Cyprus Collective Investment Declines to 10.6B; UCITS Maintain Retail Participation

The Cyprus Securities and Exchange Commission released its Q2 2025 Statistical Bulletin for the Management Companies and Undertakings of Collective Investments sector. The report covers supervised entities, their assets, investment strategies, and investor profiles. CySEC noted that the data is provided by the entities and is not independently verified.

Supervised Entities and Management Companies

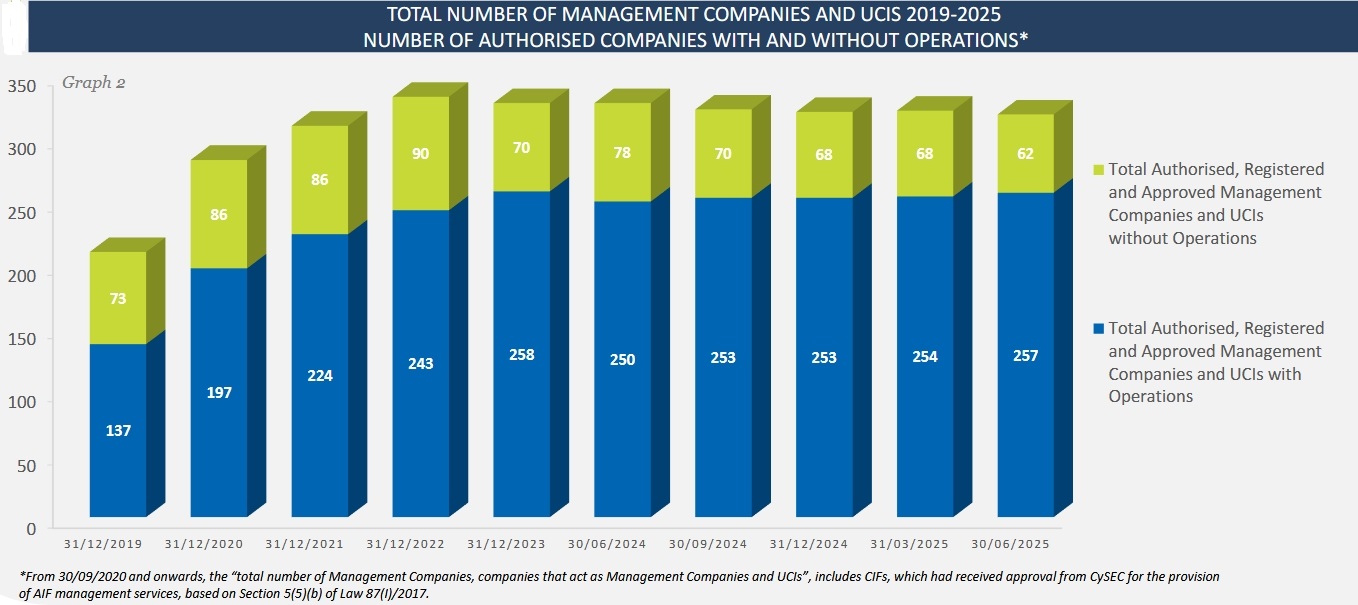

As of June 30, 2025, 319 entities were under CySEC supervision, of which 257 were operational. This includes externally and internally managed UCIs and external fund managers. Management companies consisted of Alternative Investment Fund Managers, UCITS management companies, and dual-license entities.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

[#highlighted-links#]

Assets Under Management

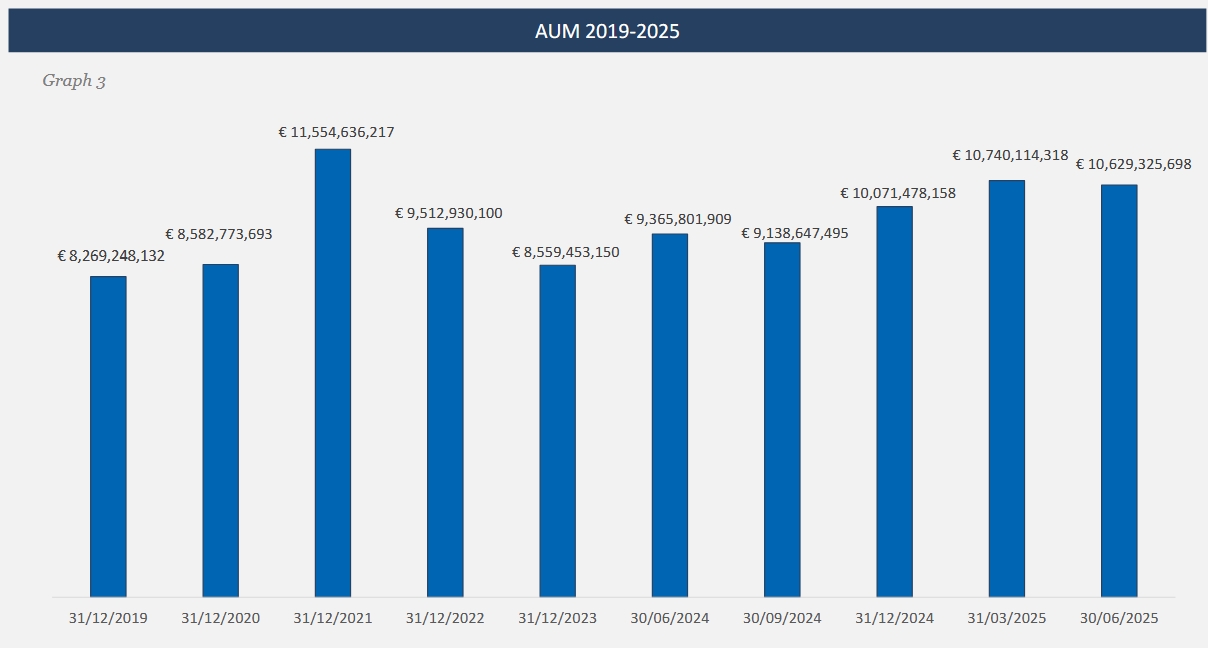

Total assets under management declined by 1.03% from the previous quarter to €10.6 billion, with AIFMs holding the largest share. UCITS focused on liquid assets, mainly transferable securities, while alternative funds invested heavily in private equity and real estate. Investments within Cyprus totaled €2.75 billion, also primarily allocated to private equity.

Investor Profiles and Fund Composition

Investor profiles reflected fund types. UCITS were mainly held by retail investors. Alternative funds were dominated by well-informed and professional investors. Key sector allocations included shipping 582 million euros, energy 446 million euros, fintech 106 million euros, and sustainable investments 97 million euros.

Δελτίο Τύπου - Στις 319 οι Εταιρείες Διαχείρισης και οι Οργανισμοί Συλλογικών Επενδύσεων

— CySEC - Cyprus Securities and Exchange Commission (@CySEC_official) October 17, 2025

Press Release - 319 Management Companies and Undertakings of Collective Investments (UCIs) under supervisionhttps://t.co/QanYiRvUhv

Sector Growth and Trends

The number of supervised entities has grown steadily over the years. The sector remains diverse, with a clear distinction between retail-focused UCITS and alternative funds for sophisticated investors. Despite a small decline in assets under management, the sector continues to play a significant role in Cyprus’s financial landscape.