Weekly Market Outlook (24-28 February)

UPCOMING EVENTS:

- Monday: German IFO.

- Tuesday: US Consumer Confidence.

- Wednesday: Australia Monthly CPI.

- Thursday: Switzerland Q4 GDP, US Durable Goods Orders, US Q4 GDP (2nd estimate), US Jobless Claims.

- Friday: Tokyo CPI, France CPI, Germany CPI, Canada GDP, US PCE.

Tuesday

The US Consumer Confidence is expected at 103.0 vs. 104.1 prior. The last report showed Consumer Confidence dropping for the second consecutive month although it remained in the range created since 2022.

Dana M. Peterson, Chief Economist at The Conference Board said: “all five components of the Index deteriorated but consumers’ assessments of the present situation experienced the largest decline. Notably, views of current labour market conditions fell for the first time since September, while assessments of business conditions weakened for the second month in a row.”

“Meanwhile, consumers were also less optimistic about future business conditions and, to a lesser extent, income. The return of pessimism about future employment prospects seen in December was confirmed in January.”

Wednesday

The Australian Monthly CPI Y/Y is expected at 2.5% vs. 2.5% prior. Inflation has been gradually falling towards the RBA’s target with the latest Australian Q4 CPI showing underlying inflation inside the 2-3% target band on a 6-month annualised basis.

As a reminder, the RBA cut interest rates by 25 bps as expected last week but it was accompanied by a more hawkish than expected guidance. We’ve also got the Australian Employment report and once again the data showed a solid labour market.

Thursday

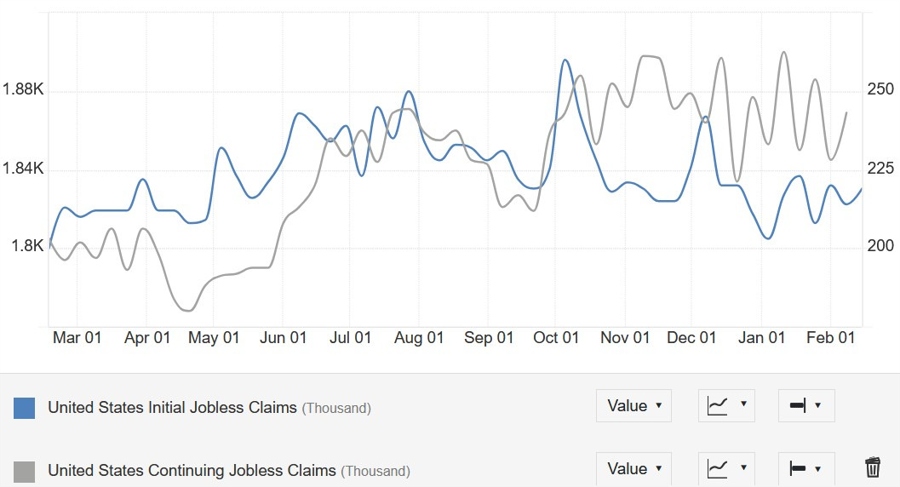

The US Jobless Claims continue to be one of the most important releases to follow every week as it’s a timelier indicator on the state of the labour market.

Initial Claims remain inside the 200K-260K range created since 2022, while Continuing Claims continue to hover around cycle highs although we’ve seen some easing recently.

This week Initial Claims are expected at 220K vs. 219K prior, while there’s no consensus at the time of writing for Continuing Claims although last week we saw an increase to 1869K vs. 1845K prior.

Friday

The Tokyo Core CPI Y/Y is expected at 2.3% vs. 2.5% prior. The JPY strengthened recently on more hawkish comments from BoJ officials, and solid wage growth and inflation data. Last Friday, the JPY got another boost on some risk-off moves triggered by the US stocks selloff following the weaker than expected US PMIs and long-term inflation expectations in the UMich survey jumping to a new 30-year high.

The US PCE Y/Y is expected at 2.5% vs. 2.6% prior, while the M/M measure is seen at 0.3% vs. 0.3% prior. The Core PCE Y/Y is expected at 2.6% vs. 2.8% prior, while the M/M figure is seen at 0.3% vs. 0.2% prior.

Forecasters can reliably estimate the PCE once the CPI and PPI are out, so the market already knows what to expect. Therefore, unless we see a deviation from the expected numbers, it shouldn’t affect the current market’s pricing.