Why Bitcoin Is Down: Prices Slip Below $100,000 for First Time Since June

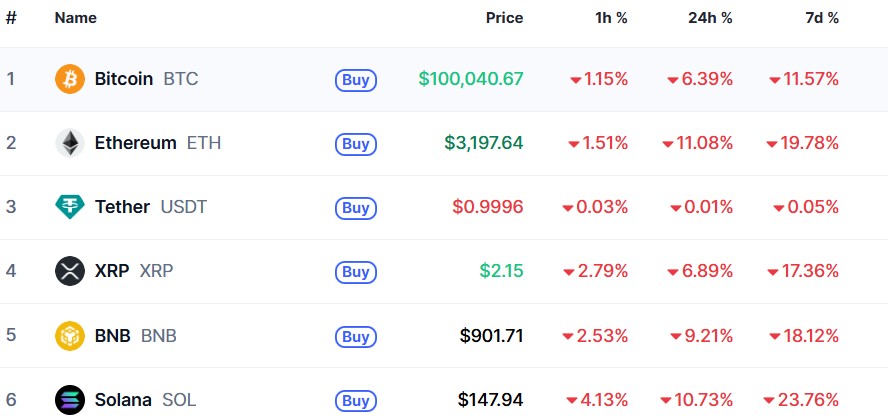

After months of record-breaking gains, Bitcoin’s rally has come to a halt. The world’s largest cryptocurrency slipped below $100,000 on Tuesday for the first time since June, as investors retreated from digital assets amid renewed uncertainty over the Federal Reserve’s next policy move.

Digital assets meet tradfi in London at the fmls25

The decline marked a five-month low for Bitcoin, which fell 6.4% in the last 24 hours to around $99,705. The drop followed a broader downturn across the cryptocurrency sector, which has erased nearly $880 billion in total market capitalization over the past month, according to CoinMarketCap data.

Bitcoin’s retreat mirrors a wider sell-off in digital assets. Over the past week, Ethereum has declined by 19.8%, XRP has dropped by 17%, BNB is down 17%, and Solana has lost 21%. Even Dogecoin, often a barometer for retail enthusiasm, has fallen more than 18%.

[#highlighted-links#]

Crypto Market Suffers Sharp Pullback

From its record high of $126,182 on October 6, Bitcoin has now shed nearly 27% of its value over 29 trading days. Analysts attribute the correction to tightening liquidity conditions and cautious signals from the Fed as the primary catalysts.

Keep reading: Bitcoin falls below the $100,000 level for the 1st time since June 23

Bitcoin’s momentum has long been sensitive to shifts in monetary policy. During the pandemic, the token’s value surged as interest rates fell. Conversely, when the Fed tightened policy in 2018, Bitcoin crashed from $20,000 to $3,000.

This pattern appears to be repeating. Last week, the central bank trimmed rates by a quarter-point, but Chair Jerome Powell hinted that another cut in December was not guaranteed. Fed Governor Lisa Cook echoed that uncertainty on Monday, saying she remained undecided about further easing.

October Marks Bitcoin’s Worst Month in a Decade

According to CoinMarketCap, Bitcoin’s 3.7% slide in October marked its weakest monthly performance since 2018. The broader crypto market capitalization fell from $4.32 trillion in early October to $3.3 trillion this week.

Market observers note that investors are shifting capital toward safer assets such as gold and government bonds, anticipating that the Fed’s cautious stance could dampen risk appetite.

Earlier this year, optimism surrounding pro-crypto legislation under the Trump administration fueled a rapid climb in digital asset prices. Bitcoin surged past $110,000 and $120,000 as major firms—including Trump Media and Technology Group—announced plans to hold Bitcoin on their balance sheets.

The U.S. government’s own holdings, estimated between $15 billion and $20 billion, added to the perception of institutional confidence. However, as monetary policy again dominates market sentiment, those bullish headlines have failed to halt the decline.

What’s Next for Bitcoin?

Technical charts indicate that Bitcoin is now testing support around $99,044, with the next downside targets located near $97,839 and $94,049. A sustained break below those levels could invite further selling pressure.

For now, traders are watching the Fed’s next meeting closely. Any sign of hesitation on rate cuts could prolong Bitcoin’s downward momentum and keep risk appetite subdued heading into year-end.