What are the main events for today?

We have once again an empty European session ahead with no notable data releases. In the American session, the focus will be on the US PPI and the US Jobless Claims.

12:30 GMT/08:30 ET - US February PPI

The US PPI Y/Y is expected at 3.3% vs. 3.5% prior, while the M/M figure is seen at 0.3% vs. 0.4% prior. The Core PPI Y/Y is expected at 3.5% vs. 3.6% prior, while the M/M reading is seen at 0.3% vs. 0.3% prior.

We got a soft CPI yesterday but the details that feed into the Core PCE were less encouraging with early estimates seeing the Core PCE Y/Y at 2.7% vs. 2.6% prior and 0.3% vs. 0.3% prior. That would explain yesterday's price action although judging by the weak momentum, the market might be waiting for the PPI release as it could change the PCE estimates materially.

12:30 GMT/08:30 ET - US Jobless Claims

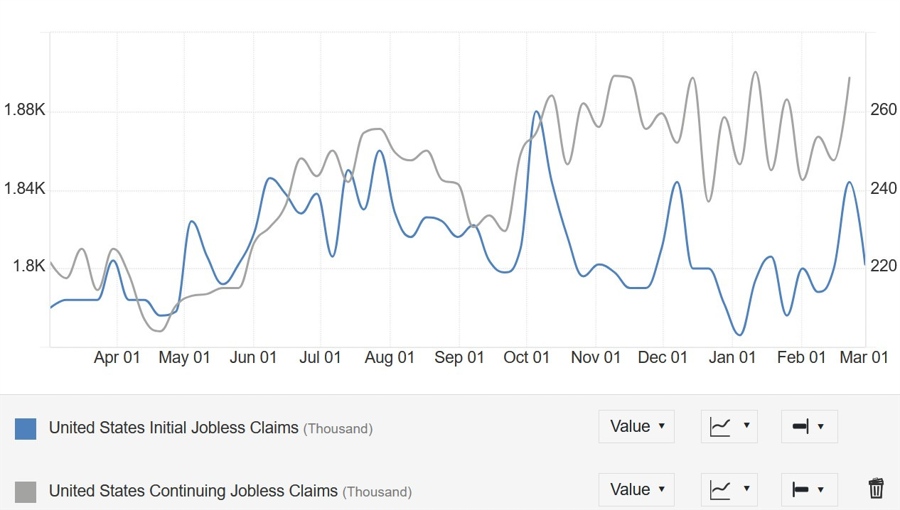

The US Jobless Claims continue to be one of the most important releases to follow every week as it’s a timelier indicator on the state of the labour market.

Initial Claims remain inside the 200K-260K range created since 2022, while Continuing Claims continue to hover around cycle highs.

This week Initial Claims are expected at 225K vs. 221K prior, while Continuing Claims are seen at 1900K vs. 1897K prior.