Why Is Bitcoin Falling: Macro Shock, Forced Liquidations, or Just Profit-Taking?

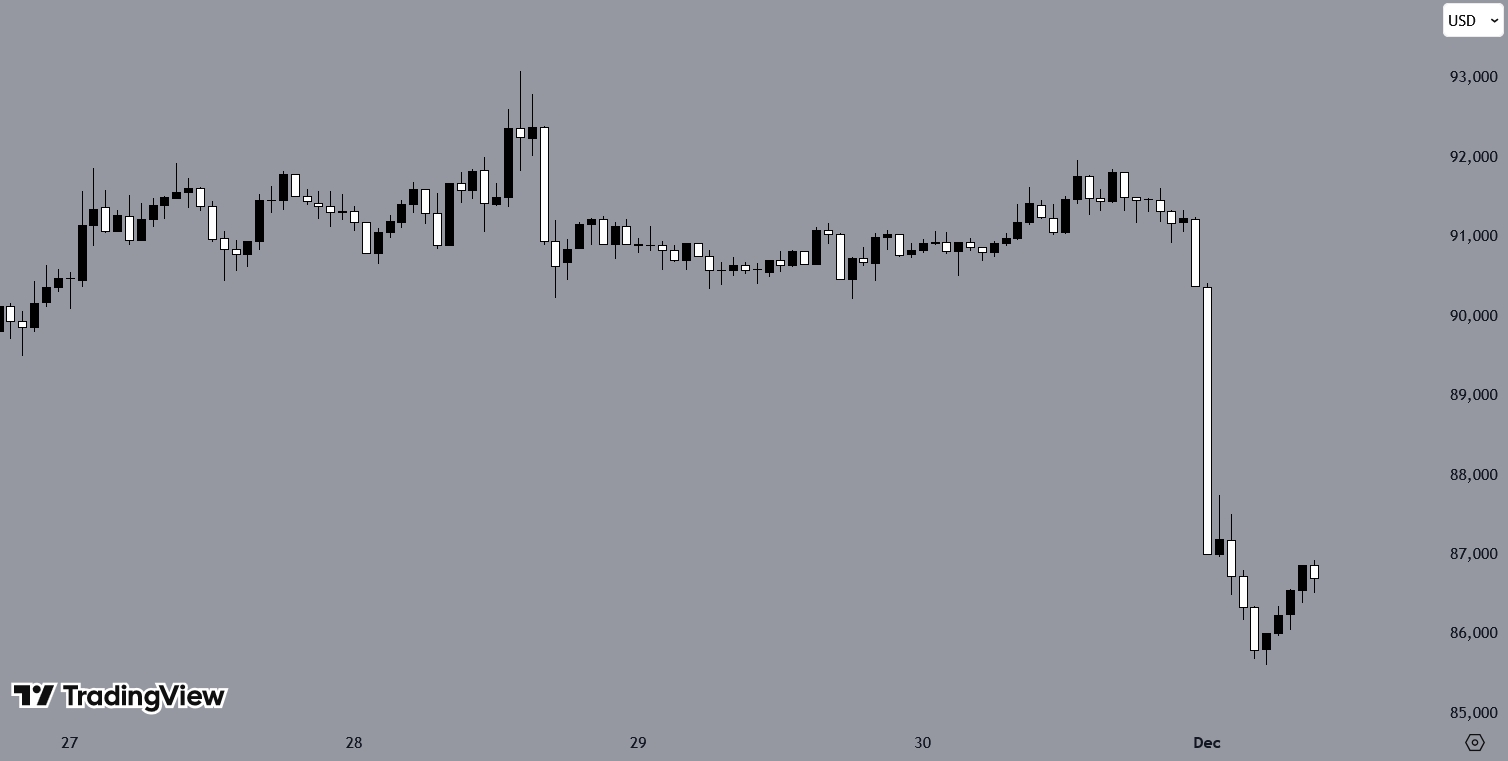

Bitcoin fell sharply during Asian trading on Monday as a macro-driven shock hit global markets at the start of the month. Analysts said rising bond yields in key markets weakened risk appetite, pushing investors away from risk assets, including cryptocurrencies. Bitcoin dropped more than 5 percent during the session. Could the decline also be driven by investors taking profits after recent gains?

The sell-off deepened as key technical levels broke. This triggered stop-loss orders across major exchanges. Forced liquidations of leveraged long positions followed. The liquidation wave added pressure to prices and accelerated the decline.

[#highlighted-links#]

The market move also came after an incident at the DeFi platform Yearn Finance. Its yETH liquidity pool faced a reported exploit. The incident allowed large amounts of invalid tokens to be created. This raised new concerns about liquidity and added to the broader sell-off.

Analyst Insights on the Decline

Market commentators linked the decline to macro pressures and leveraged trading. Coin Bureau said on X that “BTC is simply selling off because macro + leverage hit at the same time.” It added that “Japan’s 2-year bond yield just jumped above 1%.” The post said higher borrowing costs “scared global markets.” It also said the move “broke support, triggered stop-losses, and forced leveraged longs liquidation.”

🚨WHY BITCOIN JUST DUMPED 👇

— Coin Bureau (@coinbureau) December 1, 2025

BTC is simply selling off because macro + leverage hit at the same time.

Japan’s 2-year bond yield just jumped above 1%, which means borrowing in Japan may get more expensive."

That shift scared global markets and pushed investors out of risk… pic.twitter.com/rquI887Xi2

Another analyst, Rare Scrilla, pointed to multiple factors behind the price drop. The analyst said on X that attention has shifted away from bitcoin toward NFTs and “fake rares.” The post also said bitcoin miners have reduced activities linked to those assets. Rare Scrilla also referred to past internal disputes in the bitcoin community and said technical wallet issues may be pushing some holders to sell quickly.

Bitcoin's recent price decline can be attributed to a combination of factors. Discussions among Rare Pepe enthusiasts suggest a significant shift in focus towards NFTs and "fake rares," diverting attention from traditional bitcoin investments. Additionally, Bitcoin miners have… pic.twitter.com/onIxku10KL

— RARE SCRILLA (@ScrillaVentura) December 1, 2025

Crypto Rover also commented on the sell-off. The account said on X that “Bitcoin treasury demand is falling off a cliff.” It added that this is “one of the main reasons we’re seeing this dump.”

Bitcoin treasury demand is falling off a cliff.

— Crypto Rover (@cryptorover) November 5, 2025

One of the main reasons we’re seeing this dump. pic.twitter.com/B4TPipd9sB

BTC Drops Before Modest Rebound Today

Bitcoin opened the trading day at $90,400. In the first hour, the cryptocurrency moved sharply lower and continued to decline. The $85,600 level provided intraday support, which led to a modest rebound. As of writing, BTC is trading around $86,700, reflecting short-term volatility in response to ongoing market pressures.

Bitcoin Drops to Six-Month Low Amid Risk-Off Sentiment and Fed Uncertainty

The current decline echoes earlier weakness in November. On November 21, Bitcoin tumbled to levels not seen since April, dropping to around $86,270. Analysts attributed the fall to risk-off sentiment following stronger-than-expected U.S. jobs data, which raised doubts about whether the Federal Reserve would cut interest rates next month.

The drop coincided with declines in equities, as some investors hold both crypto and AI-related stocks.

Market watchers noted that heavy selling by large holders, or “whales,” contributed to the November decline, with over $20billion sold since September. Cascading liquidations of leveraged positions in early October had already left the market vulnerable, and reduced order activity following the October flash crash added to volatility.

Some Bitcoin ETFs saw inflows during this period, but earlier outflows had pressured prices further, highlighting fragile market conditions.