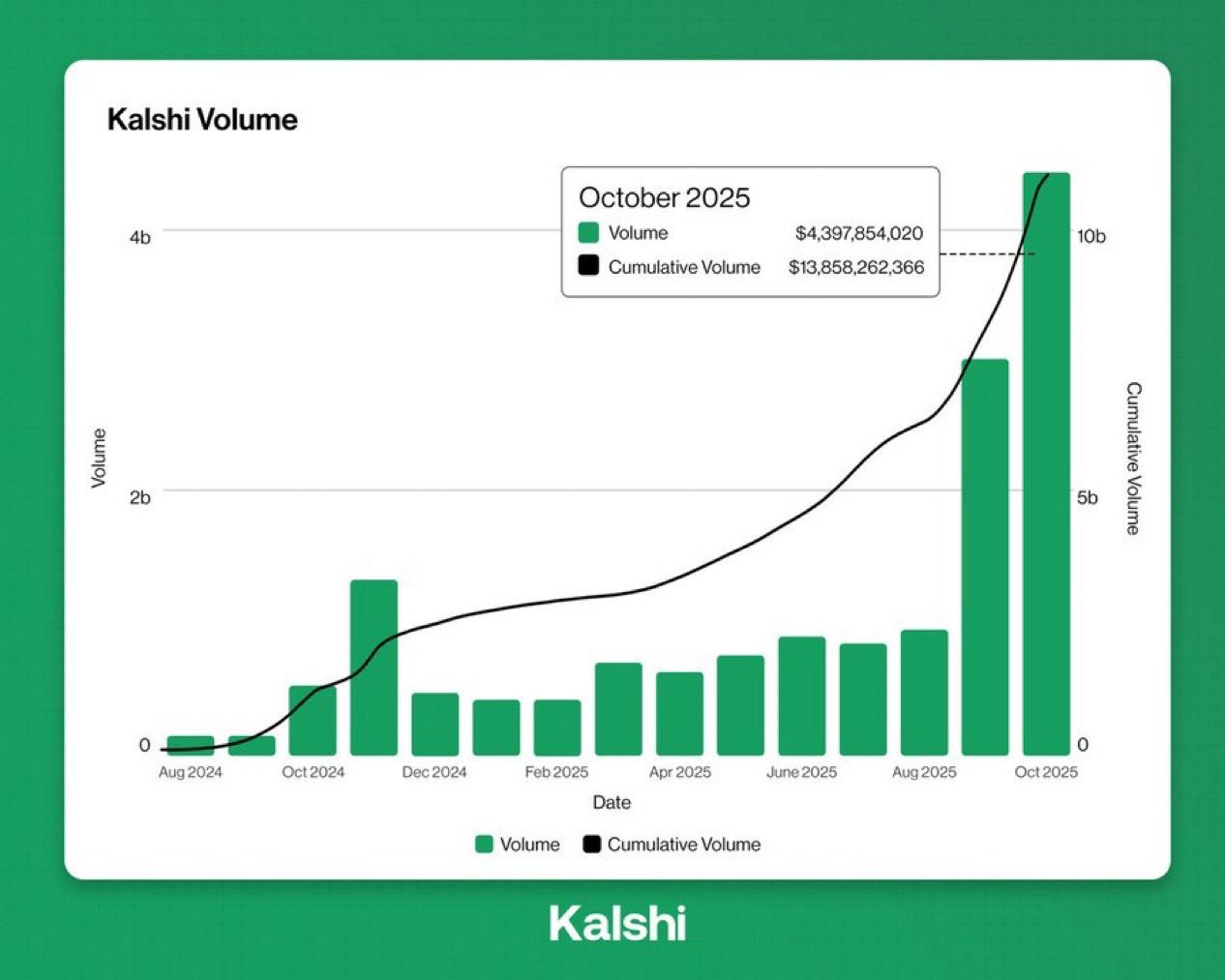

Retail Traders Flock to Prediction Platforms; Kalshi Hits $4.4 Billion Volume in October

Prediction markets are moving into new territory, breaking past previous records in October. Data from Kalshi and Polymarket shows more than $7.4 billion in trades during the month, the strongest performance these platforms have seen to date.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

Robinhood has also reported a sharp rise in prediction activity. The broker said users traded 2.3 billion event contracts between July and September, followed by 2.5 billion in October alone. Together with Bitstamp, the platform now generates around $100 million in annualised revenue. Total revenue for the third quarter reached $1.27 billion, an increase of 129% from the same period last year.

October Trading Dominated by Sports

Kalshi remained the top venue, handling about $4.4 billion in trades, while Polymarket followed with around $3 billion. A notable shift occurred within the market itself: sports contracts overtook political and economic predictions as the most active category.

[#highlighted-links#]

In a single week, from October 20 to 27, Kalshi processed over $1.1 billion in sports-related bets, compared with just $51 million in political trades.

Prediction Markets Rise on Multiple Factors

Industry observers point to two factors behind the rise. First, recent changes in U.S. tax discussions may have made prediction markets more appealing than traditional sportsbooks.

Second, growing interest in potential token airdrops has drawn a wave of crypto-native participants.

Robinhood $HOOD now has 11 separate business segments generating more than $100 Million of revenue on an annualized basis pic.twitter.com/yBx9pGLWya

— Evan (@StockMKTNewz) November 5, 2025

Romania Blocks Polymarket Over Gambling

The surge in trading has also caught the attention of regulators. In late October, Romania’s National Office for Gambling ordered local internet providers to block Polymarket, arguing that the platform operates as an unlicensed betting site.

The agency said Polymarket’s peer-to-peer model meets the country’s legal definition of gambling and lacks the required safeguards on responsible betting and money laundering.

The action highlights a broader regulatory challenge facing crypto-linked prediction platforms. While these services often describe themselves as marketplaces for event trading, regulators across Europe are beginning to view them through the same lens as online gambling operations.