"AI Will Reshape Investing," Says Edge Hound CEO - And Investors Who Ignore the Trend May Soon Be Left Behind

"We're not just predicting markets, we're decoding their behavior." That's how Peter Pavlov, CEO and Co-Founder of Edge Hound, describes his company's new AI-powered research platform launching into an increasingly crowded field of automated trading tools.

The New York-based startup promises to deliver thousands of daily trade ideas backed by multi-agent AI architecture. But Pavlov insists the real value isn't the volume, it's the clarity.

As brokerages from Interactive Brokers to regional players rush to integrate AI features, Edge Hound is betting that retail and institutional investors alike are hungry for something different: AI that explains the "why" behind every signal.

Edge Hound's Approach: Trade Ideas Come With Explanations, Not Just Signals

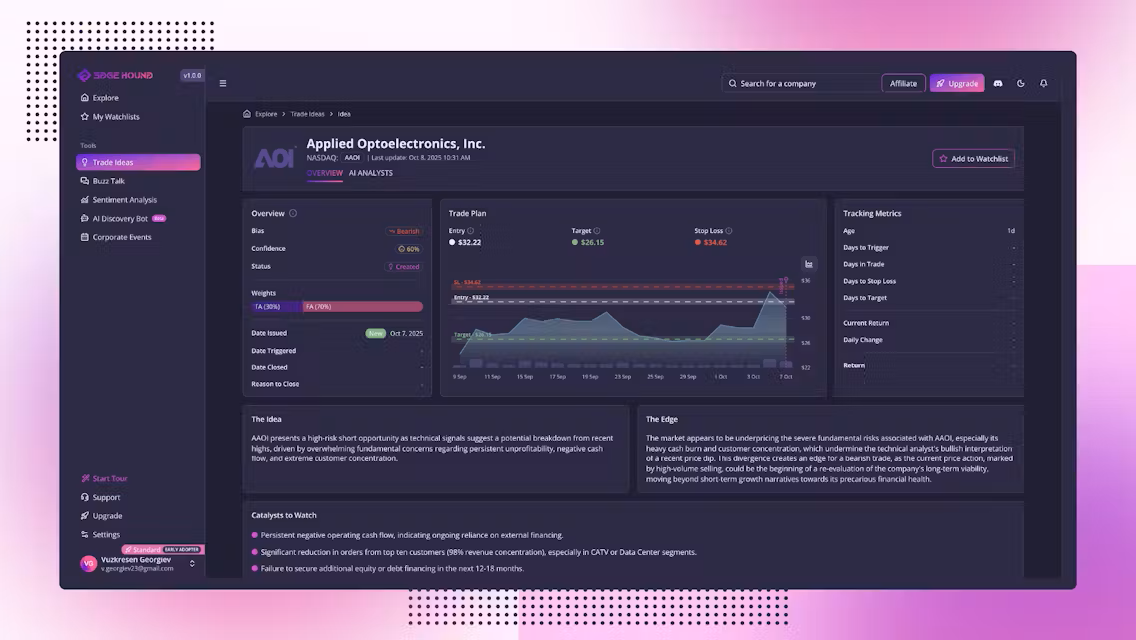

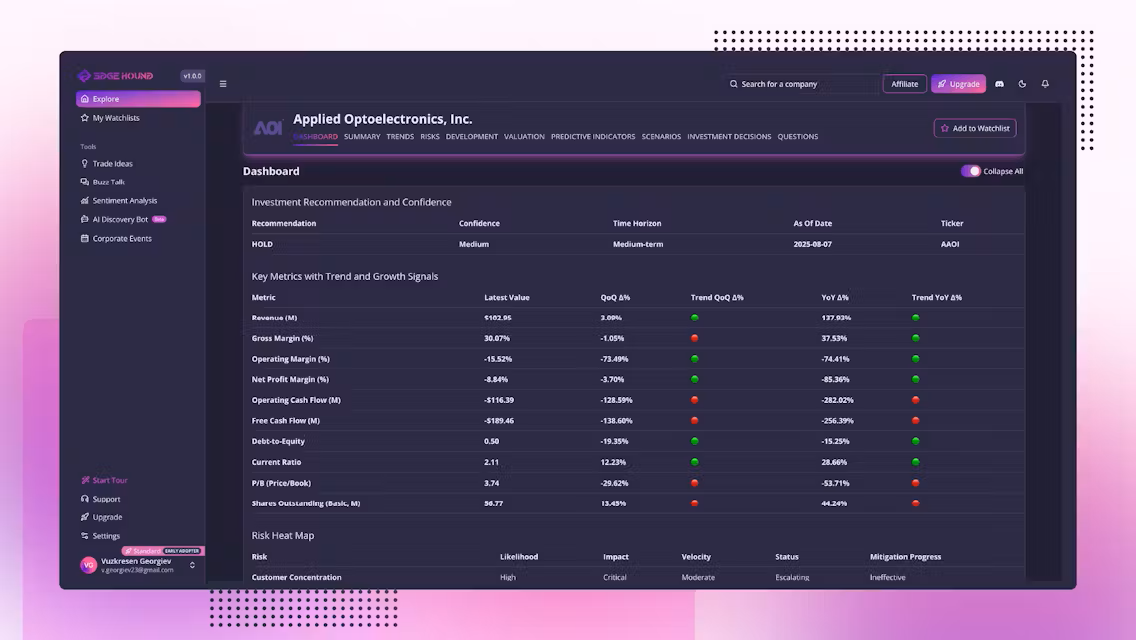

Edge Hound says its AI does more than just spit out trading signals. The platform processes thousands of news sources, crowd trends, social media, filings, and macroeconomic events to deliver over 2,500 actionable trade ideas every day. By the end of 2025, it aims to bump that number up to 10,000, with broader global coverage including ETFs and markets across Europe and Asia.

"To be candid, we haven't seen any publicly available tool that operates the way Edge Hound does," said Peter Pavlov, CEO and Co-Founder, in an interview with FinanceMagnates.com

"Many platforms claim to use advanced NLP or sentiment analysis, but in practice they tend to be information-heavy, noise-dense dashboards rather than systems that deliver actionable, decision-ready insights."

[#highlighted-links#]

Key features include a chat-driven investing interface, positioned as a "co-pilot" for research and stock discovery. "Buzz Talk" scans news and social conversations for hot topics and drivers behind price swings, while near real-time sentiment analysis reveals extremes in optimism or pessimism. Multi-agent AI architecture weighs the judgments of multiple "virtual analysts," with a Collective Oracle to reconcile opinions and surface the most compelling conclusions.

Discovery Bot connects the dots between macro events, sector shifts, and specific trade signals. The system's theoretical cumulative return across all AI-generated ideas topped 1,200% in September, though Edge Hound cautions that actual results depend on individual usage, capital, and trading costs.

AI Competition Picks Up Momentum Across Brokers

Peter launched Edge Hound together with his brother Miroslav, who serves as CBO. And while they told FinanceMagnates.com that they had not seen similar solutions until now, the market is beginning to fill up with AI-powered trading tools.

For example, Interactive Brokers only recently integrated a knowledge graph-driven tool within its platform, letting users spot thematic investment ideas and broader trends without wading through mountains of data.

The tool links market relationships, products, and competitors and now covers every S&P 1500 company, simplifying research for hundreds of thousands of traders worldwide.

Other industry players, including CMC Invest and TradeStation, have worked tools like TipRanks into their research offerings. Meanwhile, brokers such as Traders' Hub have added Acuity's AnalysisIQ to their product lineups, offering machine-generated signals and rankings supported by human oversight.

Sentiment-tracking features and explainable AI are quickly becoming must-haves for both compliance and customer experience.

Academic Rigor With Trading Experience

The Pavlov brothers draw on years of experience in applied mathematics, computer science, and hands-on trading.

"I personally lectured in computer science at the university level for eight years," Pavlov said. "My business partner also has a strong mathematics foundation and is a computer science engineer with significant industry experience." The team includes Dr. Dimitar Dobchev, an associate professor in nuclear physics, and Dr. Georgi Simeonov, an associate professor with a PhD in mathematics and AI engineering.

Pavlov emphasized that technical skill alone doesn't guarantee a viable product. "The equilibrium comes from combining this technical excellence with real investing and trading experience," he said.

"Both my partner and I have been active in the markets for years, and that commercial awareness ensures we're not just building advanced technology, we're building the right product for real decision-makers."

The team also includes Desimir Paskalev, a long-time CFD industry veteran who spent over a decade at XM and later founded proprietary trading firm FundedBull before joining Edge Hound in June 2025 as head of affiliate marketing.

Balancing AI Power With User Responsibility

The founders stress that users should approach the platform with clear eyes. "AI is a tool, not a holy grail, and when your own capital is at stake, you have a responsibility to understand the decisions you're making," Pavlov said.

Edge Hound is preparing video tutorials, walkthroughs, and best-practice guides after early testing with roughly 2,000 users revealed that many still struggle to extract the platform's full value.

"We've already done the heavy lifting - aggregating, analyzing, and distilling vast amounts of information into a clean, digestible one-page summary for every stock -updated daily," Pavlov explained. "What we're ultimately selling is time saved, but users still need to invest a bit of time to read, understand, and make informed decisions."

Retail Focus, But Institutional Demand Emerging

Edge Hound remains bootstrapped to around $1.5 million, with plans to push for profitability by mid-2027. The company is focusing first on retail users, where rapid scaling is more feasible.

Still, the founders believe institutional partnerships will become "a major pillar of the business, both in revenue and strategic importance". When institutional clients are open to having their use cases adapted into retail-facing features, it upgrades the platform for all users, Pavlov noted.

Looking forward, Edge Hound expects to expand into crypto and Forex markets by the second quarter of 2026, with options analytics, prediction markets, and broker integrations on the roadmap.

As for whether AI will fundamentally reshape investing, Pavlov is unequivocal. "Absolutely, AI will fundamentally reshape the industry," he said. "But the transformation won't come from generic sentiment tools or shallow automation. It will come from systems capable of analyzing businesses, markets, dependencies, and risk at a depth that no human alone can process.”

“That's exactly what we are building,” he concluded.