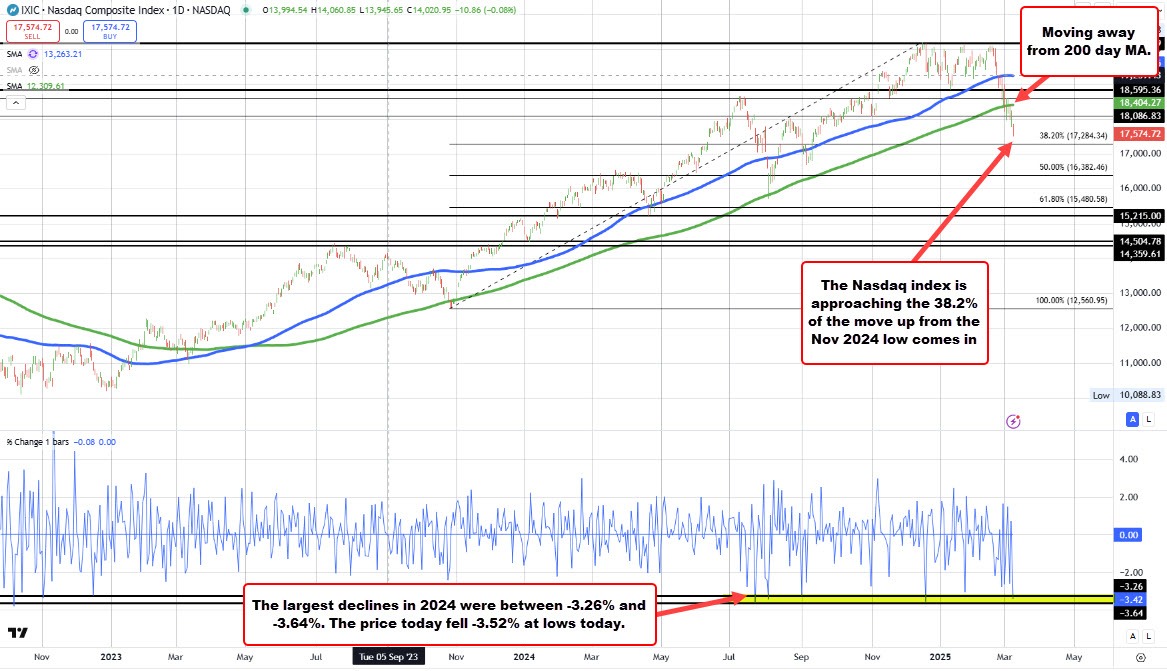

Nasdaq decline today rivals the big moves lower in 2024

The Nasdaq Composite Index is experiencing continued downside pressure, moving further away from its 200-day moving average (MA) at 18,404. The index is now approaching the 38.2% Fibonacci retracement level of the rally from the November 2024 low, which comes in around 17,284. This level will be a key technical test for buyers looking to defend support.

At today's low, the index fell 3.52%, nearing the largest daily declines of 2024, which ranged between -3.26% and -3.64%. Will the declines start to slow? So far, there is not a lot of bounce.

If selling pressure persists and the 38.2% retracement level fails to hold, it opens the door for increased selling momentum. The next major downside target would be the 50% retracement at 16,382. The last time the index traded at that level was back in August 2024

For upside recovery, the index would ultimately need to regain the 200-day MA at 18,404 to shift momentum back in favor of buyers. However, a closer resistance would be between 17832.70 to 18086.83 area (see yellow area on the 4-hour chart below. Getting above that area would give the buyers some comfort with work to do toward the 200 day MA. Absent that, and the sellers are in control.