ZFX UK Posts Loss Despite Revenue Rising 5%, Reversing Last Year’s Profit

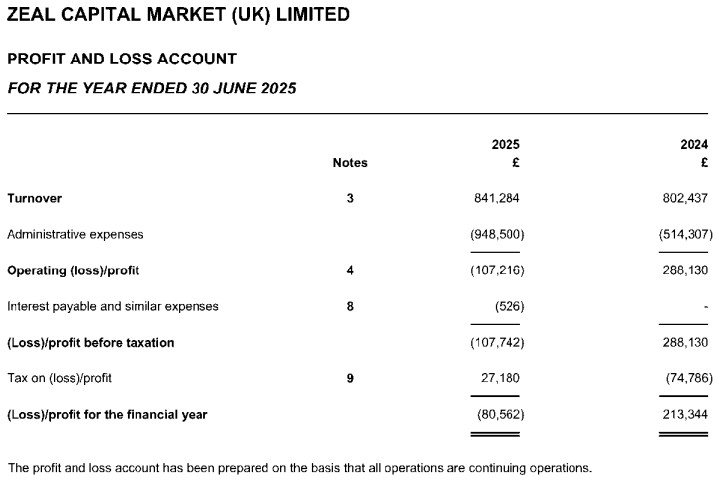

Zeal Capital Market (UK) Limited, the FCA-regulated firm behind the ZFX broker brand, recorded impressive trading growth in the fiscal year ending 30 June 2025, yet finished in the red.

The company saw its trading volume surge by 43.5% to $28.8 billion, up from $20 billion the previous year. Revenue also edged up 4.8% to £841,284, reflecting steady client demand and strengthened trading activity.

“Adverse GBP/USD Exchange Rate Movements”

Despite the growth, the company posted a net loss of £80,526, a sharp turnaround from a £213,344 profit in 2024. Officials attributed the result to unfavorable GBP/USD exchange rate movements that reduced the value of capital and reserves held largely in dollars.

[#highlighted-links#]

“This result was primarily driven by adverse GBP/USD exchange rate movements, which affected capital and reserves held predominantly in USD, combined with higher costs related to trade execution and operations,” the company mentioned in its Companies House filing.

Balance Sheet Highlights

Zeal Capital Market ended the year with net assets of £2.42 million, slightly down from £2.5 million in 2024. Cash balances, however, jumped significantly to £1.45 million from £369,109.

Expect ongoing updates as this story evolves.