Why XRP Is Going Down? Crypto Falls Today With Bitcoin and Could Drop 50% According to This New XRP Price Prediction

XRP price plunged 4.73% today (Monday), 3 November 2025, to $2.407, emerging as one of the weakest major altcoins as broader cryptocurrency market weakness intensified and the newest XRP price prediction points to a potential 50% decline toward $1.25.

XRP Price Today

According to my technical analysis of the daily XRP/USDT chart, the cryptocurrency is one of the most heavily declining major altcoins. It is testing the $2.38 level, which represents the daily minimum, and is currently exchanging hands at $2.40.

XRP Decline Metrics | November 3, 2025 |

Current Price | $2.407 |

Daily Change | -$0.119 (-4.73%) |

Intraday Low | $2.381 |

Session Range | $2.381-$2.533 |

October Performance | -12.04% |

Market Cap | $135.2 billion |

As visible on the chart below, prices are currently stuck in a narrow consolidation at levels last observed in early July. The range of this consolidation falls between the $2.20-$2.30 level, a support zone at multi-month lows, and the resistance zone of $2.59-$2.70, which simultaneously houses two important exponential averages, namely the 50 EMA and 200 EMA.

Why XRP Is Going Down Today?

Broader Crypto Weakness Pressures XRP

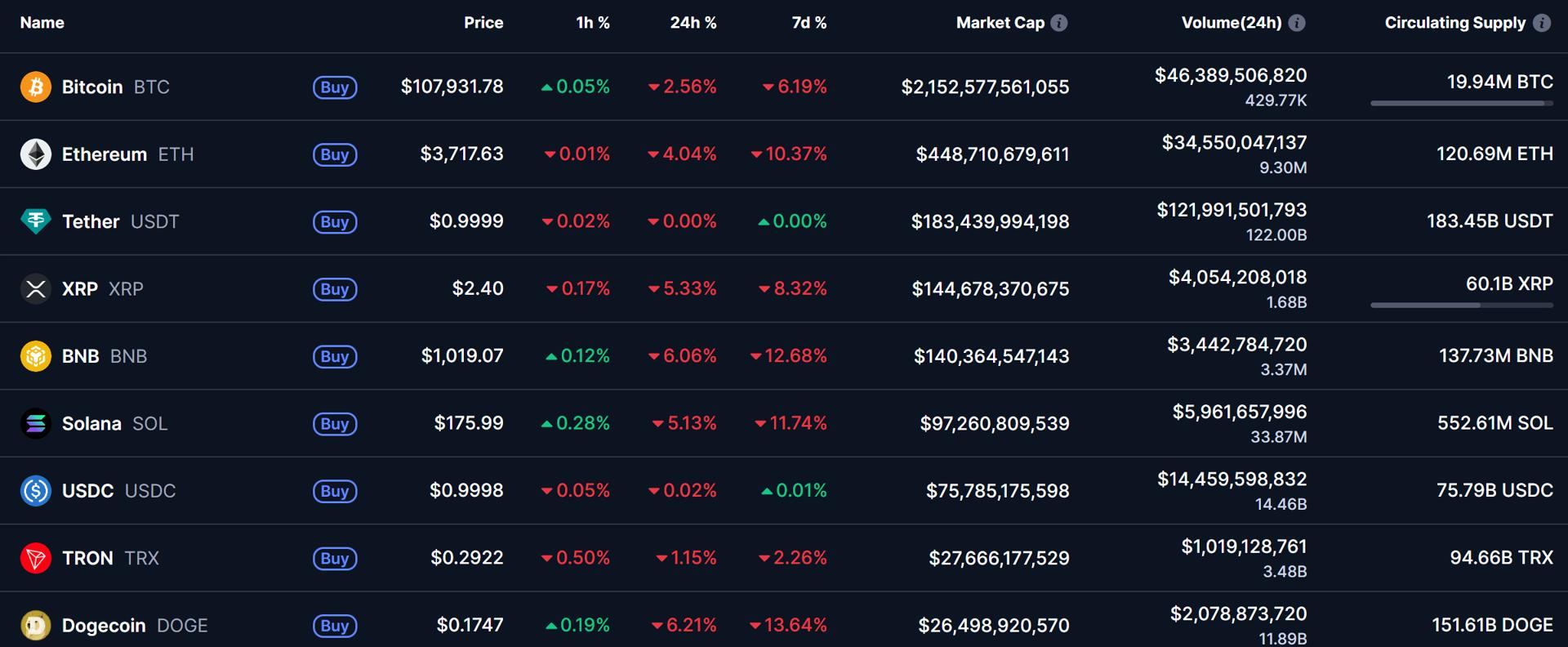

XRP's weakness stems from the general downward trend in the cryptocurrency market observed in the last 24 hours. Bitcoin is losing 2.5% and falling below $108,000, Ethereum is giving up 4% of its value testing the $3,720 level, and falling more strongly than XRP are BNB dropping 6% to $1,020 and Solana sliding 5.5% to $176. The meme cryptocurrency Dogecoin is falling 6.2% daily and costs just over 17 cents, according to current data from CoinMarketCap.

Simon Peters, crypto analyst at eToro, explained the broader market context: "Crypto markets retreated 6.5% last week, after Fed Chairman Powell signalled that a December interest rate cut is not a foregone conclusion, which dampened investors expectations for looser financial conditions going forward in the short-term."

The shift in Federal Reserve expectations proved dramatic. "Leading up to last Wednesday's interest rate decision, the market's probability of a cut at December's FOMC meeting stood as high as 96%. After the press conference this dropped drastically to less than 70% chance," Peters noted.

You may also like: This XRP Price Prediction From Ex-Goldman Analyst Eyes $1,000 by 2030

Dollar Strength Automatically Pressures Crypto

Cryptocurrencies are also not being served by the current fundamental picture of broader markets and the fact that the dollar is strengthening for a fourth consecutive session and is currently the strongest in 3 months. Cryptocurrencies valued in dollars therefore suffer from this automatically.

The dollar index reached its highest levels since August, creating powerful headwinds for dollar-denominated assets. This currency dynamic amplifies selling pressure across the entire cryptocurrency complex, with altcoins like XRP exhibiting greater sensitivity to dollar strength than Bitcoin.

Joel Kruger, strategist at LMAX, provided perspective on October's performance: "October proved to be a mild disappointment for those leaning on historical seasonality and trend analysis. Traditionally one of Bitcoin's stronger months, October finally broke its six-year streak of positive performance, ending roughly 3.7% lower. Yet, this modest decline should be viewed in perspective rather than alarm."

XRP Technical Analysis: Wedge Breakdown Signals Bearish Trend

XRP found itself in this range after breaking out of a wedge formation drawn from summer highs, which was broken downward, simultaneously denying the potential bullish connotation of this arrangement. According to my technical analysis, I currently forecast that XRP's price may decline in the short and medium term, and the impulse for this will be breaking out of the current green-marked support zone.

The falling wedge pattern, typically considered a bullish formation, was invalidated when prices broke to the downside rather than rallying upward. This technical failure creates a bearish setup where previous support levels become vulnerable to breakdown.

XRP Price Prediction: 50% Decline Target at $1.25 via Fibonacci Extension

My bearish targets include the zone of the round $2.00 level combined with $1.90, the June minimums, then the $1.61 level representing lows from the first part of this year, and ultimately the level of just $1.25. This level coincides with the intraday minimum from October 10 when there was strong deleveraging of cryptocurrency positions and its momentary collapse.

Most significantly, this $1.25 level also coincides with Fibonacci extensions, and at this height falls the 100% extension of the current downtrend from July highs to October lows, and then the upward correction observed over the last 2 weeks. This would mean that from current levels, XRP's price could decline by 50%.

XRP Bearish Price Targets | Level | Decline from Current | Technical Significance |

Current Price | $2.407 | — | Consolidation zone |

Immediate Support | $2.20-$2.30 | -9% to -4% | Multi-month lows |

First Target | $2.00-$1.90 | -17% to -21% | June 2025 minimums |

Second Target | $1.61 | -33% | Q1 2025 lows |

Ultimate Target | $1.25 | -48% to -50% | Oct 10 low + Fibonacci 100% |

Both the 50-day exponential moving average at $2.712 and the 200-day EMA at $2.622 sit above current prices, creating a formidable resistance ceiling in the $2.59-$2.70 zone. This technical setup is bearish, prices trading below both major moving averages typically indicate downtrends with momentum favoring sellers.

XRP Price Analysis, FAQ

Why is XRP falling today?

XRP dropped 4.73% to $2.407 Monday as weakest major altcoin amid broader crypto weakness (Bitcoin -2.5%, Ethereum -4%, BNB -6%, Solana -5.5%), dollar strengthening fourth consecutive session to 3-month highs automatically pressuring dollar-denominated cryptocurrencies, Fed Chairman Powell walking back December rate cut expectations (probability collapsed from 96% to below 70% per Simon Peters eToro), wedge formation broken downward contradicting bullish connotation, long-term holder outflows accelerating 2,647% to -90.14M XRP indicating institutional distribution.

How low can XRP price go?

According to my technical analysis, XRP could decline 50% from current $2.407 to ultimate target $1.25 via staged breakdown: first support failure $2.20-$2.30 opening path to $2.00-$1.90 (-17% to -21%), then $1.61 Q1 2025 lows (-33%), ultimately $1.25 coinciding with October 10 deleveraging crash low and Fibonacci 100% extension (-48% to -50%), with resistance overhead at $2.59-$2.70 housing 50-day EMA $2.712 and 200-day EMA $2.622 creating bearish ceiling.

Will XRP price fall?

My Fibonacci technical analysis shows $1.25 represents 100% extension of downtrend from July highs to October lows measured from recent two-week correction, coinciding with October 10 deleveraging event intraday low when cascading liquidations pushed XRP to this level, requiring breakdown below current $2.20-$2.30 support then $2.00/$1.90 and $1.61 levels, with Changelly algorithmic forecast also showing bearish 2026 path declining to $1.34 by December 2026 broadly consistent with substantial downside scenario.

Is XRP a sell now?

Yes. XRP trading below both 50-day EMA $2.712 and 200-day EMA $2.622 (bearish technical structure), wedge broken downward invalidating bullish formation, repeated $2.55 resistance rejections with 85% above-average volume confirming institutional distribution, long-term holder outflows +2,647% and short-term supply share -39.5% showing capitulation, though recovery above $2.59-$2.70 resistance would invalidate bearish setup, requires individual risk assessment considering potential 50% downside versus recovery scenarios if adoption accelerates.

You may also be interested in my previous analyses and predictions on XRP prices:

[#highlighted-links#]