Forexlive Americas FX news wrap 20 Mar> SNB cuts rates. BOE keeps rates unchanged

- Major indices close lower on the day

- Doubletree's Gundlach: Don't think we see a cut at the next meeting

- Germany, Italy, Poland, UK and Canada to meet in Paris next week to discuss Ukraine

- Crude oil futures settled $68.07

- More from BOC Macklem: Expecting March CPI to be around 2.5%

- BOC's Macklem: We're not in a situation where there is a single most-likely outcome

- US sells $18 billion of 10 year TIPS a yield of 1.935%

- BOC Macklem: BOC needs to set policy that minimizes the risk of errors

- European indices close lower with German Dax down -1.18%. France CAC down -0.95%

- Apple shakes up AI executive ranks.News sends the NASDAQ & the S&P into negative territory

- BOE's Bailey: We have to wait to see evidence of falling inflation, need to be careful

- UK February inflation expectations for the year ahead 3.9% vs 3.5% prior

- US February existing home sales 4.26m vs 3.95m expected

- Mark Carney will call Canadian election for April 28 - report

- March Philly Fed +12.5 vs +8.5 expected

- Canada Feb producer price index +4.9% y/y vs +5.8% prior

- US initial jobless claims 223K vs 224K estimate

- The Fed kept rates unchanged yesterday. How are the markets reacting to the decision?

- BOE leaves bank rate unchanged at 4.50%, as expected

- ForexLive European FX news wrap: Dollar firms as risk appetite gets sapped

As the US day started, the market was digesting the 25 basis point cut by the SNB to 0.25%. The USDCHF had moved higher after bouncing near the lows from last week and from Tuesday. In the rotation higher, the USDCHF moved above its 100 hour moving average, 200 hour moving average and 200-day moving average near 0.8806 and 0.8811. The high price extended to 0.8845 before rotating back down to test the converged 200-day and 200-hour moving average of 0.8811 you 7. That level will be close support in the new trading day

The Bank of England (BOE) left its bank rate unchanged at 4.50%, as expected, with an 8-1 vote (Dhingra voted for a 25 bps cut). The BOE noted substantial progress on disinflation, allowing for a gradual withdrawal of policy restraint while maintaining restrictiveness. However, global trade and geopolitical uncertainties have intensified, and financial market volatility has risen. Business surveys indicate weak growth, reinforcing the need for a cautious approach to policy easing.

The BOE stated that if inflation pressures ease, a less restrictive rate path would be warranted. However, concerns over second-round inflation effects could justify keeping policy tighter for longer. The statement shows a slightly less dovish stance, suggesting the BOE may delay cuts if inflation risks persist.

A notable shift came from Mann, who did not vote for a rate cut after previously favoring a 50 bps cut in February, signaling a more cautious approach.

BOE Governor Andrew Bailey emphasized the need for patience in assessing inflation trends, stating that policymakers must wait for clear evidence of a sustained decline before making decisions. He stressed the importance of caution in monetary policy and is closely monitoring labor market conditions, particularly for any increase in redundancies, which have not yet appeared in early indicators.

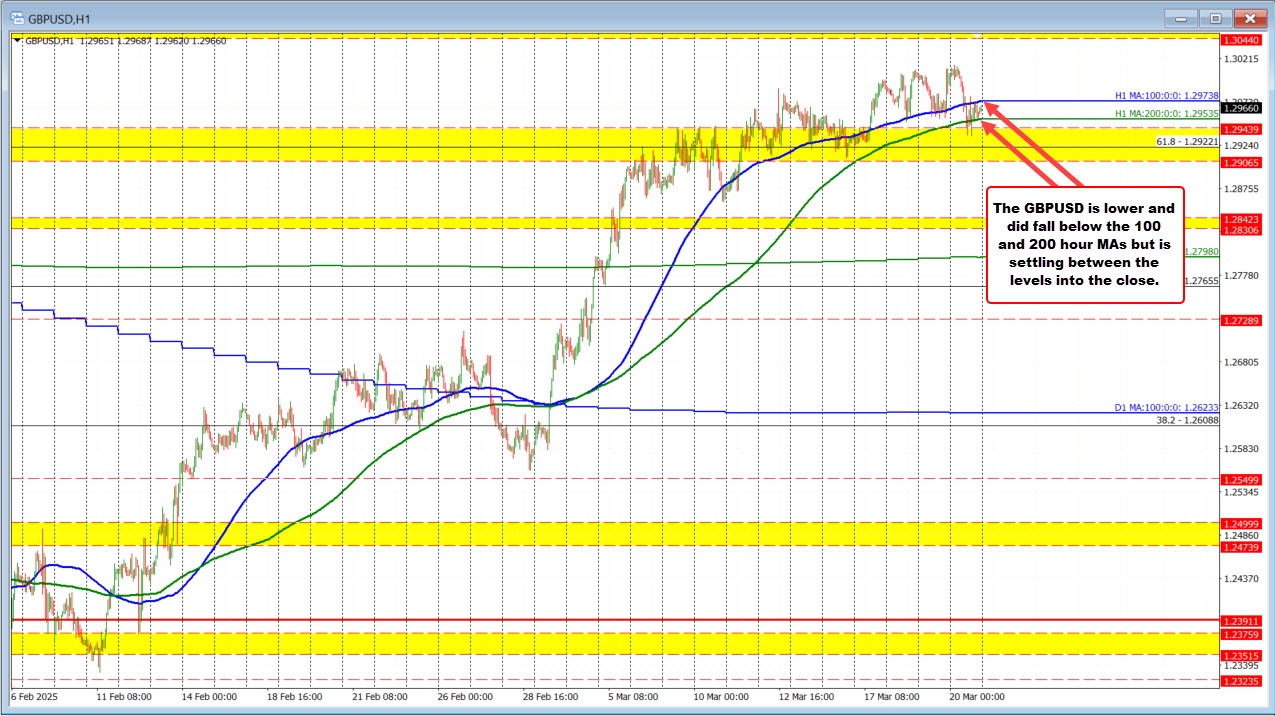

For the GBPUSD, The pair is lower and did fall below the 100 and 200 hour MAs but is settling between the levels into the close. A move above the higher 100 hour MA would tilt the bias more to the upside, while a move below the 200 hour MA would tilt the bias more to the downside.

Bank of Canada Governor Tiff Macklem spoke today and stressed the need for a cautious and flexible policy approach, prioritizing minimizing errors over long-term forecasting. He emphasized that the BOC must act quickly when economic conditions change and reiterated its commitment to controlling inflation, particularly in the face of rising tariff-related price pressures. With significant economic uncertainty, the central bank is focusing less on defining the "best" monetary policy and more on adapting to evolving risks. While Canada has managed a soft landing, Macklem warned that it won’t last indefinitely, especially with U.S. tariffs threatening to lower energy prices and hurt producer profitability. Additionally, he reinforced that there is no question about Canada’s sovereignty and border integrity, underscoring the government's firm stance amid global trade uncertainties.

The BOC is moving to the sidelines for the time being but may cut aggressively (or hike) as developments on tariffs and the economy unfold. In the meantime, he's saying not to expect any hints on what's coming.

In an interview on CNBC, Doubletree's Gundlach expects no Fed rate cut at the next meeting, with the first cut likely in June or July. He sees the Fed pausing at seven cuts in Q3 and estimates a 50-60% chance of recession. He doubts the 10-year yield will fall below 4% and sees inflation struggling to settle near 2%. With risk assets expected to get cheaper, he advises keeping cash on hand to capitalize on opportunities.

In economic news

- US initial jobless claims came in at 223K, slightly below the 224K estimate. Continuing claims increased to 1.892M, slightly above the 1.887M estimate, with the prior week revised down to 1.859M from 1.870M. No weakness seen in the weekly claims data.

- The March Philly Fed index came in at +12.5, beating expectations of +8.5 but lower than the +18.1 reading in February. The six-month outlook dropped significantly to 5.6 from 27.8, indicating weakening future sentiment. The capex index also edged lower to 13.4 from 14.0. However, employment surged to 19.7 from 5.3, showing strong labor demand. Prices paid jumped to 48.3 from 40.5, signaling rising cost pressures. Meanwhile, new orders fell sharply to 8.7 from 21.9, suggesting slowing demand. Overall, the data reflects moderate current strength but deteriorating future expectations, with inflation pressures persisting.

- US February existing home sales rose to 4.26M, exceeding expectations of 3.95M and improving from the revised 4.09M in January. Sales increased 4.2% month-over-month, reversing the prior -4.7% decline. The median home price reached $398,400, marking a 3.8% YoY increase, though lower than the previous 4.8% gain. Inventory remained steady at 3.5 months, suggesting no significant supply shift. Despite high mortgage rates in December and January, demand held up. However, the NAHB homebuilder survey weakened, highlighting mixed signals in the housing market.

IN the US stock market today, the Powell rally after his "dovish comments" yesterday, lasted one day. The major indices are closing lower in volatile up-and-down price action:

- Dow Jones: -11.31 points (-0.03%) at 41,953.32 (At the high +286, At the low: -269)

- S&P 500: -12.4 points (-0.22%) at 5,662.89 (At the high +35.86, At the low: -42.96)

- NASDAQ: -59.16 points (-0.33%) at 17,691.63 (At the high +152.41, At the low: -173.97)

- Russell 2000: -13.44 points (-0.65%) at 2,068.62 (High: +7.90, At the low: -21.58)

In the European equity markets, major indices fell:

- German DAX: -274.95 points (-1.18%) at 23,013.12

- France CAC 40: -77.27 points (-0.95%) at 8,094.21

- UK FTSE 100: -4.67 points (-0.05%) at 8,702.00

- Spain IBEX 35: -101.78 points (-0.76%) at 13,306.31

- Italy FTSE MIB: -524.49 points (-1.32%) at 39,188.16 (worst performer)

In the US debt market, yields are ending the day marginally lower:

- 2-year yield 3.963%, -1.5 basis points

- 5-year yield 4.015%, -1.4 basis points

- 10-year yield 4.240%, -1.5 basis points

- 30-year yield 4.559%, -0 point basis points.