Why Robinhood Stock Is Down Today: HOOD Plummets 20% amid Broader Nasdaq and Tech Sell-Off

Robinhood Markets Inc. (NASDAQ: HOOD) faced a sharp downturn on Monday, March 10, 2025, with shares falling almost 20%, closing at $35.63, down significantly from the previous close of $44.42.

The sell-off coincided with a devastating day for Wall Street, where the Nasdaq 100 plunged over 4%, its worst single-day decline since September 2022, dragging down the broader technological sector, including all FAANG stocks (Facebook/Meta, Amazon, Apple, Netflix, and Google/Alphabet).

Robinhood Stock Price Today: HOOD Falls 20%

Today (Tuesday, March 11, 2025), the price of a single HOOD share on NASDAQ stands at $35.63 ahead of Wall Street’s opening. This marks its lowest level since December 2024, and the 20% drop during a single session was one of the sharpest declines across the entire index.

The severe drop is part of a broader downward trend that has seen Robinhood shares lose almost half their value since mid-February when they traded at approximately $67. This represents a stark reversal of fortune for a company whose stock had more than doubled in value over the past year before this recent collapse.

However, as of writing, in the pre-market, HOOD shares are rebounding, rising by $1.30 (3.6%) to $36.90,

Why is Robinhood Stock Falling? Regulatory Woes

The sharp drop in Robinhood’s stock was primarily driven by regulatory setbacks. The Financial Industry Regulatory Authority (FINRA) fined the company $26 million, citing inadequate anti-money laundering practices and technical deficiencies in its clearing systems. Additionally, Robinhood was ordered to compensate affected customers, amounting to approximately $3.75 million.

Investors responded swiftly to these regulatory issues, contributing to elevated selling pressure. Trading volume surged, indicating heightened investor anxiety and undermining market confidence in Robinhood’s near-term outlook.

Moreover, investor sentiment has been severely damaged by ongoing uncertainty surrounding President Trump's trade policies and tariff announcements. Adding to these concerns, President Trump did not dismiss the possibility of a recession in 2025 during a Fox News interview, stating: "There is a period of transition because what we're doing is very big. We're bringing wealth back to America. That's a big thing... It takes a little time."

Nasdaq 100, Tech Sector Declines and Bitcoin Going South

Robinhood’s decline occurred within a broader context, as major indices experienced significant downturns:

- Nasdaq Composite: Dropped 4% to close at 17,468.32, marking the index’s steepest single-day fall since 2022.

- S&P 500: Declined by 2.7%.

- Dow Jones Industrial Average: Fell by 2.1%.

Technology giants known collectively as the FAANG stocks—Meta (formerly Facebook), Amazon, Apple, Netflix, and Alphabet (Google)—also saw considerable losses. Tesla was notably impacted, with shares declining over 15%, its worst one-day performance since 2020.

Bitcoin's behavior is also significant, as the largest cryptocurrency saw its price drop below $80,000 during Monday’s session and today tested over four-month lows at $76,600. For HOOD, BTC and cryptocurrencies represent a key part of its monthly trading volume and, consequently, its revenue, which explains the correlation.

Technical Analysis and Robinhood Stock Price Forecasts

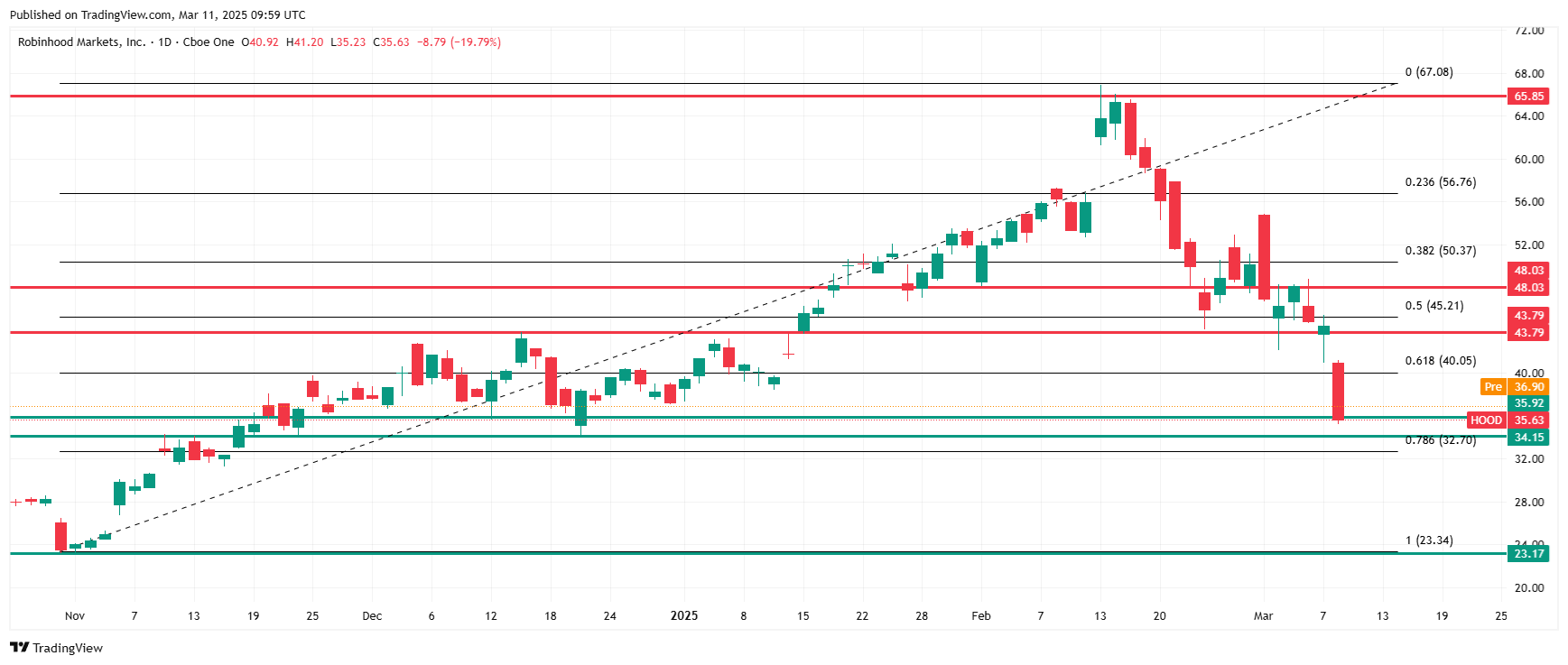

From a technical standpoint, Robinhood’s sharp decline broke key support levels, prompting further bearish signals. The key level was the $44 zone, reinforced by the 50% Fibonacci retracement at $45, which acted as a dividing line between bulls and bears.

Breaking this level—defined by the highs from late last year and the local lows from late February—indicates that sellers are regaining control. The sharp, nearly 20% drop pushed the stock straight to the next support zone, formed by December's lows. If this support fails, I would expect Robinhood shares to decline toward $23, which aligns with the October lows.

Support | Resistance |

$36 – December lows | $44 – Key support level broken in March |

$34 – Additional support/December lows | $48 – September 2021 highs |

$23 – Potential downside target | $66 – February 2025 peaks |

According to MarketBeat, Robinhood has received a consensus rating of "Moderate Buy" from 16 research firms covering the stock. The average 12-month price target among these analysts is $59.53.

Several investment firms have recently updated their outlook on Robinhood:

- Piper Sandler: Raised their price objective from $54.00 to $75.00 and gave the company an "overweight" rating (February 13th, 2025)

- Mizuho: Boosted their price objective from $60.00 to $65.00 and maintained an "outperform" rating (February 7th, 2025)

Is Robinhood Stock a Buy After the Crash?

Robinhood’s dramatic fall on March 10, 2025, reflects a perfect storm of Wall Street’s tech sector woes, crypto volatility, and macroeconomic uncertainty. While the Nasdaq 100 and FAANG stocks struggled, Robinhood’s retail-driven model amplified its losses. For investors, the question remains: Is this a dip to buy or a sign of deeper trouble?

Short-term risks loom large, but long-term believers in Robinhood’s growth story might see value at these levels. Stay updated with Robinhood stock charts, market news, and expert analyses to navigate this turbulent landscape.

Key Takeaways:

- Robinhood stock crashed nearly 20% on March 10 amid a Wall Street sell-off.

- The Nasdaq 100 and FAANG stocks tanked, dragging the tech sector down.

- Recession fears, crypto declines, and earnings woes fueled the drop.

- Robinhood stock prediction 2025 remains uncertain—proceed with caution.

Robinhood News, FAQ

Why Is Robinhood Stock Going Down?

Robinhood's stock price fell sharply due to regulatory fines totaling $26 million, issued by FINRA, along with broader market volatility driven by fears of an economic recession. This situation led investors to sell off Robinhood shares, resulting in nearly a 20% drop.

Is There a Problem With Robinhood Today?

Yes, Robinhood faces significant regulatory challenges. FINRA fined the company $26 million for inadequate anti-money laundering practices and issues related to its clearing systems. This regulatory scrutiny has shaken investor confidence, triggering significant selling pressure.

What's Going On With Robinhood?

Robinhood's shares plunged nearly 20% due to regulatory penalties combined with a broader market downturn that impacted technology and financial stocks. Economic uncertainty and recession fears, amplified by political commentary and tariff disputes, have further affected investor sentiment.

Is Robinhood Stock Expected to Rise?

Robinhood's future stock price movement will depend on resolving current regulatory issues and overall market conditions. Analysts recommend closely monitoring developments in regulatory matters, broader economic indicators, and technical support levels, particularly around the $30 and $32 range, before anticipating any significant recovery.