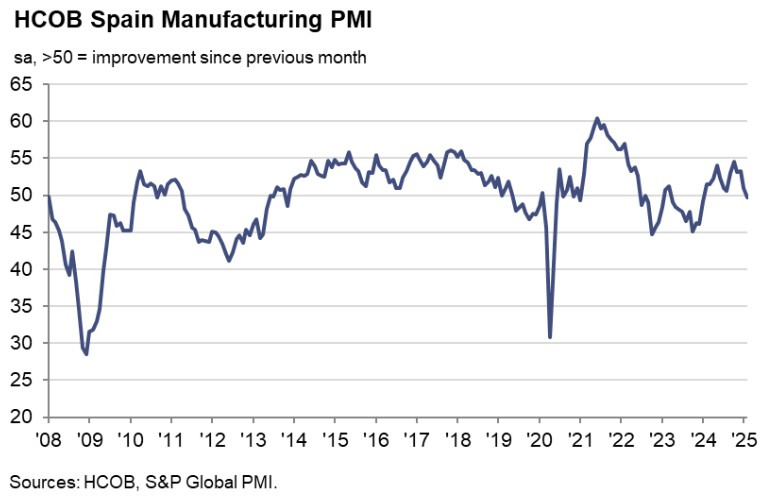

Spain February manufacturing PMI 49.7 vs 51.4 expected

- Prior was 50.9

Key findings:

- Modest drop in new orders for the first time since July 2024

- Production growth supports clearance of work outstanding

- Job losses recorded but confidence in outlook strengthens

Comment:

Commenting on the PMI data, Jonas Feldhusen, Junior Economist at Hamburg Commercial Bank, said:

“The performance of Spain’s manufacturing industry took a hit in February. According to the HCOB PMI headline index, Spain's manufacturing sector managed to avoid decline over the past 12 months, unlike many of its European counterparts. This resilience was mirrored in the hard data, with industrial production rising in three out of four quarters last year. However, that positive trend has now come to a halt. February marked the first, albeit marginal, decline in the manufacturing sector since the start of 2024

“The first deterioration in over a year is attributed to both stagnating output and falling orders. While production saw a slight uptick, this was largely due to clearing existing backlogs, as reported by panellists. The order situation is particularly worrisome. Geopolitical uncertainties are casting a shadow over business, leading to cancelled or postponed investments in manufacturing and reduced activity. The weakness of key trade partners in the Eurozone exacerbates this issue. Additionally, the prospect of various US tariffs, though probably not as impactful on Spain as on Germany and Italy for example, still create a level of uncertainty that affects business decisions.

“On a brighter note, price developments are somewhat encouraging. After months of building input price pressure, February saw a slight easing. Nonetheless, raw materials and supplier costs continue to drive input prices up. Some companies have passed these higher costs onto customers, but the overall price pressure remains within a normal range and is not overly concerning.

“A closer look at sub-sectors reveals some disparities. The consumer goods category continues to expand, in contrast to investment goods, which has been in contraction territory for two successive months. This is likely to be the result of investment uncertainty. The intermediate goods sector remains in growth territory but has only seen marginal improvement.

“Finally, while large-scale layoffs are unlikely to hit Spanish workers, the employment index has dipped back into contraction territory for the first time in six months. Despite these challenges, the outlook among manufacturers remains cautiously optimistic.”