Phishing Accounts for 69% of Fraud in Germany, Consumers Lose Over €200 Billion

Germany is grappling with an escalating wave of digital banking fraud, driven by a surge in phishing attacks, investment scams, and emerging tactics like QR code phishing.

Unlike other European nations, where fraud trends are shifting, phishing remains Germany's primary threat, with cases rising 4.8% in the past year, according to research by BioCatch.

With the EU's Instant Payments Regulation (IPR) now in effect, fraud risks could intensify as criminals exploit faster transactions to deceive consumers and financial institutions.

Phishing, Social Engineering, and a Trust Deficit

Phishing scams continue to dominate Germany's fraud landscape, leading to financial losses and diminishing trust in online banking. According to the research, Germans have collectively lost €267 billion to phishing attacks, with 69% of incidents occurring through digital channels.

This has made consumers increasingly wary of online transactions, with 32% viewing AI as a threat rather than an opportunity. Unlike other European countries where banks often cover losses, German victims must prove they were not negligent, making it harder to reclaim stolen funds.

Additionally, the rise of QR code phishing, or "quishing," has further complicated the landscape. Fraudsters have reportedly been placing fake QR codes on parking meters, EV charging stations, and even bank notifications to steal user credentials and inject malware into unsuspecting victims' devices.

A staggering 43% of social media users in Germany have invested in digital assets, often relying on influencers rather than professional advisors. Despite their confidence, younger investors are highly vulnerable. While 55% of Gen Z and Millennials believe they won't be scammed, they now account for 72% of all scam victims.

However, financial losses remain higher among older generations, with Baby Boomers losing an average of €18,000 per scam compared to just €400 for Gen Z victims.

Improved Transaction Speeds and Fraud

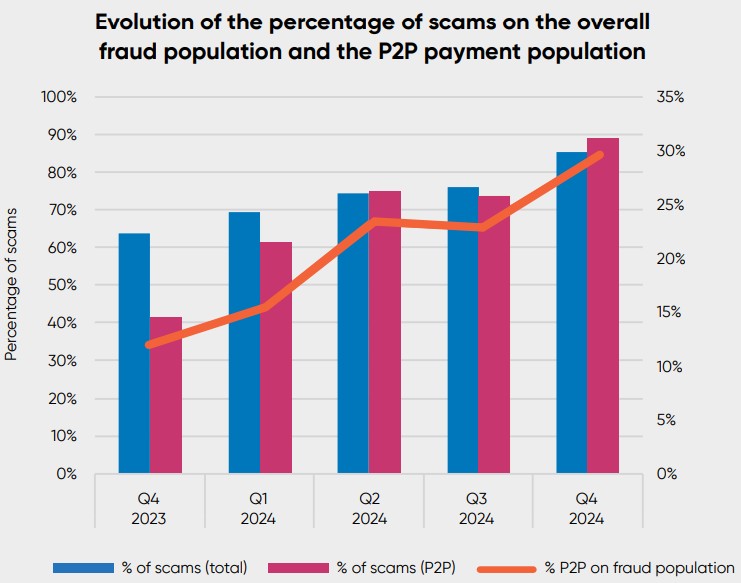

The EU's Payment Services Directive 3 (PSD3) and the Instant Payments Regulation (IPR) have introduced significant changes to banking security. Under IPR, payment service providers must process and confirm euro-denominated instant payments within 10 seconds.

PSD3 aims to strengthen consumer protections by enhancing Strong Customer Authentication (SCA) requirements, improving Open Banking oversight, and enforcing stricter compliance for financial institutions.

However, lessons from early adopters like the UK suggest that such measures may be more effective in preventing errors than stopping fraud. Criminals are already adapting, using social engineering tactics to manipulate victims into authorizing transactions.