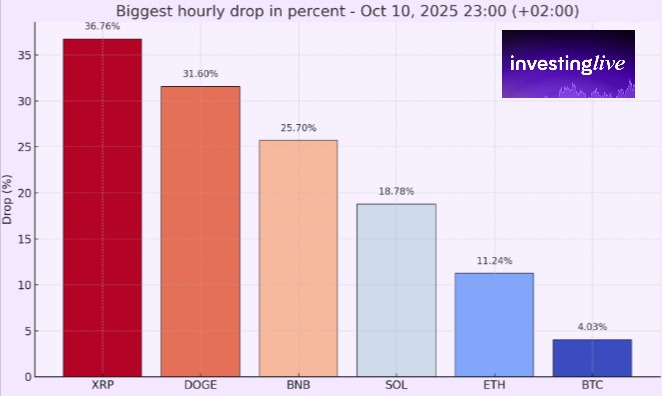

The six largest cryptocurrencies by market capitalization—Bitcoin, Ethereum, Binance Coin (BNB), XRP, Solana, and Dogecoin—all endured sharp losses in the hour beginning at 23:00 on October 10.

Price drops ranged from Bitcoin’s minimal 4% to XRP’s steep 36.8% fall. Despite the initial plunge, most coins bounced back quickly, though not all recovered equally.

Bitcoin showed the smallest decline and fastest recovery, holding steady as a relatively stable asset during the chaos. Ethereum even closed higher than its initial price at the start of the crash hour, displaying swift resilience.

Binance Coin took a serious hit but steadily regained value, finishing the next day slightly up from the crash close. Conversely, XRP and Dogecoin suffered the largest drops and failed to maintain their rebound gains, signaling weaker market confidence. Solana bounced sharply but lost ground by the next day, raising questions about its ability to hold recovery levels.

Binance Announces 283M Payout

Adding to market jitters, Binance experienced a unique technical failure. Some altcoins, like Cosmos (ATOM) and IoTeX (IOTX), briefly showed zero prices on their platforms. This flash crash occurred as the exchange’s trading systems became overwhelmed by sell orders and collateral liquidations tied to cross-margin positions.

🔥 LATEST: Binance pays out $283 million to cover user losses from Friday’s depegging.

— CoinDesk (@CoinDesk) October 12, 2025

Binance automatically sold off collateral altcoins to cover losses, creating a feedback loop that pushed prices down rapidly. Without buy orders to stabilize prices in the moment, the system displayed zero valuations, although these tokens maintained real values on other exchanges.

Binance’s Chief Customer Service Officer acknowledged the incident and promised compensation for losses caused directly by platform malfunctions, distinguishing them from losses due to natural market volatility.

At the peak of the fall, Bitcoin dropped only 4%, while XRP crashed nearly 37%. By the time the market stabilized, nearly $380 billion in value had been wiped out in less than 24 hours.

What Triggered the Crash

The initial spark came from a late-night message by former U.S. President Donald Trump, who threatened new tariffs of up to 100% on imports from China. The post hit markets after Wall Street closed, when liquidity was thin.

Ethereum showed what traders call an “instant repair,” pushing back above the crash opening level before the hour ended. Bitcoin held steady throughout the next 24 hours and did not revisit its lows. In a market drowning in leverage, these reactions signaled stability.

BNB Quietly Recovered—XRP and Dogecoin Struggled

BNB faced a larger intra-hour decline of over 25% but attracted steady inflows afterward, finishing the following day slightly above the crash close. The move sparked debate about capital rotation back into BNB after its brief slip under $1,000, a level that had acted as a magnet for traders.

Not every major coin managed to repair damage. XRP and Dogecoin bounced sharply with recoveries of 58.8% and 40% from the lows, but both failed to hold those gains. Solana rose and then faded into the next session, highlighting lingering selling pressure.

Binance Flash Crash Sent Some Altcoins to Zero

The broader panic exposed another risk—platform fragility. Several Binance-listed altcoins, including Cosmos (ATOM), IoTeX (IOTX) and Enjin (ENJ), briefly printed zero-dollar prices. The same tokens retained normal value on other exchanges.

Binance later explained that forced liquidations against cross-margin accounts overloaded liquidity, and when market makers pulled back, some trading pairs temporarily lost buy orders altogether.

Despite the violence of the crash, analysts are not calling it the end of the cycle. 10x Research wrote that the market flush “may be the cleanest setup for a new rally,” arguing that forced liquidation events remove weak leverage and reset market structure. Fear indicators support that view—the Crypto Fear & Greed Index fell from 74 to 24 in a week, a level often associated with market bottoms.

What if the $380 billion crypto crash wasn’t the end — but the cleanest setup for the next major rally?

— 10x Research (@10x_Research) October 11, 2025

Crypto just endured one of its most violent unwinds in history — nearly $19 billion in liquidations wiped out over $380 billion in market value within hours.

Hidden beneath… pic.twitter.com/V01bucpf6l

Risk Signals and What Comes Next

The crash left clear levels on every crypto chart. Technical traders now track two price markers from the panic hour: the crash low, which signals risk, and the opening price of the crash hour, which signals recovery.

XRP and Dogecoin are still momentum trades with weak follow-through. Solana needs a convincing return above its recovery line to shake out doubts. The crash did not break the market. It exposed it. And in that exposure, a new roadmap has emerged for anyone watching closely.