Zandi says US inflation is higher than reported as CPI data quality worsens

Summary

Mark Zandi says official US CPI data significantly understates inflation.

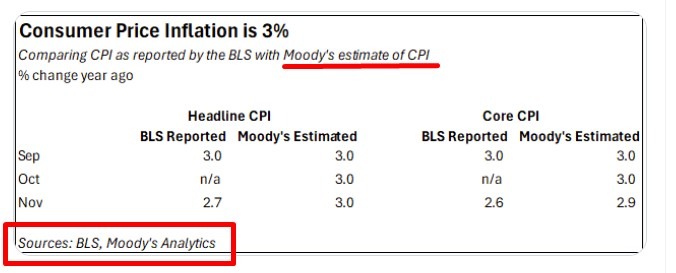

Moody’s Analytics estimates November inflation remained near 3%, not 2.7% (Goldman Sachs share concerns)

Measurement issues stem from shutdown disruptions and survey timing distortions.

CPI data quality has deteriorated due to rising reliance on imputed prices.

Underlying inflation remains well above the Fed’s target, Zandi warns.

US inflation may be running materially hotter than official data suggest, according to Mark Zandi, who warned that recent consumer price figures released by the Bureau of Labor Statistics are “badly flawed.”

In a series of social media posts, Zandi said the BLS estimate showing headline consumer price inflation slowing to 2.7% year-on-year in November significantly understates actual price pressures. Using an alternative methodology, Moody’s Analytics estimates inflation instead remained unchanged at around 3.0%.

Zandi said a key problem stems from October’s CPI calculation, when the BLS was unable to conduct its full price survey due to the US government shutdown. In response, the agency assumed prices for most goods and services were unchanged, an assumption Zandi said was unrealistic. Moody’s Analytics replaced those assumptions with private-sector price data where available, and forecasts where necessary, to reconstruct October inflation.

He also flagged distortions in November’s CPI data due to delayed survey collection. November pricing patterns are particularly sensitive to timing, Zandi said, with stronger price increases typically seen early in the month before discounting intensifies ahead of the holiday shopping season. Adjusting for this timing bias, Moody’s estimates core CPI inflation at close to 3.0% year-on-year, rather than the lower official reading.

Beyond timing issues, Zandi pointed to growing structural weaknesses in CPI measurement. Budget cuts and staffing shortages at the BLS have sharply increased reliance on imputed prices, with nearly one-third of CPI components no longer directly observed, up from roughly one-tenth earlier this year.

As a result, Zandi warned that “noise is increasingly drowning out the signal” in inflation data. Abstracting from that noise, he argued inflation remains uncomfortably high and well above the Federal Reserve’s 2% target, with little evidence of sustained disinflation.