Why Gold Will Hit $10,000? This New Gold Price Prediction Sees the Yellow Metal Doubling

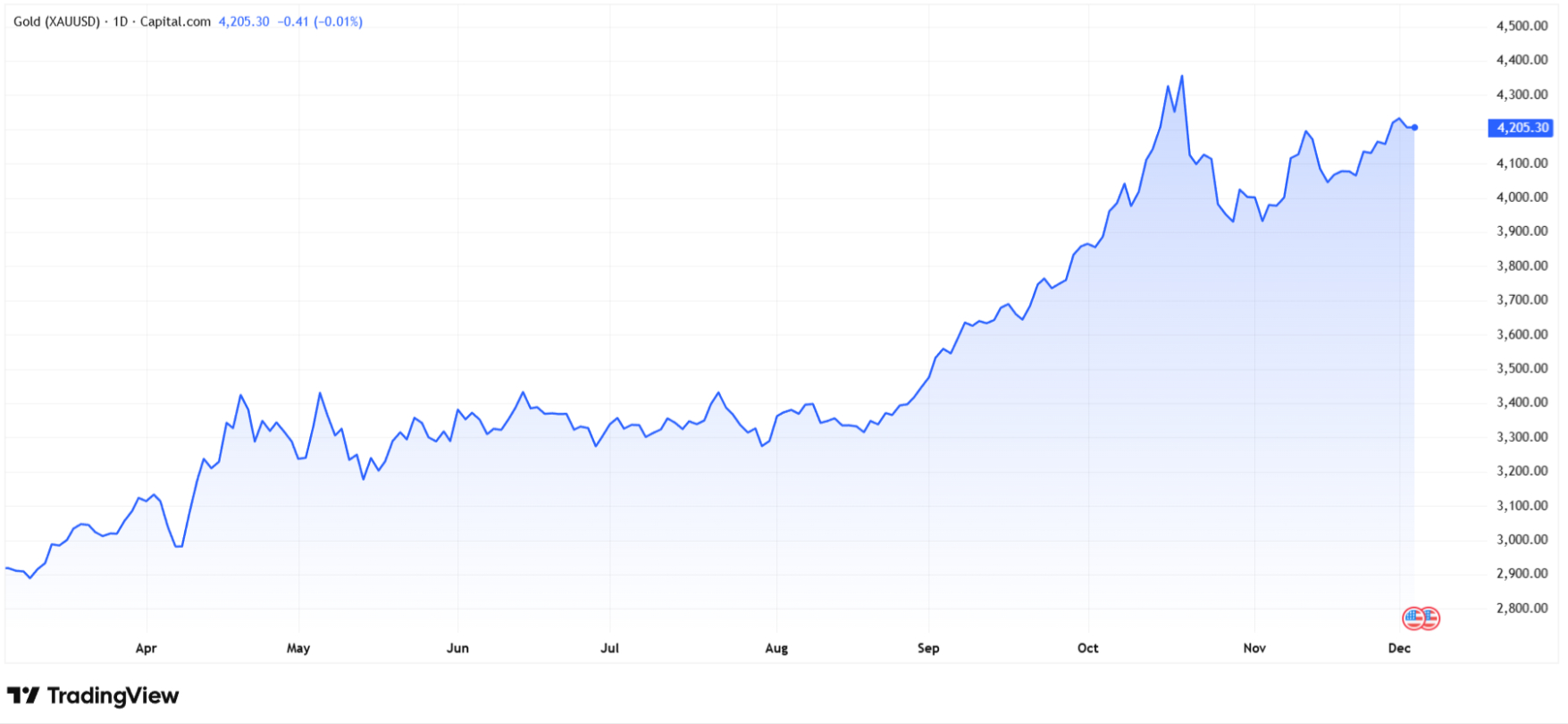

Gold price is currently staging a quiet but significant rebellion against gravity. After correcting through November, the precious metal is back on the offensive, trading firmly around the $4,200 level today, Wednesday, December 3, 2025. While the market remains in consolidation below the October all-time high of roughly $4,400, the technical structure and macroeconomic backdrop suggest this pause is merely the "calm before the storm."

While my technical models point to an extension toward $5,700, new "outrageous" gold price predictions from Saxo Bank warn that a technological black swan could send the yellow metal skyrocketing to $10,000 in 2026. More than doubling the current rates.

In this article, I examine why gold is going up, what technical analysis of the XAU/USD chart shows, and what the most up-to-date gold price predictions are.

Gold Price Today: Consolidation Before Explosion?

To the untrained eye, gold price’s recent action might look like hesitation. However, seeing the market test local resistance at $4,200 confirms that the bullish trend remains intact. November’s dip served as a healthy reset, allowing indicators to cool off without damaging the structural integrity of the rally.

"Today brings a slight pullback in gold contracts, which market observers attribute to profit-taking after significant gains in recent days,” Marek Rogalski, Analyst at BossaFX, dismisses the recent pullback as a temporary phenomenon driven by profit-taking rather than a shift in sentiment.

“However, in the wider context, the narrative still favors gains, and a breakout to a new ATH above $4,400 on gold contracts seems to be a matter of time."

Rogalski notes that the market is already pricing in a Federal Reserve rate cut on December 10, providing a near-term catalyst for the next leg up.

Gold Price Technical Analysis: The Road to $5,700

From my technical perspective, the chart remains overwhelmingly bullish. Since hitting historical maximums in October just below $4,400 per ounce, the price has consolidated. Importantly, this consolidation has held above the psychological floor of $4,000 and the key support zones established between April and August.

My Technical Outlook: November was corrective, but we are now witnessing a gradual return to higher levels. The price is moving in a distinct uptrend, supported by both the 50-day and 200-day moving averages. Even if we were to dip from the current consolidation, those local peaks from earlier in 2025 offer robust support.

Forecasting the Uncharted: Forecasting price targets when an asset is trading near all-time highs is difficult because we are navigating "uncharted waters,” there is no historical resistance overhead. However, using Fibonacci extensions, we can map out the likely trajectory:

- $5,000: This psychological level aligns with forecasts from several major financial institutions.

- $5,700: This is the 161.8% Fibonacci extension of the recent move.

In my view, $5,700 is the "bullish" technical target for the next major impulse. However, compared to some institutional "tail risk" scenarios, this figure might actually be conservative.

Why Gold Is Surging? The Fed & The Dollar

Beyond the charts, the macro environment is conspiring to weaken the US Dollar—gold’s primary rival.

Vijay Valecha, Chief Investment Officer at Century Financial, highlights a political wildcard that could supercharge gold’s ascent: the speculation surrounding Kevin Hassett potentially becoming the new Fed Chair.

"Speculation surrounding the possible selection of Kevin Hassett as the new Fed chair is ramping up. This has added to this bullish outlook, given his perceived dovish stance towards interest rates, as well as strengthening market expectations that 2026 could see another accommodative policy."

Valecha argues that as the policy environment softens, the resulting weaker dollar will naturally drive gains in gold, regardless of short-term profit-taking.

Saxo Bank’s $10,000 Gold Price Prediction And The "Black Swan"

While technicals point to $5,700, investors must consider "tail risks,” low-probability, high-impact events. In their newly released "Outrageous Predictions 2026", Saxo Bank outlines two scenarios that could fundamentally reprice gold.

Scenario 1: The "Quantum Leap" to $10,000

Saxo’s UK Investor Strategist Neil Wilson warns of "Q-Day,” the moment a quantum computer breaks standard digital encryption. In this scenario, trust in digital assets (crypto) and traditional banking systems evaporates.

"Bitcoin collapses toward zero. Fear spills into traditional finance... Gold rockets toward USD 10,000 as the ultimate 'no-password' asset." You can read more about this gloomy Bitcoin price prediction here.

[#highlighted-links#]

Scenario 2: The "Golden Yuan" to $6,000+

In a separate prediction, Saxo suggests China could back the offshore yuan (CNH) with gold to challenge the US dollar's dominance.

"Market impact: Gold advances above USD 6,000... as the 'golden yuan' becomes a durable second global anchor."

These scenarios highlight that gold isn't just a hedge against inflation; it is the ultimate hedge against systemic failure.

Should You Buy Gold Now?

The confluence of technical strength, dovish monetary policy, and rising geopolitical/technological risks creates a "perfect storm" for gold prices.

- Watch $4,400: A breakout above the October highs validates the trend.

- Target $5,700: This is the technical objective derived from Fibonacci extensions.

- Hedge for $10,000: While an "outrageous" prediction, the quantum risk highlights gold's unique role as a non-digital store of value.

As we approach the December 10 Fed meeting, the window to accumulate below the breakout level may be closing fast.

Gold Price Analysis, FAQ

How high can gold go in 2026?

Based on Fibonacci technical analysis, the primary target is $5,700. However, if geopolitical shifts like a "Golden Yuan" or technological crises occur, Saxo Bank predicts prices could reach $6,000 or even $10,000.

Why is gold rising today?

Gold is recovering from a November correction, driven by expectations of a Fed rate cut on December 10 and speculation regarding a dovish shift in US monetary policy under a potential new Fed Chair.

Is it too late to buy gold?

No. With the price currently consolidating below the $4,400 all-time high, technical analysis suggests the major breakout has not yet occurred. The trend remains bullish as long as prices hold above the $4,000 support level.