Tech stocks slide as Broadcom tumbles amid market turbulence

Major US stock indices are closing lower. The NASDAQ is down for the 3rd consecutive day. The Dow industrial average and the S&P indices are down for the 2nd consecutive day.

A snapshot of the closing levels shows:

- Dow industrial average down 41.31 points or -0.09% at 48416.74

- S&P index -10.89 points or -0.16% at 6816.52

- NASDAQ index -137.76 points or -0.59% at 23057.41

- Russell 2000-20.79 points or -0.81% at 2530.66.

Broadcom shares continued its move sharply lower today, extending recent weakness despite the company delivering better-than-expected earnings and revenue after the close on Thursday last week. Broadcom reported EPS of $1.95 versus $1.86 expected, with revenue at $18.02 billion versus $17.47 billion expected, and also issued stronger-than-expected guidance. However, the stock had been priced for near-perfection, and investors quickly shifted focus to slightly lower margins, which fell by a few percentage points and raised concerns about profitability trends.

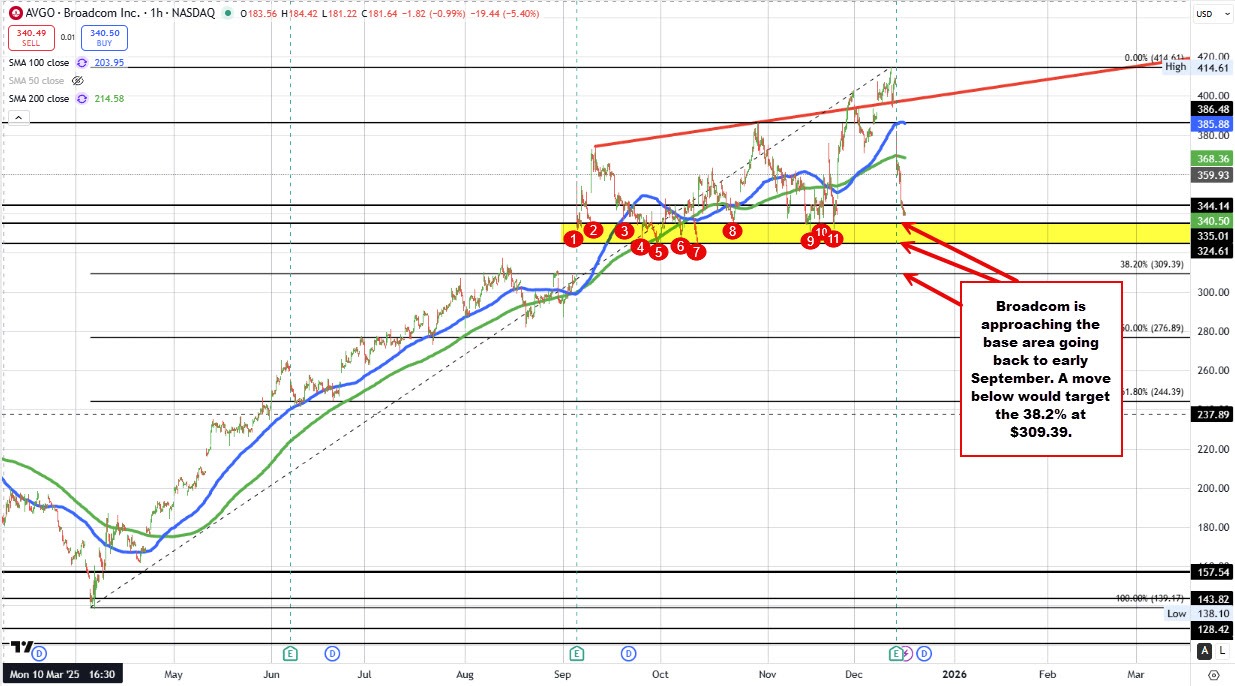

From a market perspective, the reaction highlights a broader theme in the NASDAQ, where high-multiple stocks are struggling to absorb even modest disappointments. Broadcom shares are now down roughly 18.25% from recent all-time highs from last Wednesday, with sellers firmly in control. Technically, the stock has broken below the 100 and 200 hour MAs at $385 and $368 respectively, and is approaching a swing area floor that extends back to early September between $324.61 and $335.01 (see red numbered circles on the chart below). Below that the 38.2% retracement of the 2025 trading range comes in at $309.39.

Bottom line: Broadcom’s results were fundamentally strong, but valuation sensitivity and margin concerns outweighed the beat, making the stock a focal point for the broader tech-led pullback.

Shares of the Strategy (formally Micro Strategy – MSTR) tumble -$14.37 or -8.14% at $162.08. The shares closed at its lowest level going back to the end of September 2024. The price bitcoin is down -2.88% today at $85,601.

Strategy (MSTR) is effectively a leveraged Bitcoin proxy. The company’s core software business is now secondary to its strategy of accumulating Bitcoin, largely financed through convertible debt and equity issuance. As a result, MSTR’s share price tends to amplify moves in Bitcoin—rising faster when BTC rallies and falling harder when BTC pulls back.

- The "Holdings" Numbers (Latest Data)

Total Bitcoin Held: ~660,624 BTC

Recent Purchase: Acquired 10,645 BTC for ~$980 million (Dec 8–14, 2025).

Current Market Value: With Bitcoin fluctuating near $92,000–$95,000, the total stack is valued at approximately $61 Billion.

2. "Strategy BE" (The Break-Even Analysis)

The "BE" or Break-Even point is the critical metric investors watch to see if MicroStrategy's leveraged bet is underwater.

Estimated Average Cost Basis: ~$74,696 per BTC.

Note: This average has crept up significantly as the company purchased aggressively throughout 2025 at prices above $80k and $90k.

The Safety Cushion:

Current BTC Price: ~$93,000

Break-Even Price: ~$74,696

Buffer: MicroStrategy is currently ~25% in the profit zone.

Risk Zone: If Bitcoin falls below $75k, the company’s "unrealized profit" vanishes, which could trigger a negative feedback loop for MSTR shareholders (though Michael Saylor has pledged never to sell).

Some of the major decliners today included:

Strategy (MSTR): -8.14%

Nebius NV (NBIS): -7.44%

Broadcom (AVGO): -5.61%

SoFi Technologies (SOFI): -5.28%

Arm Holdings (ARM): -5.00%

Grayscale Bitcoin Trust (GBTC): -4.90%

Uber Technologies (UBER): -3.93%

Robinhood Markets (HOOD): -3.62%

Alibaba ADR (BABA): -3.57%

Zoom Video (ZM): -3.32%

CrowdStrike Holdings (CRWD): -3.38%

Salesforce (CRM): -3.17%