Bitcoin’s Rally Depends on Fed Cuts, Institutional Investment & Tech Moves

[#highlighted-links#]

October was expected to live up to its “Uptober” reputation, but so far, Bitcoin’s price action tells a different story. After kicking off the month with momentum, BTC has struggled to maintain altitude, slipping below key resistance levels as risk appetite faded across equities and crypto alike.

Still, history suggests the month isn’t over yet for the bulls. October has been Bitcoin’s best-performing month on average, delivering roughly 20% gains historically, with a median return of nearly 15%. That track record, coupled with shifting macro conditions, is keeping investor optimism alive.

Much of Bitcoin’s near-term trajectory may now hinge on what happens in traditional markets, particularly with U.S. Federal Reserve policy and tech stock performance. Traders are eyeing the upcoming Fed decision closely, where even a modest rate cut could reignite “risk-on” sentiment, boost the Nasdaq, and spill over into digital assets.

In short, Bitcoin’s next breakout may depend less on on-chain dynamics and more on how Wall Street reacts to Washington, making the coming weeks a pivotal test of whether “Uptober” can still live up to its name.

Why Rate Cuts are Bullish for BTC

On Oct. 29, the Federal Reserve is scheduled to hold its next Federal Market Open Committee (FOMC) meetings. These are the meetings where America’s central bank decides to make changes in interest rates. There is a high likelihood that the Fed cuts interest rates once again.

At least, that’s the view of CME Group’s FedWatch, which says that there is a 94.7% chance that the Fed cuts rates by 25 basis points, or 0.25%, from the current 4%-4.25% target rate, down to 3.75%-4%.

Why are lower interest rates bullish for Bitcoin prices? Lower interest rates mean greater market liquidity, which in turns spur a “risk on” sentiment among investors. When investors are in “risk on” mode, more speculative asset classes, whether they be growth stocks, or in this case, cryptocurrencies, typically experience an increase in value.

Make no mistake. Fedwatch isn’t unique in its highly confident view. It may just be stating the obvious, based on how institutional investors continue to steadily invest in spot Bitcoin ETFs, and how publicly-traded companies continue to stockpile Bitcoin in their corporate treasuries.

Institutional interest continues to increase even with the recent crypto pull-back. One example of this is the recent partnership between crypto exchange leader Binance and global investment leader Franklin Templeton. Binance CEO Richard Teng commented on the partnership in a recent X post, “We continue to see a convergence of TradFi and crypto, furthering adoption and legitimacy of crypto. We are proud to partner with #FranklinTempleton @FTI_Global which is a great testament to the positive momentum and the integration of crypto in the broader financial system.”

A Growth Stock Rally Could Give a Bitcoin Rebound More Runway

As a risk-on asset, Bitcoin tends to move in tandem with growth stocks, particularly those that dominate indices like the Nasdaq-100. If the Federal Reserve follows through with a rate cut later this month, the resulting drop in yields could reignite demand for high-growth equities, extending the rebound already underway in tech and innovation-heavy sectors.

That momentum could easily spill over into digital assets. Bitcoin has maintained a notably high correlation with the Nasdaq-100 in recent quarters, a relationship reinforced during its recent pullback, which coincided with equity weakness amid renewed U.S.–China trade tensions. As those fears ease and growth stocks regain traction, Bitcoin has begun climbing back in parallel, albeit more gradually.

Beyond monetary policy, additional catalysts could keep the recovery alive. A strong earnings season from Big Tech names, including Apple, Nvidia, and Microsoft, could sustain investor confidence and further buoy broader risk sentiment. Combined with the prospect of easier credit conditions, these dynamics give Bitcoin ample runway for a renewed rally into year-end.

So while “Uptober” may have disappointed, the setup for an “Upvember” or even “Upcember” remains very much in play if macro tailwinds align.

The Bottom Line

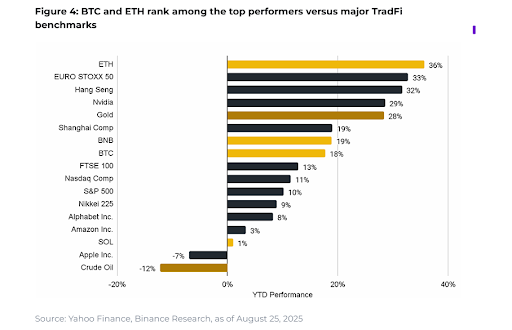

In Binance Research’s August 2025 edition of 10 Charts Shaping 2025, one of the key topics discussed was the outsized performance of cryptocurrencies, including Bitcoin, relative to traditional asset benchmarks:

Since the latest pullback, however, Bitcoin’s YTD price performance has taken a hit, falling down to the low double-digits, similar to that of the S&P 500. This recent weakness notwithstanding, though, a return to “risk on,” spurred by an additional 25 basis point rate cut, may be just around the corner.

Keep in mind, too, that, as spot gold prices soar to new all-time highs, while Bitcoin flounders, BTC has become undervalued relative to gold once again. If a greater number of market participants begin to once again appreciate Bitcoin’s strength as a U.S. Dollar alternative, BTC could rise, as it starts to benefit from the “debasement trade” that has been driving this latest mega-rally in spot gold prices.