Only One Top 10 Crypto Exchange Resisted Bitcoin's 30% Price Drop - Find Out Which

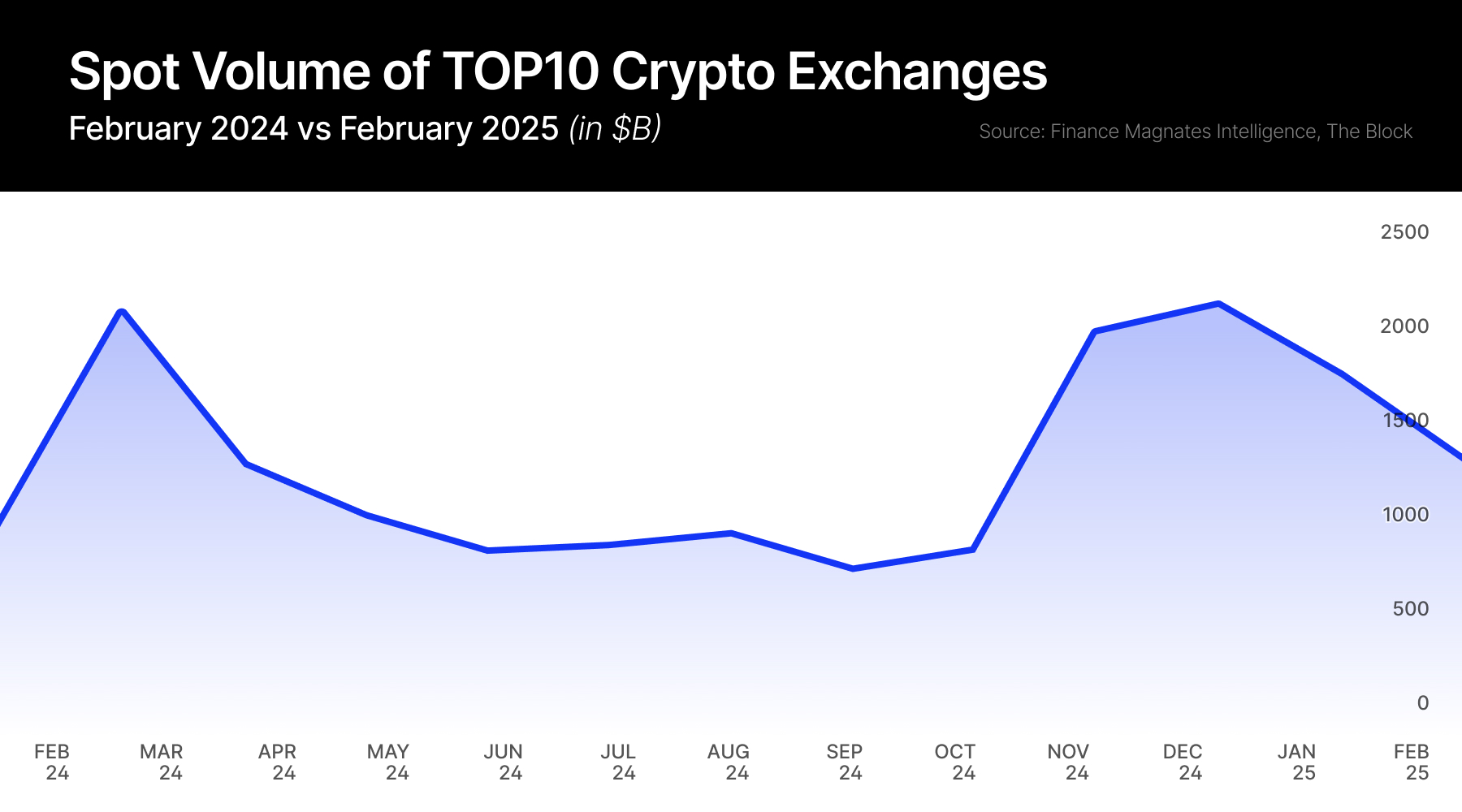

Global cryptocurrency exchange spot volumes fell sharply in February 2025, dropping 23% month-over-month (Mom) to $1.3 trillion as Bitcoin prices retreated from recent highs. Despite the monthly decline, year-over-year (YoY) comparisons show robust 45% growth across major trading platforms.

Crypto Exchange Volumes Plunge as Bitcoin Slump Drives Four-Month Low

The February cooldown marks the second consecutive month of declining volumes, bringing trading activity to its lowest level since October 2024. The downturn comes amid broader market consolidation following Bitcoin's volatile price action in early 2025.

In January, Bitcoin tested historical highs above $108,000. Since then, a sharper correction began, briefly pushing the price below $80,000—a nearly 30% drop. While bear markets also drive trading activity, historically, the highest volumes are seen during bullish surges.

The result? A significant month-over-month decline in trading volumes.

Exchange Performance Shows Widespread Declines

Nine of the top ten cryptocurrency exchanges reported volume decreases in February, with South Korea's Upbit experiencing the steepest drop at 46% MoM. The platform's trading activity fell from $187.87 billion in January to $101.51 billion in February, though it maintained its 8% market share.

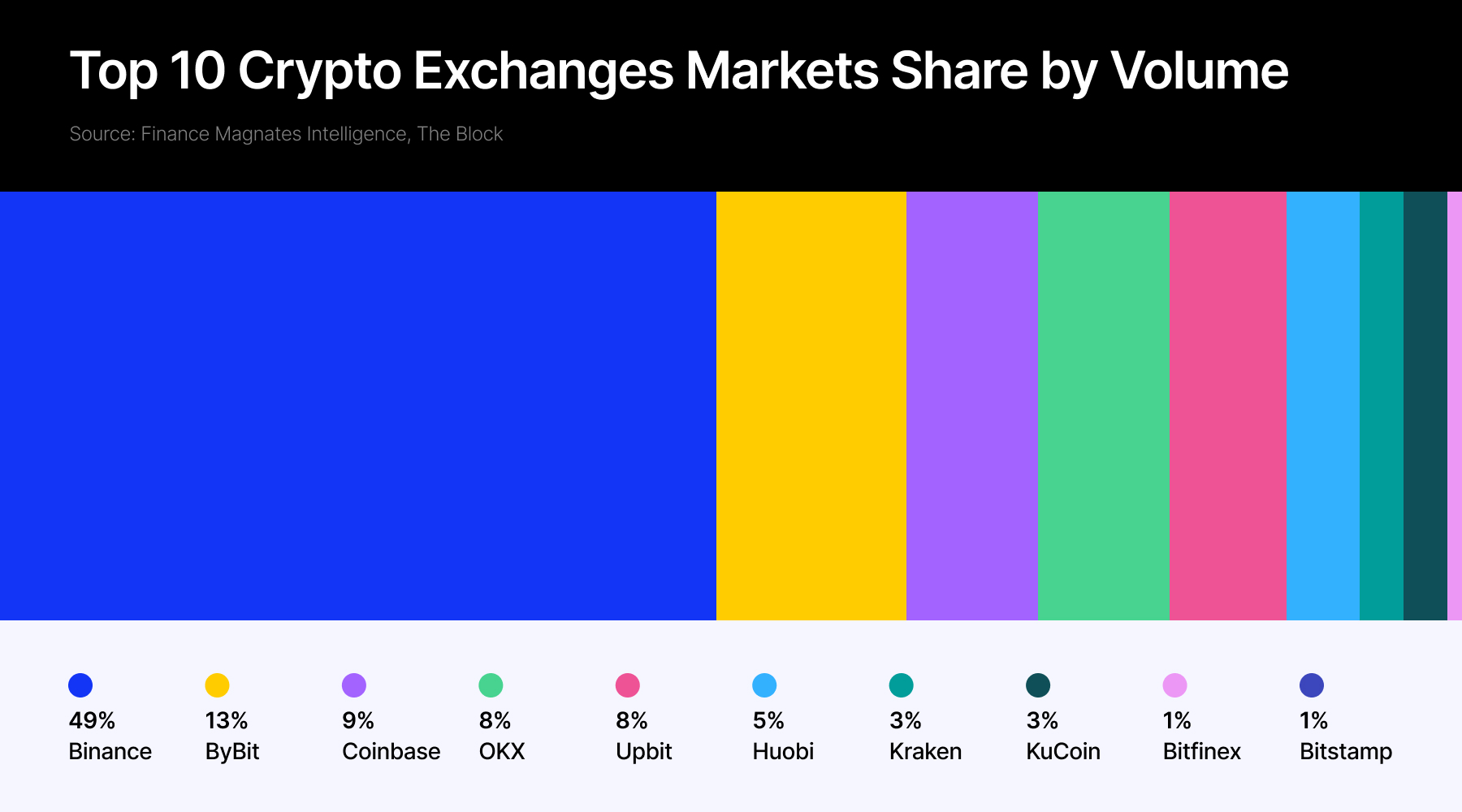

Binance retained its commanding market position with a 49% share despite seeing volumes fall 19% to $651.48 billion. ByBit and Coinbase rounded out the top three, commanding 13% and 9% market share, respectively.

Bitfinex emerged as the only exchange to buck the downward trend, posting a 16% increase in trading volume. However, its overall market impact remains limited with just 1% market share.

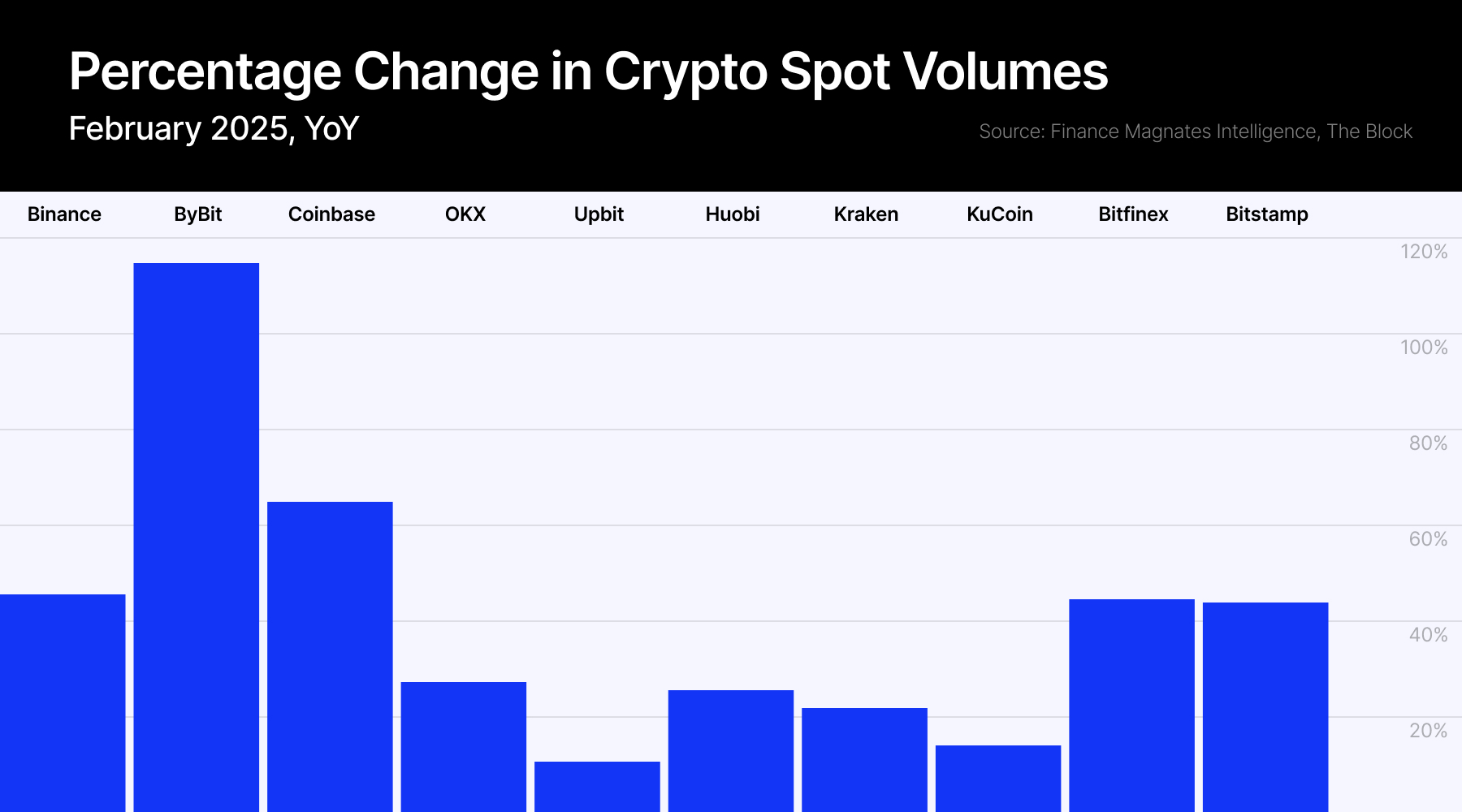

Crypto Trading Activity Shows 45% Annual Growth

The YoY data paints a more optimistic picture of the cryptocurrency trading landscape. Total volume across major exchanges grew 45% compared to February 2024, with ByBit leading the annual growth charts with a remarkable 116% increase.

Coinbase showed particularly strong annual performance with a 66% volume increase compared to February 2024, while Binance grew 46% year-over-year. Even smaller exchanges like Bitstamp demonstrated robust annual growth at 44%, despite its modest market share.

The contrasting monthly and annual trends suggest the cryptocurrency market is experiencing a temporary pullback rather than a fundamental shift in trading patterns. The top three exchanges maintained their collective dominance with approximately 71% market share, virtually unchanged from January.