Gold trades to a new all time high

Gold continues its bullish momentum, surging $30.60 (1.02%) to $3,031.76, marking a new all-time high. The precious metal is now up 15.57% in 2025, following a 27.2% rally in 2024. With record highs being set, traders must ask: "What could derail this rally, even in the short term?" Until a clear bearish signal emerges, buyers remain firmly in control, and the trend can persist.

Key Technical Levels to Watch

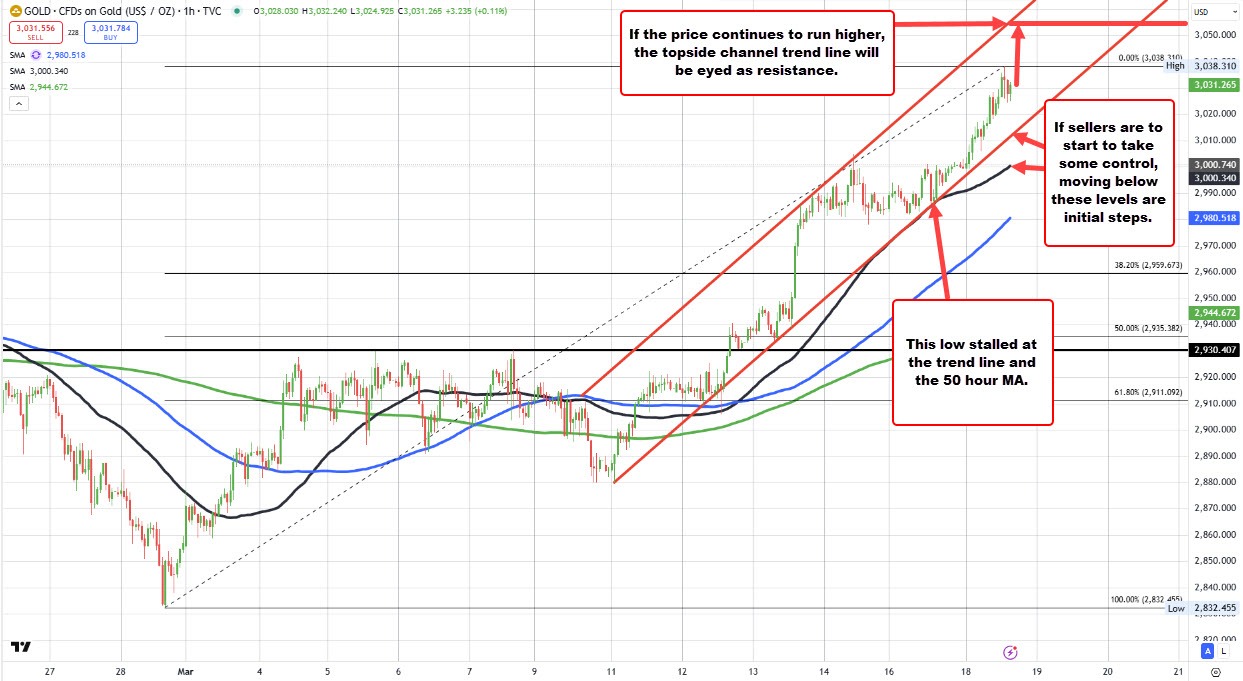

On the hourly chart, gold recently tested its 50-hour moving average and an upward sloping trendline. Buyers stepped in at these support levels, propelling the price higher. Today’s bullish momentum has pushed gold away from those key supports, reinforcing the strength of the uptrend. A break below these levels would be the first signal that sellers are gaining some traction, but until then, the path of least resistance remains higher.

Upside Potential

If momentum continues, traders will eye the upper parallel trendline, currently near $3,055 and rising, as the next potential target. The saying "the trend is your friend" remains true here—gold’s upward trajectory shows no immediate signs of slowing.

Bottom Line

The uptrend remains intact, and sellers have little control until key support levels break convincingly. A downside move may pause the rally, but it will take more than that to shift the broader bullish bias. For now, gold remains in the hands of the buyers, and the rally can extend further.