Gold holds ground above $2,900 while traders await February's NFP release

- The Trump administration loosens tariff pressure for Mexico and Canada.

- US yields recovered a touch while Fed’s Waller sees chances for two or even three rate cuts this year.

- Traders mull the upcoming Nonfarm Payrolls release for February this Friday.

Gold’s price (XAU/USD) holds on to gains and consolidates for the third day in a row this week. The rally in Bullion stalls after US President Donald Trump shielded off all goods from Mexico and Canada that fall under the USMCA trade agreement from its freshly baked tariffs that got implemented earlier this week. Meanwhile, US equity markets trade below where they were on President Trump’s inauguration day.

On the rates side, traders got some support from Federal Reserve (Fed) official Christopher Waller, who said on Thursday that he wouldn’t support lowering interest rates in March but sees room to cut two, or possibly three, times this year. This coincides with what markets expected, with June being the first pivotal moment for the Fed to cut interest rates this year.

Daily digest market movers: China tensions

- Tensions rise between the world’s two largest economies, the US and China. Chinese Foreign Minister Wang Yi defended his nation’s actions on stemming the flow of fentanyl to the US on Friday at a high-profile briefing and accused US President Donald Trump of using the issue as a pretext to pressure his government, Bloomberg reports.

- Anticipations were high for the crypto industry after President Donald Trump signed a long-awaited order creating a strategic Bitcoin reserve and an additional stockpile of other digital assets. However, Bitcoin tanked below $90,000 after it turned out that only already owned tokens would be centralized and no new Bitcoin would be bought with taxpayers’ money, Bloomberg reports.

- “If the labor market, everything, seems to be holding, then you can just kind of keep an eye on inflation,” Fed’s Waller said on Thursday at the Wall Street Journal CFO Network Summit. “If you think it’s moving back towards the target, you can start lowering rates. I wouldn’t say at the next meeting, but could certainly see going forward.”, Waller added, Reuters reports.

- Australia shipped a record amount of Gold to the US in January, as fears over potential tariffs saw traders rush to deliver metal into New York warehouses in order to capitalize on extreme price dislocations between key markets. Exports to the US totaled A$4.6 billion ($2.9 billion) in the month — the highest amount in records dating back to 1995, the Australian Bureau of Statistics said in its latest monthly trade report, Bloomberg reports.

Technical Analysis: Simmer of hope

Bets on interest rate cuts by the Federal Reserve are now starting to get support from the central bank’s policymakers. This should support Gold’s price throughout the year, though it might not be enough to push Gold to fresh all-time highs for now. For that, a fresh catalyst, such as new tariffs or another page in the trade war book, would need to occur.

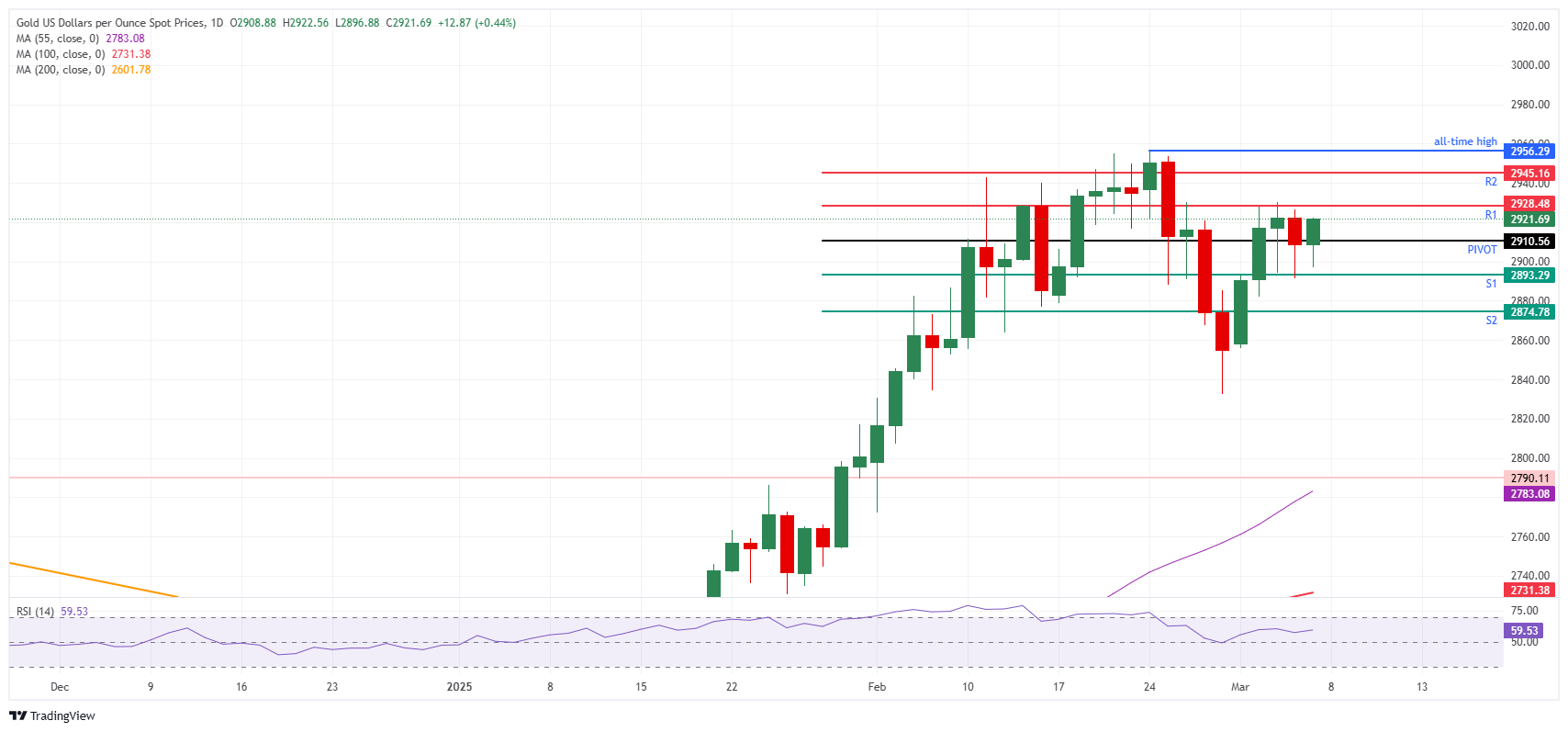

While Gold trades near $2,917 at the time of writing, the daily Pivot Point at $2,910 and the daily R1 resistance at $2,928 are the key levels to watch for on Friday. In case Gold sees more inflows, the daily R2 resistance at $2,945 will possibly be the final cap ahead of the all-time high of $2,956 reached on February 24.

On the downside, the $2,900 psychological big figure and the S1 support at $2,893 acts as a double support barrier. If Bullion bulls want to avoid another leg lower, that zone must hold. Further down, the daily S2 support at $2,874 should be able to catch any additional downside pressure.

XAU/USD: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.