Weekly Recap: Bitcoin Sinks Double-Digit; Could Consumer Duty Pit FCA Against CFD Brokers?

Cloudflare outage may have cost average CFD broker $1.6B

In today’s fast-paced technological world, even a few hours of downtime can quickly translate into millions in lost revenue. This week’s Cloudflare three-hour outage may have impacted approximately $1.58 billion in trading volume among brokers, roughly equivalent to 1% of their typical monthly revenue.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

Brokers confirmed to be affected include Monaxa, Skilling, Xtrade, and FXPro. The outage affected almost every sector, disrupting services like Twitter, ChatGPT, and the majority of crypto platforms.

Prop firms report ProjectX ending service offering

At the same time, futures prop platforms are facing a different kind of disruption. Prop ProjectX, a trading platform provider for futures prop firms, will end support for all third-party platforms by the end of February 2026.

This move comes less than a month after Plus500 became TopStep’s trading tech provider, and the ProjectX website lists Plus500 as its exchange partner.

[#highlighted-links#]

CMC Markets raises full-year guidance 10%

Elsewhere, the London-listed broker CMC Markets lifted its full-year revenue guidance by around 10% after stronger-than-expected trading and stockbroking activity in the six months to September.

CMC reported first-half net operating income of £186.2 million, up 5% year-on-year, while profit before tax remained at £49.3 million, with a slight margin dip to 26.5%.

Half-Year Performance Metrics

Metric (£ millions) | HY2026 | HY2025 | Change |

Net operating income | 186.2 | 177.4 | +5% |

EBITDA | 57.1 | 60.3 | -5% |

Profit before tax | 49.3 | 49.6 | -1% |

Profit before tax margin | 26.5% | 27.9% | -1.4ppts |

Basic EPS (pence) | 13.3 | 12.8 | +4% |

Dividend per share (pence) | 5.5 | 3.1 | +77% |

The announcement comes amid plans by the broker to launch a multi-asset platform, the first phase of its Super App, next month in the UK. It reportedly aims to launch its planned “Super App” in three phases.

But even amid the expansion, reports emerged that this week that the Australian customers of CMC Markets were targeted in a new phishing campaign.

IG launches stock trading in France

Meanwhile, IG Group will leverage Upvest’s technology to provide stock and ETF trading services to customers in France. The partnership gives IG access to Upvest’s Investment API, a modular platform that manages trading infrastructure and back-office functions.

IG intends to use Upvest’s system to support its expansion into additional European markets, although the company has not disclosed specific countries or timelines for those future launches.

Consumer duty: FCA vs. CFD brokers next flashpoint?

In the regulatory space, tensions between the FCA and brokers remain unresolved. The divide, over consumer protection, shows that many of the issues flagged back then are still relevant today.

Contracts for Difference (CFD) providers may be failing to deliver fair value to consumers.

— Financial Conduct Authority (@TheFCA) November 13, 2025

The Consumer Duty raises the bar for consumer protection and CFD providers must meet those standards. https://t.co/HWsDOpKDwK pic.twitter.com/ILmNnLBGWe

In February 2016, the FCA pointed out that numerous firms failed to gather enough information on clients’ experience with services, transactions, and specific investments. They often did not properly assess whether CFDs were suitable for their clients and relied on scoring systems that underweighted clients’ actual knowledge of these products.

UK raises deposit protection to £120k

Still in matters regulations, UK savers will see their cash deposit protection rise from December 1, but the higher limit will not apply to brokerage or investment accounts, which remain capped at £85,000. The change affects only bank and building society deposits covered by the Financial Services Compensation Scheme (FSCS).

The Bank of England said the FSCS limit will increase from £85,000 to £120,000 per eligible depositor, marking the first adjustment since 2017. The final figure is higher than the Prudential Regulation Authority’s initial proposal of £110,000.

Japan eyes 20% tax on crypto

And in crypto, Japan’s taxman is coming knocking. This week, the Financial Services Agency announced that it is preparing a broad overhaul of the country’s cryptocurrency framework that would combine a significant tax reduction with expanded regulatory oversight. The initiative forms part of wider efforts to update Japan’s approach to digital assets.

Under the proposal, the tax rate on crypto gains would be lowered from a maximum of 55% to a flat 20%, bringing it in line with the tax treatment of stocks and other capital gains. The measure is being considered for Japan’s next annual tax reform cycle and is intended to encourage greater domestic engagement in the digital asset market.

Kraken files for US IPO

The IPO craze in the crypt space is far from over. Kraken submitted a confidential draft registration statement to the U.S. Securities and Exchange Commission this week as it prepares for a potential initial public offering.

The move comes after the San Francisco-based crypto exchange raised $800 million in a funding round that valued the company at $20 billion. The round included a $200 million investment from Citadel Securities, along with participation from Jane Street and DRW Venture Capital.

Bitcoin ATMs flood Kenya’s malls

In Kenya, Bitcoin ATMs started appearing in major shopping centers just days after new crypto law came into force, drawing warnings from regulators who say no operator has been authorized to offer digital-asset services in the country. Officials noted that licensing requirements under the new framework are still not in place.

Public Notice on the Virtual Assets Service Providers Act 2025 pic.twitter.com/suDoXIVWhN

— Central Bank of Kenya (@CBKKenya) November 18, 2025

According to local outlet Capital News, the machines—branded “Bankless Bitcoin”—have been seen positioned next to traditional bank ATMs in several prominent malls, including Two Rivers, Westlands locations, and sites along Ngong Road.

Devexperts launches prediction markets platform

Keeping pace with the prediction market hype, Devexperts rolled out a new software platform that enables CFD brokers and exchanges to offer event-based trading. Previously largely confined to the cryptocurrency sector and adopted by Robinhood last year, event contracts have attracted increasing attention in recent months.

Devexperts’ offering could encourage proprietary trading firms and the broader CFD industry to explore these products, though questions remain over whether this could signal a return to binary options, which have been banned since 2018.

Executive moves: Amber Markets

This week, UK-registered CFD broker Amber Markets named Adel Jibrin as its new Chief Revenue Officer. He will lead the sales, partnerships, and product teams, ensuring strategic alignment across the company.

At the same time, CFI Group, a UAE-based global trading and investment firm, has added three independent members to its Board of Directors.

Also, Trading.com has named Katerina Michael as Regulatory Officer for Global Licensing and Compliance. She joins from IG Group, where she spent nearly three years managing regulatory compliance and risk.

Robinhood opens 24/7 access to prediction markets

As activity in prediction markets surges, Robinhood expanded its prediction markets, enabling users to trade around the clock. The company announced on X that the markets are now open 24 hours a day, seven days a week.

Prediction markets on Robinhood are now open 24/7. Trade your insights anytime, day or night.

— Robinhood (@RobinhoodApp) November 17, 2025

The move comes amid strong growth in Robinhood’s prediction-market activity. The platform saw 2.3 billion event contracts traded in the third quarter and 2.5 billion in October.

Sneakers and Hype Items Enter Prediction Markets

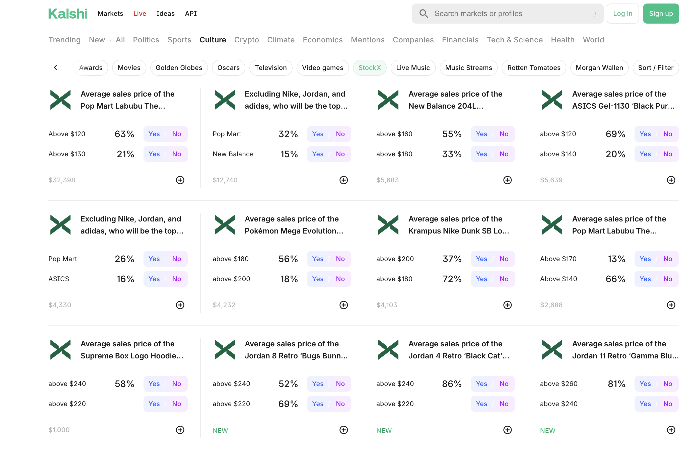

StockX partnered with Kalshi, the first CFTC-regulated exchange for trading on the outcome of future events. The collaboration aims to create a new class of event contracts tied directly to consumer culture and resale-market trends.

Traditionally, traders focused on commodities, equities, treasuries, and Forex for volatility. Today, the range of tradable assets has expanded dramatically, with sneakers, collectibles, trading cards, and other hype items now transformed into financial instruments.

Nvidia Q3 Beats: Revenue Soars, Stock Rises, AI Safe

Lastly, Nvidia reported a record $57.0 billion in revenue for its third quarter of fiscal 2026, marking a 22% increase from the previous quarter and a 62% rise year-over-year. Earnings per diluted share came in at $1.30, beating Wall Street estimates of around $1.26.

The company’s data-center segment, central to its AI growth, drove the surge with $51.2 billion in sales—up 25% sequentially and 66% year-over-year. Nvidia also provided strong Q4 guidance of $65 billion, underscoring robust momentum despite some cautionary signals.