What are the main events for today?

We don't have much in the European session except a couple of low tier data releases which aren't going to influence markets' expectations. The main events will be in the American session when we get the ECB rate decision and the US Jobless Claims.

13:15 GMT/08:15 ET - ECB Policy Announcement

The ECB is expected to cut interest rates by 25 bps bringing the policy rate to 2.50%. The recent Eurozone Flash CPI report released on Tuesday showed inflation easing further, especially on the services side which is what the central bank is more concerned with. There’s been a growing concern among some ECB officials about easing rates too fast.

The recent spending boost was the catalyst for the market to reprice interest rates expectations to just two cuts by the end of the year (today's cut included). Therefore, the expectations are for a "hawkish" cut today although that should be already priced in by now.

13:30 GMT/08:30 ET - US Jobless Claims

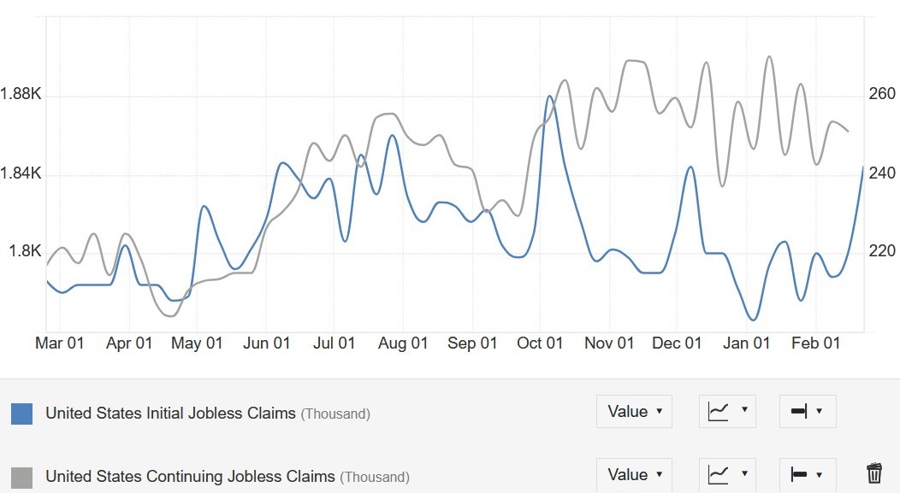

The US Jobless Claims continue to be one of the most important releases to follow every week as it’s a timelier indicator on the state of the labour market.

Initial Claims remain inside the 200K-260K range created since 2022, while Continuing Claims continue to hover around cycle highs although we’ve seen some easing recently.

This week Initial Claims are expected at 235K vs. 242K prior, while Continuing Claims are seen at 1880K vs. 1862K prior.

Central bank speakers:

- 13:45 GMT/08:45 ET - ECB's Press Conference

- 13:45 GMT/08:45 ET - Fed's Harker (slightly hawkish - non voter)

- 15:00 GMT/10:00 ET - BoE's Mann (dove - voter)

- 20:30 GMT/15:30 ET - Fed's Waller (neutral - voter)